Hydrogen, on-site generation through decentralised electrolysis can help fix supply issues?

93% of European public transport decisionmakers have expressed concerns about the capacity of their grid connection to fuel their current and future battery electric or hydrogen-powered fleets as the sector transitions to greener fuel sources. Plus, 89% of respondents from these markets said that hydrogen would be effective for overcoming the limitations of battery-powered fleets, […]

93% of European public transport decisionmakers have expressed concerns about the capacity of their grid connection to fuel their current and future battery electric or hydrogen-powered fleets as the sector transitions to greener fuel sources. Plus, 89% of respondents from these markets said that hydrogen would be effective for overcoming the limitations of battery-powered fleets, such as weight, range and grid strain.

The research ‘The Road Ahead’, commissioned by specialist engineering company IMI, surveyed 300 senior public transport professionals across the UK, Germany and Italy about the element’s adoption within the sector.

Looking at the 2024 European market, 378 fuel cell buses were registered, growing +82% on 2023. However, if we consider the zero emission bus market in the continent (then considering also battery-powered electric buses), hydrogen buses cover just 4.6 of that market, with BEV buses covering the remaining 95%.

Fuel cell bus concerns of public transport professionals

Going ahead with the study outcomes, 21% of respondents confirmed they had already purchased hydrogen vehicles, 61% said they would invest in the next two years, and almost three quarters said they expect to grow their hydrogen fleet over the next decade.

What is also interesting, “On one hand, the sector believes hydrogen will eventually solve the issues found with EVs; on the other, many believe EVs will become the dominant form of transport through the energy transition, irrespective of their shortcomings”.

Another challenge revealed by the research is the ability to store hydrogen safely – a key consideration for adoption at scale. A total of 76% of UK respondents saying it was a significant barrier to their deployment of hydrogen-powered vehicles, following by Italy and Germany at 73% and 66% respectively. With hydrogen-powered fleets expected to grow, and without large-scale production and distribution infrastructure in place, the report emphasises the importance of decentralised storage and smaller, localised electrolysers in working around these concerns without major intervention. In any case, “Almost three-quarters of respondents (73%) said they would consider on-site hydrogen production to fuel their fleet if there was sufficient funding in place; 24% said they would not”.

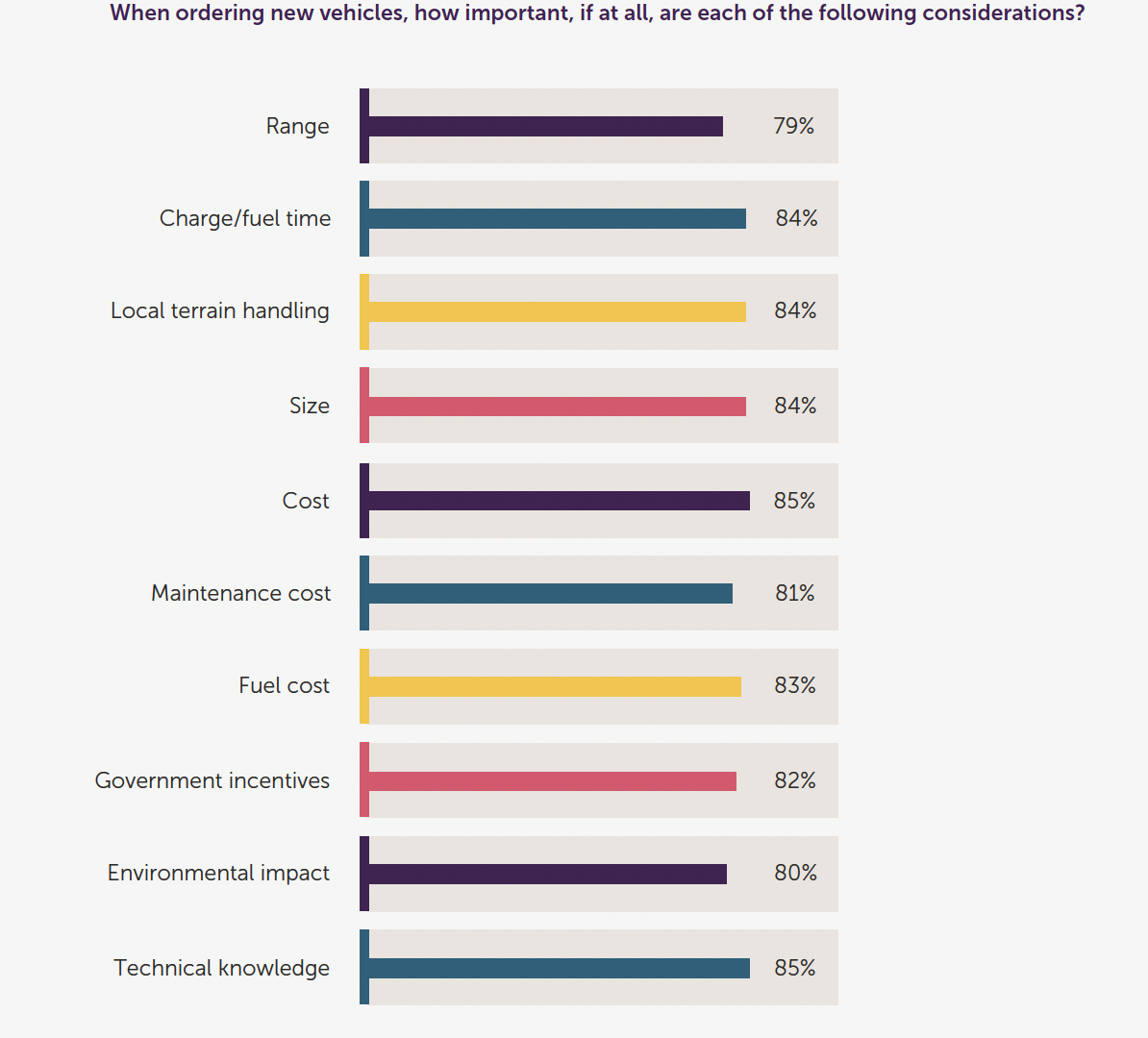

The report also found that range issue is no more the dominant topic when it comes to plan the evolution of the fleet, coming behind concerns on charging time, size, costs, technical knowledge.

“While many hard-to-abate industries have active research and development programmes concerning hydrogen’s use as a fuel, public transport is very well placed to reap the benefits of a potential transition,” said Andrea Pusceddu, Business Development Director for Hydrogen at IMI. “But this by itself isn’t new, and we wanted to find out more. However, there is little publicly available research on the opinions of those with a stake in the success of hydrogen, including public transport operators”

“On-site generation through decentralised electrolysis is an effective solution to bridge this gap, eliminating the distance between production and end users while allowing transport networks to trial vehicles without fuelling stations.”