Where will hydrogen come from in the future? [The Hydrogen Hub #1]

Below, a contribution from EMCEL, a German-based engineering company focusing on hydrogen, fuel cells and e-mobility. It’s the first of a series of articles on topics around hydrogen economy and applications. Feedbacks, questions and contributions are welcome (at info@sustainable-bus.com) Hydrogen is being treated as a key pillar of a future energy system – but where does […]

Below, a contribution from EMCEL, a German-based engineering company focusing on hydrogen, fuel cells and e-mobility.

It’s the first of a series of articles on topics around hydrogen economy and applications.

Feedbacks, questions and contributions are welcome (at info@sustainable-bus.com)

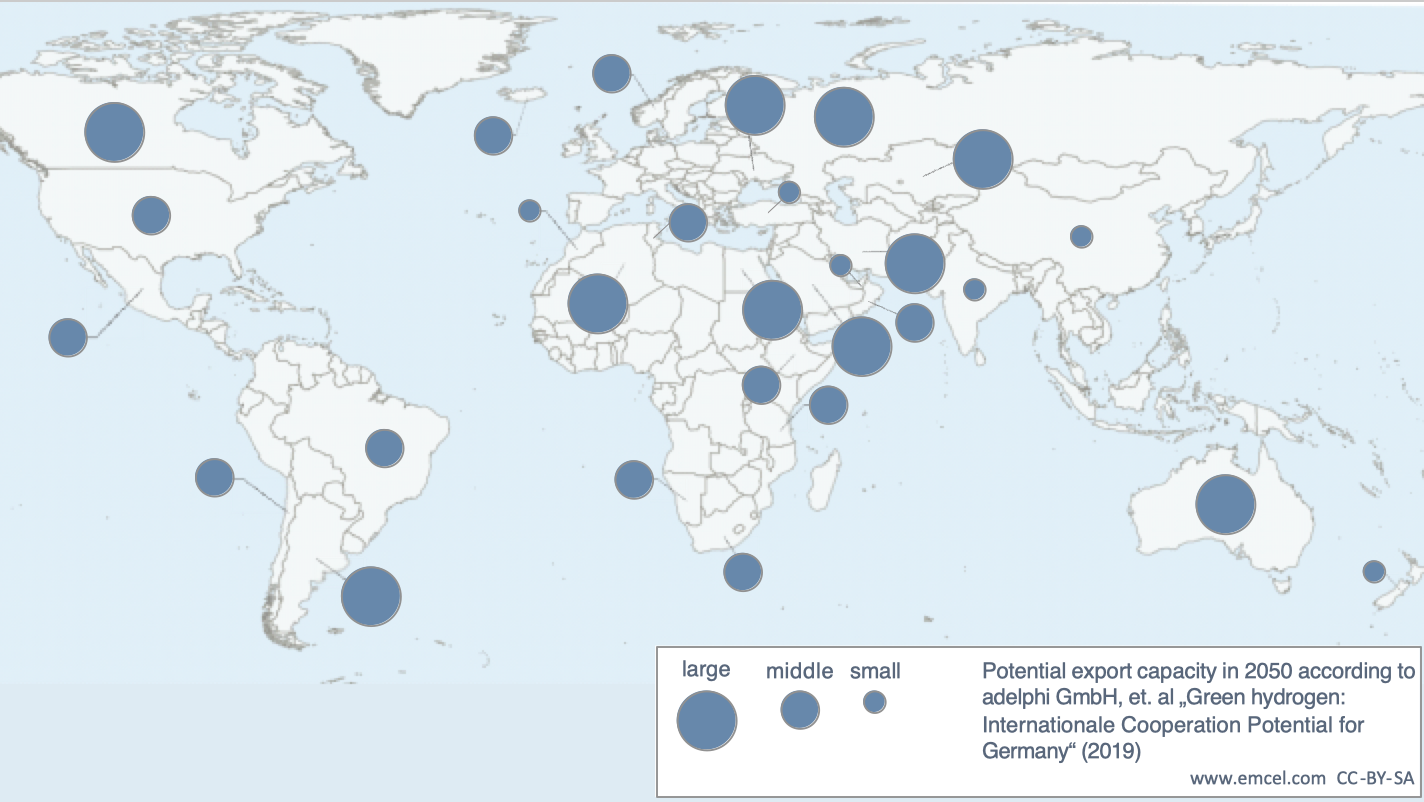

Hydrogen is being treated as a key pillar of a future energy system – but where does the hydrogen come from? Often large proportions of primary energy requirements in EU member states are covered by imports. For example, approximately 70% of the primary energy requirements in Germany are covered in this way. 100% of the hydrogen will not come from these countries either. The map shows the countries from which hydrogen could be imported into the EU in the future.

The EU will need to import hydrogen

Forecasts relating to the future demand for green hydrogen in the EU vary greatly depending on the scenario. However, the studies largely agree that the hydrogen demand will increase significantly in the medium to long term. Taking Germany as an example, a country where hydrogen projects are heavily funded, studies on the development of the energy market in the context of the German climate targets indicate values of 250 to 600 TWh in 2045. The predicted German production capacity for green hydrogen is specified at up to 60 TWh for 2045.

Where will the hydrogen come from?

The national hydrogen demand will exceed the production capacity in each scenario. For example, up to 87% of the demand in Germany will be covered by imports in 2045. According to the dena pilot study, a proportion of the import needs could be covered by other European countries.

Import regions outside the EU include Eastern Europe, North Africa, and Asia-Pacific, as well as large countries such as Argentina, Brazil, Australia and Canada (SOURCE). These regions are also known as “sweet spots”, as they have locational advantages with areas that experience a lot of sun and/or strong winds, which promote the production of green hydrogen by electrolysis.

Opportunities and risks

A global hydrogen economy has great development potential, both for the import countries, which can decarbonise their local economy with green hydrogen, and for the production countries, which can benefit from local added value. But there are also risks: For example, in regions that experience a lot of sun, such as MENA countries (Middle East and North Africa), the provision of sufficient pure water is a challenge. In addition, the political and economic framework for stable trade relations should be in place.

International standards are needed to ensure the sustainable origin of green hydrogen. The EU could play a leading role in the implementation of sustainability criteria.

Hydrogen production also in the EU

The EU will import a large proportion of hydrogen in the future. However, the domestic production potential should not be neglected. On the one hand, the compensation of volatile, renewable energy generation offers flexibility options for the energy system. On the other hand, early positioning on the market is the best way to create a knowledge advantage and therefore a competitive advantage in the field of hydrogen technology.