ACEA reports over 7,000 electric buses have been registered in Europe in 2023

According to ACEA, in 2023 electric bus registrations in the European Union “increased by 39.1% to 5,166 units, claiming a 15.9% market share”. Diesel bus share decreased from 67% in 2022 to 62% last year. In 2022 e-bus registrations accounted for 12.7% of the total EU bus market. Looking at wider area EU + EFTA […]

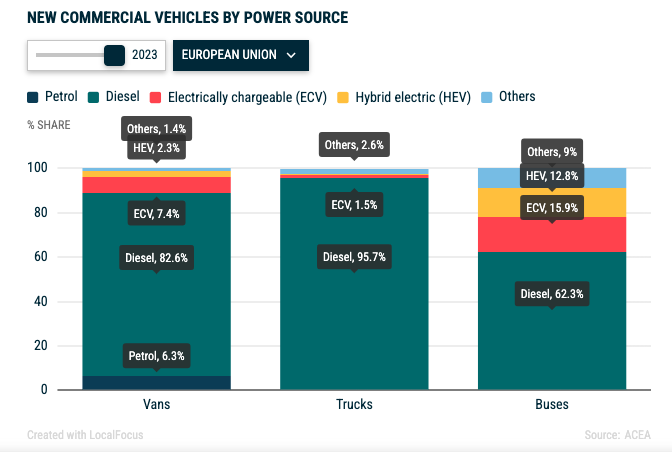

According to ACEA, in 2023 electric bus registrations in the European Union “increased by 39.1% to 5,166 units, claiming a 15.9% market share”. Diesel bus share decreased from 67% in 2022 to 62% last year. In 2022 e-bus registrations accounted for 12.7% of the total EU bus market.

Looking at wider area EU + EFTA + UK, the number of e-bus registration rises to nearly 7,200 units, with a 18% share on a market worth 39.944 buses and coaches.

Looking at the total European bus and coach market, registrations grew by 19.4% compared to 2022, totalling 32,593 units. Looking at major EU markets, ACEA adds, “Italy and Spain experienced a 56.2% growth. The largest and second-largest bus markets, Germany and France, grew by a 12.5% and 4.1%, respectively”. It’s unclear why German, French and Spanish data are coherent with the ones we reported lately (based on country-based organizations), while for Italy ANFIA data show a 72% increase, higher than the 56 reported by ACEA.

Still based on ACEA’s figures on the electric bus market, Spain led with a 269.7% growth, followed by Italy (+253.4%) and Germany (+29.3% – with a 10% difference compared to data released by KBA, that can be attributable to the fact that KBA figures concern buses over 3.5 ton).

Hybrid-electric buses also showed positive year-end figures, experiencing a 115.1% growth that nearly doubled market share from 7.1% to 12.8% compared to 2022. Noteworthy growth in the top three markets – France (+221.3%), Spain (+172.4%), and Germany (+37.5%) – contributed to this result.