Why fuel cell buses are becoming operators’ vehicle of choice for public transport

In the race towards a greener future, the global transport sector is undergoing a significant transformation. Leading this charge is the remarkable growth of zero-emission buses (ZEB) – both battery electric and fuel cell electric – which are quickly becoming the backbone of public transit across major markets worldwide.

Authored and sponsored by Ballard Power Systems

In the race towards a greener future, the global transport sector is undergoing a significant transformation. Leading this charge is the remarkable growth of zero-emission buses (ZEB) – both battery electric and fuel cell electric – which are quickly becoming the backbone of public transit across major markets worldwide.

While there is consensus that no “cookie cutter” solution currently exists – duty cycles, climate, terrain, and depot location are all factors determining the right technology for the operator’s needs – transit agencies are increasingly choosing hydrogen buses for their fleets. Their motivation – longer operational range, quick refueling, and robust performance in a variety of climates, are all critical factors for the diverse geographical and weather conditions.

Unlike electric buses, which require several hours to recharge, hydrogen buses can be refueled in as little as 10 minutes, mirroring the convenience of traditional diesel buses but without the environmental toll. Furthermore, the scalability of hydrogen fueling infrastructures and the potential for green hydrogen production to align with global climate goals, makes hydrogen buses not just a transitional technology but a long-term sustainable solution to public transit.

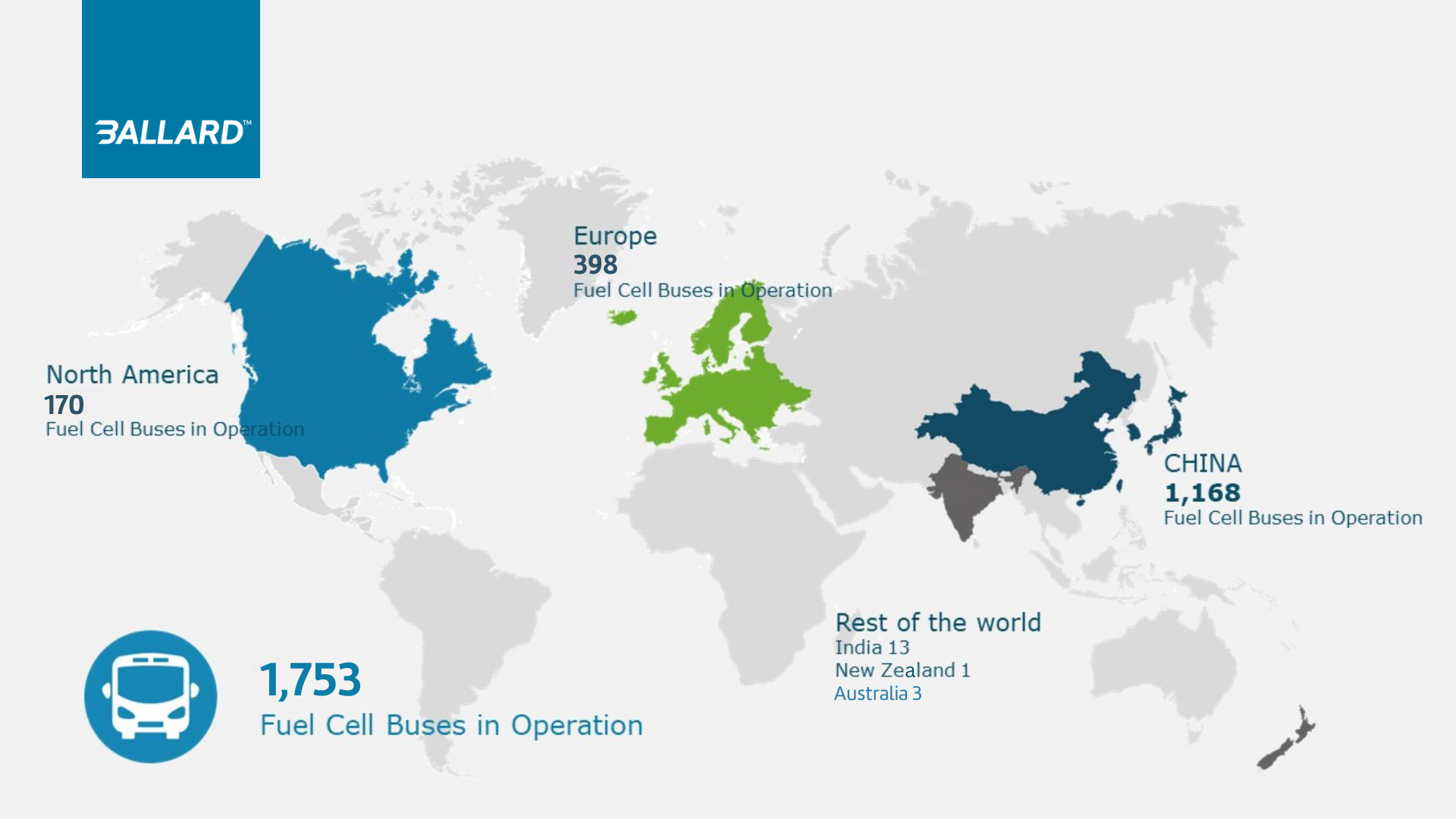

Aided by increased policy support, technological advancements, and commitments from both public and private sectors to achieve ambitious sustainability objectives, global deployment of fuel cell electric bus fleets is currently experiencing an upturn with transit agencies and operators.

With a concerted shift towards cleaner public transport, major players such as NFI, Wrightbus and Van Hool are at the forefront of this transition, with more and larger hydrogen-powered fleets deployed across an ever-increasing number of cities worldwide – while Solaris is trailblazing efforts in Europe with nearly 200 vehicles on the road and existing orders for another 500 of its Urbino Hydrogen 12- and 18-metre emission-free models.

In the U.S. fuel cell electric bus adoption has enjoyed robust growth of 76% from 2022-2023, with 13 states now reporting the inclusion of fuel cell buses in their transit fleets. California still leads the way with plans to deploy more than 2,000 additional hydrogen-powered buses in the coming years, to complement the existing 170 vehicles in service today.

Based on the specific needs of transit agencies around the world, it is becoming increasingly apparent from operational data that fuel cell buses offer several advantages over battery electric buses for operators transitioning from diesel power to a zero-emission alternative.

With data demonstrating superiority in range and refueling time, operators’ insights and recent transit agency evaluations of zero-emission technologies have also revealed significant infrastructure challenges and cost implications in accommodating battery electric buses. In contrast, fuel cell alternatives require minimal alterations to existing depot infrastructure and provide an answer to electric grid capacity constraints, offering a more cost-effective and practical solution.

This is exacerbated when addressing the scalability of infrastructure and potential increases in fleet size long-term. While investment in electric buses may initially appear lower, as an agency’s number of zero-emission buses increase, it becomes evident that fuel cell platforms offer an enhanced economic advantage due to scalability of refueling infrastructure and their position as a 1:1 drop-in replacement for existing diesel vehicles and fleets.

For transit agencies, the priority is in providing a passenger experience that is high quality, comfortable, and has minimal waiting times. With high vehicle availability and no compromise in range or operational performance, fuel cell electric buses deliver an optimal solution that presents an enhanced offering to both passengers and transit agencies globally.