Ebusco, from revolutionary promises to the race for survival

Ebusco, that started operations in Europe in 2012, remains under pressure to stabilize its operations and secure long-term viability. The company is currently implementing a Turnaround Plan that includes the transition to a OED (Original Equipment Designer) company, with outsourced production. Let's recap the history of a company that promised to deliver the European bus market truly innovative products.

As of late 2024, Ebusco is at a critical juncture in its business. The company has faced significant financial instability over the past few years, with its future uncertain as it works to fulfill key orders and meet production targets.

After narrowly avoiding insolvency, Ebusco, that started operations in Europe in 2012, remains under pressure to stabilize its operations and secure long-term viability. The company is currently implementing a Turnaround Plan that includes the transition to a OED (Original Equipment Designer) company, with outsourced production. “We will not do any assembling in-house after Q1 2025”, stated CEO Christian Schreyer in an interview with Sustainable Bus.

Let’s recap the history of a company that promised to deliver the European bus market truly innovative products.

| 2021 | 2022 | 2023 | H1 2024 | |

| Revenue (million €) | 24.3 | 111.6 | 102.4 | 38 |

| EBITDA (million €) | – 34.2 | – 34.8 | -95.7 | -60 |

| Result for the year (million €) | – 26.8 | – 32.2 | -120.1 | -64 |

| Units delivered / market share | 132 / 4% | 78 / 1.9% | 193 / 3% | |

| Order book (units) | 325 | 1,474 | 1,717 | 1,662 |

2020: The launch of the Ebusco 3.0

Ebusco started to release announcements about the Ebusco 3.0 model in 2019 (articulated version will follow in 2022). The vehicle focused on providing greater energy efficiency and longer range compared to previous models, the 2.1 and, mainly, the well-established 2.2 model, produced in China. The Ebusco 3.0 was designed using lightweight materials and advanced battery technology embedded in the chassis. Its entrance in operation was expected in the Netherlands for early 2022.

2021: Ebusco goes public

Listing on Euronext Amsterdam

Ebusco announces intention to launch Initial Public Offering and admission to listing on Euronext Amsterdam in October 2021. Through the IPO the company said it targeted to raise approximately €300 million as gross proceeds. Goal? Using the net proceeds “to fund investments in Ebusco’s international expansion and growth strategy through 2023”, it was announced.

Listing and first trading was planned for 22 October 2021. The indicative price range for the offering was set between €21.50 and €24.50 per Offer Share, implying a market capitalisation post-listing for Ebusco of €1.33 billion. The IPO was then concluded at a IPO price of 23 euros.

Opening Deurne factory

On 28th October 2021 the King of the Netherlands officially opened the new factory hall in Deurne, Netherlands, by putting a Ebusco 3.0 bus on the charger. The factory was expected to have a production capacity of five hundred emission-free buses per year by 2022, Ebusco stated. It’s the place where the Ebusco 3.0 was supposed to be entirely built.

Ebusco’s post-IPO plans included an international expansion. And indeed, in late 2021, former BYD Regional Vice President Ted Dowling had been appointed Managing Director North America. He had been in the company until July 2024.

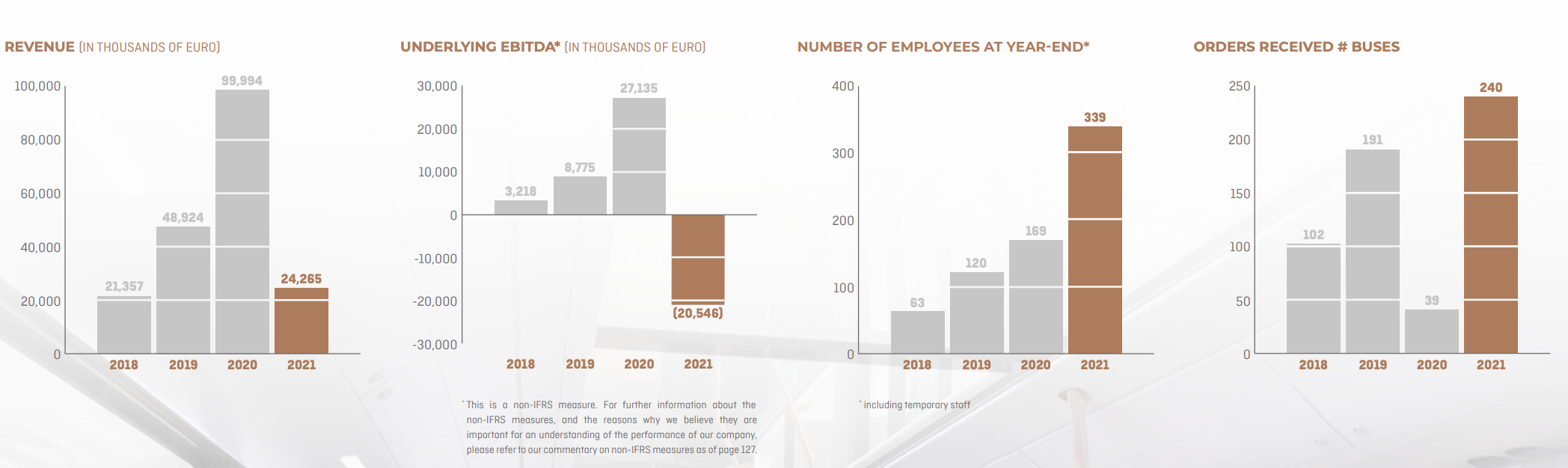

At the end of 2021, looking at 2021 European e-bus market, Ebusco had 132 units delivered, +21% on 2020, equal to a 4% market share (decreasing since previous year).

2022: rising orders and growing pains

In 2022, the company began securing large orders across Europe, including a notable agreement with the French city of Rouen for its Bus Rapid Transit (BRT) system. This contract, along with others, helped establish Ebusco as a promising player in the electric bus sector.

By 2022, Ebusco was ramping up production to meet a growing order book, including large contracts with operators like Qbuzz. However, financial struggles began to emerge as production costs rose, supply chain disruptions occurred, and competition intensified. Despite a strong pipeline of orders, Ebusco faced mounting pressure from investors and stakeholders, as its finances began to show strain.

Potrebbe interessarti

Steering Ebusco on track: focus on design and engineering. But cash management comes first. Our interview with CEO Christian Schreyer

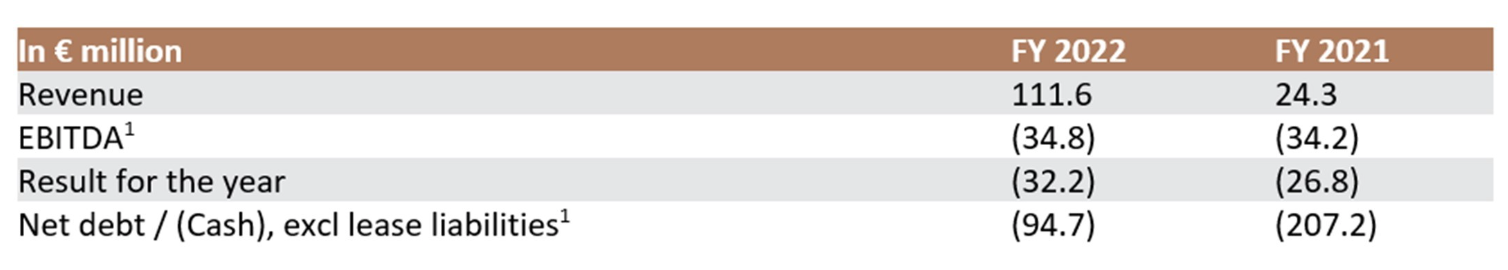

The company’s 2022 financial results revealed EBITDA loss of €34.8 million “due to the ramp up and supply chain related production inefficiencies” and a net loss for the year of €32.2 million. On the other hand, revenue increased by 360% to €111.6 million “despite delayed shipments and deliveries”.

The company said having the goal of reaching a production volume of “over 3,000 zero emission buses per year within the next five years”. Quite a striking goal, considering that in 2022 just 78 Ebusco e-buses were registered in Europe. Ebusco also expects to reach an EBITDA margin of 20-25% within the following five years compared to 35% previously.

What is also interesting, Ebusco ended 2022 with an order book of 1,474 buses compared to 325 at the year end 2021.

2023: Ebusco adjusts production model and strategy

A strategic change in Ebusco’s business model was announced in March 2023, with the company stating it was targeting a production model that involves assembly partners. At that time, by outsourcing part of the assembly activities, Ebusco aimed to enhance capacity and support the ramp up in Deurne.

But already in mid-2023 the company made clear that the results were still below expectations. Bad performances were attributed to supply chain issues and labour shortages. At that time, Therefore, Ebusco said it was working with three assembly partners (not mentioned). Moreover, with the planned opening of the production facility in Rouen, France and an external casco assembly partner, Ebusco declared it was working to further scale its casco production.

As of October 2023, Ebusco’s shares had a value of 5.29 €, and witnessed a -65% decrease in the previous 12 months (it was 15 euros in October 2022). The loss compared to the time when the company went public (October 2021) is -77%, as Ebusco’s shares value at that time was around 23 euros.

The 2023 of Ebusco, according to the financial data released in early 2024, resulted “disappoinging”, in the company’s words. Ebusco achieved €102.4 million revenue in 2023, recording EBITDA loss of €95.7 million, compared to €34.8 million negative a year earlier, and net loss for the year of €120.1 million (vs €32.2 million in 2022). At the same time, the order book grew from 1,474 to 1,719 buses at year-end.

2024: things are falling apart in Ebusco’s crisis

Financial results are (still) below expectations

In June 2024, Ebusco stated its current guidance of revenue in excess of €325 million combined with a positive EBITDA in 2024, released in March 2024, was no longer achievable. A new CCO was appointed.

In July 2024 the company released the mid-year results. Well, it’s enough to mention EBITDA loss of €60.7 million (increased 40% compared to 43 in 2023) and revenue at €38 million (-8.8%). Just 98 buses were delivered, vs a order book of as many as 1,662 buses. Late delivery penalties and direct damage claims from customers amounted to €10.4 million.

“Scaling up with contract manufacturers has been hampered by start-up inefficiencies”, says the company, that was pivoting to a new strategy based on assembly of 3.0 model in China being made by a external partner, as stated during the presentation of 2023.

As of July 2024, Ebusco shares have today a value of 1.5 €, and witnessed a -82% decrease in the previous 12 months, down -93% compared to the time when the company went public (October 2021) is -93%.

Fall 2024: Christian Schreyer appointed CEO, orders cancelled

In September 2024 a new CEO was appointed: Christian Schreyer replaced the founder (and shareholder) Peter Bijvelds. The move by the Supervisory Board to hand over the management of the company to an outsider was deemed necessary in order to be able to implement a tough restructuring plan aimed at getting back on track a company whose survival was being challenged by severe liquidity problems and balance sheets in serious disarray (half 2024 financial results show EBITDA loss of €60.7 million).

Customers started cancelling orders with Ebusco, due to dramatic delays in deliveries. The first has been the Swedish Connect Bus. Then Keolis. In the meanwhile, in September 2024, Ebusco confirmed intention to raise up to EUR 36 million of new equity through a rights issue.

October 2024: Ebusco on the brink of insolvency

While preparations for the right issue were underway, a crucial challenge was played at the end of October 2024.

On 23rd October Ebusco lost a court case against customer Qbuzz, which was then allowed to cancel an order for 45 buses whose delivery was coming late. The Dutch company had also suspended its production in anticipation of the outcome of the court hearing and the completion of the contemplated rights issue “to preserve its working capital”.

The judgement, according to the media, stated that “Ebusco did not comply with the settlement agreement that the parties concluded“.

Insolvency looked very, very close, as Ebusco itself had stated on 21st October that “Losing the order would put a significant strain on its working capital position”.

However, on 24th October, Ebusco’s shareholders adopted all resolutions on the agenda of the extraordinary meeting in order to go ahead with the turnover plan, put its operations in order and avoid bankruptcy.

At that moment, Ebusco shares had a value of 0.50 €, and had witnessed a -89% decrease in the previous 12 months. The loss compared to the time when the company went public (October 2021) was -97%.

As reported on Dutch newspaper ‘Financieel Dagblad’, “The company’s shareholders, including Ebusco founder Peter Bijvelds and ING, are thus giving Ebusco another chance to implement its intended rescue plan. Nevertheless, with the current share price, the bus manufacturer will have a tough job raising the required millions“.

November 2024: Ebusco raises 36 million euros via right issue

On 20th November 2024 Ebusco announced it has raised a total of EUR 36 million through the successful completion of its Rights Issue. Within a fresh deal, Chinese battery supplier Gotion takes a 9.3% stake in Ebusco and gains a seat on the bus maker’s supervisory board and board of directors.

Following moves included the restructuring of its management organization dissolving its Executive Committee and shifting responsibilities to the Management Board. After shareholders’ approval, to be obtained at the EGM, the revised Management Board will consist of Christian Schreyer, Jan-Piet Valk (ad interim), Peter Bijvelds and Michel van Maanen.

As of 31st December 2024 Ebusco shared plans to reduce its workforce by 16.5%, affecting 102 full-time equivalent (FTE) positions. “Our focus today is only on Europe, with a selective approach to tenders – stated CEO Christian Schreyer in the above-mentioned interview with Sustainable Bus -. And we are also completely changing our commercial model. In the past we tried to produce anything we can sell, now we sell only what we can produce. It’s written in our Turnaround Plan: we’ll accept customer orders based on production slot availability”.

2025: Ebusco’s turnaround plan ahead

Coming to recent days, in early 2025 the company issued an auction for part of its inventory of bus, truck, and general automotive parts “with discounts of up to 50%” that will be available for bidding starting on Thursday, 23 January.

An update about the development of the turnaround plan was shared on 24th February 2025: Ebusco announced it has secured a total of EUR 22 million in debt financing and relocated 74 previously-cancelled buses. Ebusco has indeed reassigned 21 buses to NIAG, 22 buses to Métropole Rouen Normandie (where 100 Ebusco buses were already supposed to be supplied) and 31 12-meter to EBS, that opted to convert their existing order of 13.5 meter buses to this nearly completed batch, the total number of reassigned Ebusco 3.0 buses now stands at 74. The cash flow from these bus reassignments will be generated over time once delivery of the buses begins, which is expected early in Q2 2025.