Paul Soubry, NFI Group: «Transition to e-buses, an evolution more than a revolution»

NFI group gets ready for an increase in EV bus orders. The approach? Agnostic: «We are able to produce any kind of vehicle on the same production line». About the transition to fossil-free drivetrains, «we view it as an evolution more than a revolution». Our interview with NFI president and CEO Paul Soubry.

This interview has been previously published on

Sustainable Bus magazine #3, issued in April 2021

NFI group gets ready for an increase in EV bus orders. The approach? Agnostic: «We are able to produce any kind of vehicle on the same production line». About the transition to fossil-free drivetrains, «we view it as an evolution more than a revolution». Our interview with NFI president and CEO Paul Soubry.

Paul Soubry, NFI Group: Covid consequences on transit

May you quantify the repercussions of the Covid crisis on NFI group sales volumes in the bus field (with a focus on public transport)? Which is the forecast for this year?

«In 2020, we had a reduction in revenue of approximately 25%, with a decrease of about half a billion US dollars. For 2021, we (NFI) have given the guidance that we will recover 250 million dollars, going back to 2.8 to 2.9 billion US dollars in revenue. We think the impact of COVID-19 on our business will require us a couple of years to get back to the level we were in 2019.

The motorcoach market stopped immediately in the US, and recorded an 82.6% decrease in 2020. Public transit slowed down but it didn’t stop, as public funded budgets were already allocated».

We are not going to witness a boom in terms of orders. We view it as an evolution more than a revolution. It could take 15 to 20 years to end the useful and economic life of current assets, and then buy new assets.

Paul Soubry, president and CEO NFI Group

How the topic of energy transition has impacted the organization of your group? I refer to skills, competences, relations with PTOs and suppliers…

«Our strategy has always been to be ‘propulsion agnostic’, meaning that we can evolve and adapt our bus structures over time, moving from diesel to hybrids to natural gas-powered, to trolley-electric buses and now battery-electric and fuel cell-electric. We designed our platforms and manufacturing facilities to be able to build any kind of vehicle on the same production line. Having said that, we have been focusing more and more on electrical skills: last year invested in and completed over 150,000 hours for internal training (both on-the-job and classroom/online workforce development) across our teams. The other thing we did is set up our Vehicle Innovation Center (VIC) in Alabama, US, in 2017 – North America’s first and only innovation lab dedicated to advancing bus and coach technology and providing critically needed workforce development, to teach skills and share knowledge on electric bus technologies and infrastructure in the face of rapidly increasing zero-emission bus adoption. For perspective, the VIC has welcomed over 3,000 people through over 300 events to date,including our pivot to virtual learning last fall (you can learn more at newflyer.com/VIC). At the VIC, we lead through customer training, electric bus component exhibits, and a hands-onbus simulator, all working to teach and illustrate what it means to operate and maintain electric buses and charging infrastructures».

E-buses in the US: financing is the issue

Which is the share of electric and alternative drive buses on the total sales volume of your group in the public transport field?

«We are still struggling to get 2020 actual data. In 2019, there were 6,717public transport purchases of buses in North America. 539 were either battery-electric, trolley-electric or fuel cell: it means a share of 8.9 per cent. In 2020 we don’t expect this number to change very much. Our group covers one third of the total market, and about 40 percent of the electric bus market».

In North America the e-bus market is still nascent. According to CALSTART there are around 1,000 e-buses currently deployed and 1,800 were ordered in 2020. Which are the reasons for this and what are, according to your view, the main barriers to e-bus adoption in North America?

«In the US, one of the biggest challenges is what we call ‘buckets and colours of money’. If we are running a transit agency in Chicago, for example, we can access 80 percent of our capital costs from the federal government, and 20 percent from the local government. But 100 percent of maintenance and fuel costs are paid locally. And since you need more money for the electric buses and more money for the charging infrastructures, this money doesn’t move very easily across budgets and sources.

So, the first real challenge is to find a way of funding that actually works. The second challenge is that the vast majority of transit agencies want a pilot or ‘demo’ project before they make an electric bus commitment (to test bus performance, to make sure they have skills required for driving, maintaining, or operating operating them, and to study the strategy with regards to charging). The intention to learn more on electric bus operation and range requirements (and performance) led many agencies to go for pilots largely funded by the federal government. As such, this has taken time in terms of getting operators to make larger and long-term orders of zero emission buses».

Paul Soubry: transition to ZE buses is a replacement game

When do you expect a ramp-up of electric bus adoption?

«Our view is that the transition to zero-emission buses is largely a replacement game. The number of public transport buses will not grow dramatically in North America. As they are publicly funded assets, there will be a replacement of diesel and CNG buses with electric buses over time. But, we are not going to witness a boom in terms of orders. We view it as an evolution more than a revolution. It could take 15 to 20 years to end the useful and economic life of current assets, and then buy new assets. Those buses are paid with tax-payer dollars, so it is not realistic to take diesel buses off the road earlier just to replace them with buy electric vehicles. We feel it wil largely be a replacement-oriented approach over the next 15 to 20 years.

The one aspect that might change this situation is the new U.S. administration. They have been very aggressive on two fronts. First, they believe in public transit in major cities so they are committed to ensure public transit has both environmental and congestion benefits. The second is their desire to invest more and more in the reduction of greenhouse emissions (to help mitigate climate change)».

When I first started in this business, 12 years ago, we used to hear that light rail would kill the transit bus industry. The problem is on capital costs: billions of dollars and ten year projects. Today it is possible to create a bus rapid transit line with electric buses, and put 300 vehicles on the road in two years, and you can have a massive impact on the city. We are starting to see elected officials more interested in using an electric vehicle that has speed, congestion, environmental, and noise benefits at a fraction of the cost required by a light rail».

Paul Soubry, president and CEO NFI Group

President elect Joe Biden announced an ambitious plan for electrification of public transport vehicles (not to mention school buses). Do you North American manufacturers are ready, in terms of production capacity, to catch up with such a ramp up? And what about the level of maturity of public transport companies?

«My answer will simply be yes. According to our strategy, today I can build approximately 5,000 buses (in North America) on our production lines, and we have a mix of diesel, natural gas, and electric. If the pace of electric bus adoption gets higher, we are building them on the same production line. And the same applies to our competitors. My personal view: there is not a gap between the demand curve and our ability to supply»

Today just a few local manufacturers offer zero emission buses in the US. Do you think this could lead Asian manufacturers to become the main competitors in the future (provided they are compliant with ‘Buy America’)?

«To sell in the US to public operators, you need to be ‘Buy America compliant’. 70 percent of the materials must be of US origin and vehicles must be final-assembled in the US. New players would require pretty significant investments. Also, the market is relatively small: there are 300 to 400 thousand buses sold in the world every year, and just 6,000 in North American markets. It doesn’t seem to be that attractive for global players.»

Gas-powered applications have gained ground in some North American regions. Do you think these drivetrain to be a long-term solution or a bridge to full electrification?

«If you go back ten years, we saw diesel, then CNG, and diesel-electric hybrids. We have built over 14,000 CNG transit buses since 1994, of which 8,000 are still in service. We still have customers buying CNG buses today, because they have them in fleets and they have fueling stationsin place. Whether CNG goes away completely is not clear or totally understood today. In our opinion, there is no question we will see diesel hybrids slow down. But let me add something…

Please…

«The electric bus is one thing, the charging infrastructure is another. And, you then need to consider the power supply andenergy capacity of the grid. The issue in some regions is: are we going to charge a bus or give electricity to houses? To evolve with electric bus deployment, we must make sure we have reliable energy. What we are seeing now is that hydrogen fuel cells can act as range extenders on battery-electric buses, and as a result we are seeing more interest paid to fuel cell-electric technology as a viable zero-emission option».

Today I can build approximately 5,000 buses (in North America) on our production lines, and we have a mix of diesel, natural gas, and electric. If the pace of electric bus adoption gets higher, we are building them on the same production line

Paul Soubry, president and CEO NFI Group

Focusing for a moment on coaches, Van Hool’s CEO told us in an interview realized in late 2019: «We are developing an electric coach for the US, and not for Europe, because in the US there is a demand for this kind of vehicle». Do you already see the coach field as a penetration area for zero emission vehicles? MCI is working on this subject…

«We are already delivering electric coaches today. We started two years ago. We have them in demo service and we have orders. The motorcoach market is not homogeneous in North America. There are tour and charter operarors and city-to-city line operators (like Greyhound), where there is a real price pressure. It’s unlikely they are going to go electric in the short to medium term, because they also have the need for distributed charging infrastructure. There is also the employee shuttle market: it’s a perfect market for electric coaches, but it is one tenth of the overall market. It is a niche».

Latest member of NFI Alexander Dennis Limited is into a partnership with a Chinese group as chassis provider for electric buses. Do you see in the future possibilities to integrate your group’s technology with ADL bodyworks?

«In our view, the UK will be a fast adopter of e-buses, compared to North America. Our strategy together with ADL is to continue to work with BYD. By the end of this year we will also be building BYD chassis in partnership in our UK facilities. In North America we are already using an ADL chassis equipped with a propulsion package not provided by BYD. We are working to integrate our strategy on batteries, on battery management systems, and on electric motors with the Alexander Dennis chassis».

NFI: fuel cell buses, BRT, autonomous driving

Which place do you forecast, in the next 10 or 20 years, for fuel cell buses? Are we bound to see them more for city traffic or for long distance applications?

«We think fuel cell will definitely have a place for a couple of reasons. First, the practicality of charging in some areas make range dynamics very challenging. Of course energy density is increasing and price per kWh is decreasing, but in some places hydrogen fuel cell technology can allow a range more appropriate for operators. Our strategy is to use the fuel cell as range extender on a battery-electric bus. We think we are going to see a coexistence of battery-electric and hydrogen fuel cell-electric, with fuel cell applications potentially appropriate both for certain city operations and long-distance services».

How do you see the future of public transport (and long distance lines) in the post pandemic situation? Are we to get back at the previous paradigm or do you expect long term changes in customers behaviour and, consequently, on networks organization?

«There is no question that COVID-19 will have an impact also in 2021. Everybody is rethinking routes and services. After that, we anticipate we will be back to some kind of normal, and in North America we are quite confident we will have a recovery. Many cities have dramatic problems of congestion, and many cities are having aggressive conversations on how to reduce congestion and at the same time reducing emissions.

When I first started in this business, 12 years ago, we used to hear that light rail would kill the transit bus industry. The problem is on capital costs: billions of dollars and ten year projects. Today it is possible to create a bus rapid transit line with electric buses, and put 300 vehicles on the road in two years, and you can have a massive impact on the city. We are starting to see elected officials more interested in using an electric vehicle that has speed, congestion, environmental, and noise benefits at a fraction of the cost required by a light rail».

Last but not least, autonomous driving. Your group recently unveiled an autonomous bus project. We are often told: the technology is ready, bur regulations and infrastructures still have to get ready. How do you see the evolution of this field?

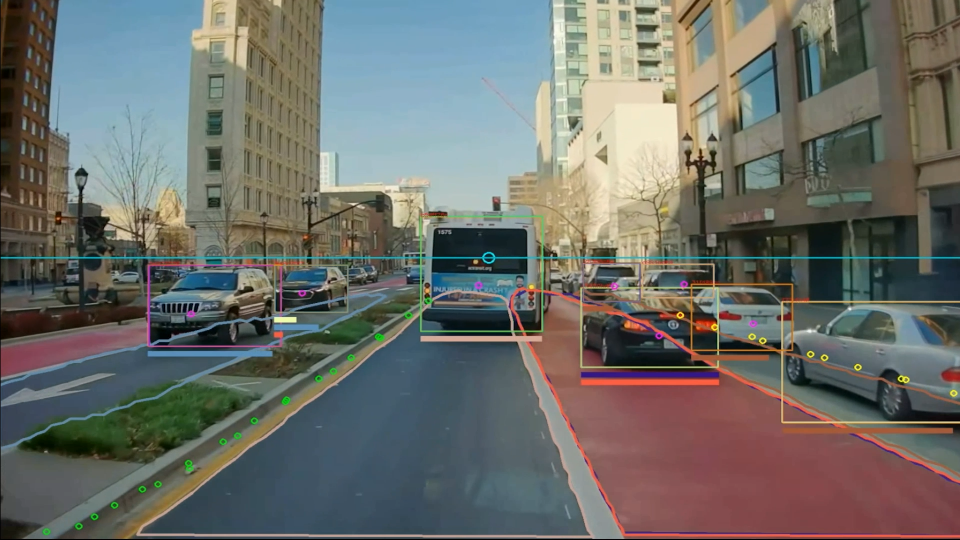

«We chose to get into this field early, teaming with Robotic Research to learn how radar, sensors and camera systems and AI can work with the vehicle. Autonomous buses make sense in BRT systems and can enhance safety in public transit.

Also if you think about a transport operator with 500 buses in a garage, efficiency, cost, and time savings of having autonomous vehicles parking, washing, charging and moving in the depot would also be significant. There is massive efficiency and safety benefits in view. That’s why we decided to step in early».