Alexander Dennis to pause coach production in 2025. Challenges and strategies on the UK bus market according to MD Paul Davies

We met Paul Davies, Managing Director of Alexander Dennis, at Euro Bus Expo 2024 in Birmingham, where the company also shared further details on the upcoming Enviro200EV model. We discussed the growing influence of global competitors, the impact of government initiatives like the Better Buses Bill, and how Alexander Dennis is adapting its strategy to stay ahead in an increasingly competitive and evolving market.

Alexander Dennis has had a strong year in 2024, maintaining its position as the UK’s market leader. With over 1,000 buses delivered by the end of October and projections to reach 1,500 by year’s end, the company continues to navigate a highly competitive landscape, where international players, particularly from China, are beginning to make significant inroads.

However, the company has also had to make difficult decisions, such as pausing coach production in 2025 due to declining volumes since the pandemic.

We met Paul Davies, Managing Director of Alexander Dennis, at Euro Bus Expo 2024 in Birmingham, where the company also shared further details on the upcoming Enviro200EV model. We discussed the growing influence of global competitors, the impact of government initiatives like the Better Buses Bill, and how Alexander Dennis is adapting its strategy to stay ahead in an increasingly competitive and evolving market.

We are still the market leader, we delivered to date (editor’s note: as of the end of October) around 1,080 buses in the UK and our closest competitor is at around 800. We should reach close to 1,500 this year. The UK market is clearly growing in overall registrations. The challenge for next year is that a lot of ZEBRA and ScotZEB money, plus some of the London orders went abroad. In 2025 between 700 and 800 buses will come from two Chinese competitors.

Paul Davies, Alexander Dennis’ Managing Director

Paul Davies, the 2024 of Alexander Dennis

The UK has established itself as a leader in zero emission bus deployment in Europe so far…

The speed of transition to zero emission buses in the UK has been quite fast thanks to government fundings not only to support purchases but to support operations. These schemes have been instrumental in stimulating the industry.

Having said that, the diesel bus market is still quite strong for us. We are quite relaxed as we have chosen to be propulsion agnostic to best serve our customers. On one side, we invested money to bring new products to the market, but on the other side we have also invested in having a good diesel bus range and that market is still strong, although less open to disruption and gaining less attention.

You recently stated that the UK bus market is an “uneven playing field”. Can you elaborate more on this?

In Scotland for ScotZEB2 the requirement to compete as an industry player was to fulfil the Fair Work First standards of employee remuneration, welfare and safety, which for us is ok as we have the practices already in place including paying more than the real living wage. But what was frustrating is that this was only applicable to businesses based in the UK, not to OEMs based outside of the UK, whether in Europe or elsewhere. This is illogical as it is disadvantageous to companies based in the UK that like us have been investing a lot in product technology and jobs – we employ 1,900 people across the UK and utilise many UK suppliers.

Duties and Better Buses Bill

Do you think import duties can play a role in this?

There are a number of issues that we argue could be reviewed. Tariffs are a big talking point. Import duties on diesel buses are 16 percent, and the main players in the UK market have historically been European-based manufacturers. Import duties on electric buses are only 10 percent. This market is much more open to disruption due to Chinese players. My argument would be: China has a head-start on zero-emission technology due to government investments and support. This difference should be reflected in the commercial environment to ensure that our domestic industry can flourish while we continue to deliver competitive products.

We were delivering as many as 200 coaches per year before the pandemic, but since the pandemic we have been around 50 – 60 per year. That’s why we are going to pause coach production next year because we don’t have enough volume to have a dedicated line. We produce bodies for coaches in steel and for buses in aluminium, so having a line operating all the year with low volumes is increasing costs and complexity. We have to focus on profitability.

Paul Davies, Alexander Dennis’ Managing Director

How do you expect the Better Buses Bill to impact the demand for zero-emission buses?

Clearly the political landscape is changing with a new government and a change in place towards publicly-managed public transport.

Looking beyond the Better Buses Bill, the Labour government have said that they want maximum economic benefit out of public funding. They are talking about a reform of procurement policies in order to give some level of consideration for companies such as ours that are based in the UK, pay wages in the UK and therefore have a higher cost structure.

Of course we are glad to hear that the economic benefit of jobs in the supply chain is going to be valued somehow. I don’t expect the government to help us for free. Our primary focus is on delivering first class products as the UK has a very challenging bus market and customers have very high expectations. So our main job is to make sure we’re offering good products.

The government announced plans to create a UK Bus Manufacturing Expert Panel. How could this initiative support local manufacturers in the face of international competition?

We haven’t had details so far, but we’re looking forward to this and are happy to help the Government. Our parent company NFI has been involved in similar initiatives with government in the United States which have helped strengthen domestic manufacturing and jobs.

If you are a new company only selling zero emission buses, then it’s a challenge. We have seen the story. We are lucky we will have delivered 1,000 diesel buses this year, plus we have a very strong aftermarket business. If you only focus on zero-emission buses there will typically be a smaller aftermarket revenue stream given there are fewer moving parts than on diesel vehicles.

Paul Davies, Alexander Dennis’ Managing Director

Market leader in buses, going to stop coach production

We are close to the end of 2024. How have sales progressed this year?

We are still the market leader, we delivered to date (editor’s note: as of the end of October) around 1,080 buses in the UK and our closest competitor is at around 800. We should reach close to 1,500 this year. The UK market is clearly growing in overall registrations. The challenge for next year is that a lot of ZEBRA and ScotZEB money, plus some of the London orders went abroad. In 2025 between 700 and 800 buses will come from two Chinese competitors.

Out of the 1,500 vehicles you mentioned, how many are coaches?

Around 50. We were delivering as many as 200 coaches per year before the pandemic, but since the pandemic we have been around 50 – 60 per year. That’s why we are going to pause coach production next year because we don’t have enough volume to have a dedicated line. We produce bodies for coaches in steel and for buses in aluminium, so having a line operating all the year with low volumes is increasing costs and complexity. We have to focus on profitability.

Tariffs are a big talking point. Import duties on diesel buses are 16 percent, and the main players in the UK market have historically been European-based manufacturers. Import duties on electric buses are only 10 percent. This market is much more open to disruption due to Chinese players. My argument would be: China has a head-start on zero-emission technology due to government investments and support. This difference should be reflected in the commercial environment to ensure that our domestic industry can flourish while we continue to deliver competitive products.

Paul Davies, Alexander Dennis’ Managing Director

The difficult relation between e-mobility and profitability…

You mentioned profitability. In Europe we are witnessing a real change in the industrial landscape… It looks like industrialization of zero emission buses faces great barriers and profitability is very tough…

Bringing new products to the market is a big investment. Another challenge we’ve got is in our higher cost structure, that’s why we have to prevent a race to the bottom in terms of pricing. We don’t have the same level of vertical integration as some of our foreign competitors, for example we don’t make our own batteries but have to buy them on a commercial basis.

A further difference we could note: if you are a new company only selling zero emission buses, then it’s a challenge. We have seen the story. We are lucky we will have delivered 1,000 diesel buses this year, plus we have a very strong aftermarket business. If you only focus on zero-emission buses there will typically be a smaller aftermarket revenue stream given there are fewer moving parts than on diesel vehicles.

Is the segment of zero emission coaches a niche you are somehow looking at within the company’s strategy?

The coach market in the UK is so crowded. I’m not sure what role we can play in a market that is completely private and where operations are unsubsidized. We need to deploy our capital carefully and be active in fields where we know we can be successful.

Paul Davies on the partnership between Alexander Dennis and BYD

Back to the bus market, Alexander Dennis is now rolling out a series of e-buses built in house following the earlier cooperation with BYD. However, two years ago you mentioned that “Alexander Dennis will continue to sell and support electric buses built in partnership with BYD“. Is this still true?

Nothing has changed. Simply put, we are not receiving any demand for that product. Since we wanted to be independent in terms of also offering our own product, and they also launched their products on the market, a natural situation has emerged where we both are pushing our own solutions. For customers who have BYD–Alexander Dennis buses in their fleet, we will continue to support them through our AD24 aftermarket business. We are still open to work with third parties if customers require this.

Then if customers require the BYD – ADL product again, you would provide it?

We would consider it. However, our product development has significantly moved on in the meantime.

In September 2023 Alexander Dennis announced the appointment of Big Rig Manufacturing as contract manufacturing partner for the production of Enviro500 double deckers in North America. Which is, in your view, the potential of the North American market and which is the timeline of such collaboration?

It’s going well! We have filled the order book for 2025. Double-decker buses are a niche in North America, but there’s a real, although modest, market. We will deliver 50 to 75 units per year, with the first units to be delivered at the end of this year and a strong outlook for the next years with both diesel and zero-emission buses.

Funding, hydrogen and autonomous driving

Do you believe that the transition to electric mobility will require consistently higher levels of structural funding for fleet renewal, or are there financial tools or technological advancements that could make electric mobility economically sustainable without increasing the financial burden on citizens?

I think that as operators learn and become experienced with the cost of operations, we’ll get to a situation where if we would ask an operator if they prefer to buy diesel or electric, they would be ready to buy electric buses commercially. This is also the direction to which government has committed, so its not something that we can influence.

I believe zero emission buses are becoming commercially viable. Vehicle prices have been coming down, and energy efficiency is increasing. In London, we are now warranting the bus for 14 years battery warranty.

Autonomous driving and hydrogen. Two topics where your company is active but they both have communalities: they are both tied to funding and slower than expected in the ramp-up…

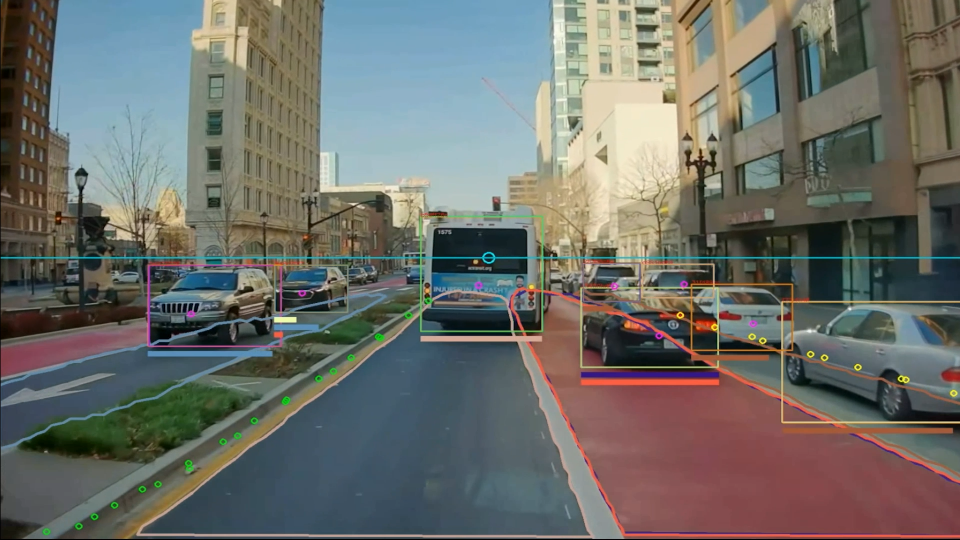

Driverless technology is interesting, we are involved in the CAVForth project in Scotland and we are getting lots of learnings. Next stop will be to provide an Enviro100AEV for CAVForth2. It has been interesting so far. It’s a job of learning and development. We have been investing our own money, we must make sure that we continue to learn and advance the technology.

And about hydrogen?

We have a hydrogen double-decker bus in our portfolio. We don’t have a single-deck fuel cell bus in our roadmap so far. I think hydrogen has a sales and infrastructure challenge because the correct supply of hydrogen, at the right quality, must be ensured. Also, if you look at the speed of depot conversion in the UK, I can’t see an operator that has already been transitioning their depots to electric, taking on a challenge such as that of a hydrogen electrolyzer.

We have a fleet of fuel cell buses in the UK that has been out of operation because there is not enough hydrogen, although this is now being resolved. I think hydrogen has some challenges to overcome.