Battery cost is bound to fall below $100/kWh by 2024 according to BNEF

Battery cost is bound to fall below $100/kWh by 2024. It used to be, averagely, above $1,100 per kilowatt-hour in 2010. The decrease in battery costs has not ended yet: prices have fallen 87% in real terms to $156/kWh in 2019. All these figures come from the BNEF’s 2019 Battery Price Survey from research company Bloomberg New […]

Battery cost is bound to fall below $100/kWh by 2024. It used to be, averagely, above $1,100 per kilowatt-hour in 2010. The decrease in battery costs has not ended yet: prices have fallen 87% in real terms to $156/kWh in 2019. All these figures come from the BNEF’s 2019 Battery Price Survey from research company Bloomberg New Energy Finance (BNEF), .

The reasons of this decrease are easily specified: «Increasing order size, growth in battery electric vehicle sales and the continued penetration of high energy density cathodes. The introduction of new pack designs and falling manufacturing costs will drive prices down in the near term», according to BNEF.

To what extent this development will be driven by Asian players? According to Interact Analysis, Europe will be the fastest growing market for lithium-ion batteries. The demand will be met thanks to the opening of local factories by big Asian players (Asia is now accounting for 72 % of the lithium-ion battery market). Meanwhile, energy storage is expected to be the fastest growing lithium-ion battery market sector. Transport will account for 68.4% of battery sales in 2023, and will become the main demand-side market driver.

Electric bus market, the players are getting ready

Among the latest news on battery development on the bus industry we could mention the agreement between FPT Industrial and Microvast aimed at building in-house batteries for CNH Industrial companies in Turin (Italy). Iveco and Heuliez buses are of course likely to get involved in this development. Solaris is ready to mount as many as 550 kWh of battery on the articulated bus, thanks to the Solaris High Energy + developed by BMZ for the Polish bus manufacturer.

The German-based supplier Akasol has huge news in store: the new battery module AKASystem AKM CYC is expected to double the maximum battery capacity today available on electric buses. And a big player as Cummins is going to be part of the challenge.

Battery cost to decrease as demand passes 2TWh

BNEF’s 2019 Battery Price Survey, published in the occasion of the BNEF Summit in Shanghai, predicts that as cumulative demand passes 2TWh in 2024, prices will fall below $100/kWh.

What is more, the battery cost at $100/kWh, according to BNEF, could be a real milestone: this cost is seen as the breakeven point for electric vehicles to reach price parity with internal combustion engine vehicles. Focusing on buses, we already reported about a study by McKinsey which outlined that large-scale adoption of electric buses in the cities will occur from 2023, the year where an electric bus will become effectively cost-competitive compared to a diesel bus.

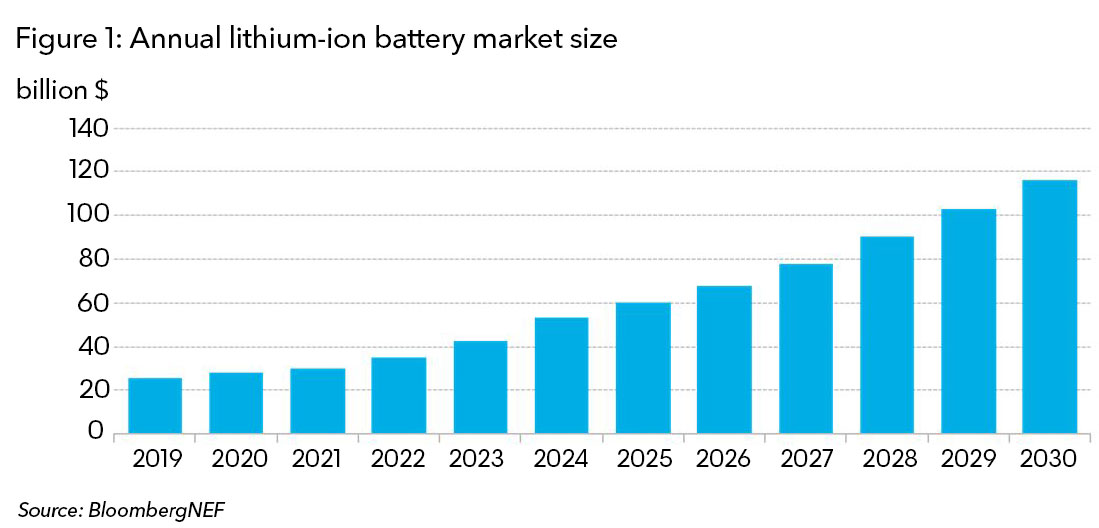

James Frith, BNEF’s senior energy storage analyst and author of the report, said: «According to our forecasts, by 2030 the battery market will be worth $116 billion annually, and this doesn’t include investment in the supply chain. However, as cell and pack prices are falling, purchasers will get more value for their money than they do today».

Commercial vehicle electrification is catching up

BNEF’s analysis finds that as batteries become cheaper, more sectors are electrifying. For example, the electrification of commercial vehicles, like delivery vans, is becoming increasingly attractive. This will lead to further differentiation in cell specifications, with commercial and high-end passenger vehicle applications likely to opt for metrics like cycle life over continued price declines, BNEF author highlights. However, for mass market passenger EVs, low battery prices will remain the most critical goal.

Logan Goldie-Scot, head of energy storage at BNEF, said: «Factory costs are falling thanks to improvements in manufacturing equipment and increased energy density at the cathode and cell level. The expansion of existing facilities also offers companies a lower-cost route to expand capacity».

Battery cost, less certainty of decrease after 2024

«The path to achieving $100/kWh by 2024 looks promising, even if there will undoubtedly be hiccups along the way – we can read in BNEF report -. There is much less certainty on how the industry will reduce prices even further, from $100/kWh down to $61/kWh by 2030. This is not because it is impossible but rather that there are a variety of options and paths that can be taken. New technologies like silicon or lithium anodes, solid state cells and new cathode materials will be key to helping cost reductions play out».