E-buses are set to exceed 60% of sales by 2030 globally, according to BloombergNEF

“Municipal buses continue to electrify at a rapid pace and exceed 60% of sales already by 2030, reaching 83% by 2040” states the latest Bloomberg New Energy Finance (BNEF) latest 2024 Electric Vehicle Outlook. Today municipal buses, estimated to be 3.4 million worldwide, emit no more than 1 per cent of road transport CO2 emissions […]

“Municipal buses continue to electrify at a rapid pace and exceed 60% of sales already by 2030, reaching 83% by 2040” states the latest Bloomberg New Energy Finance (BNEF) latest 2024 Electric Vehicle Outlook.

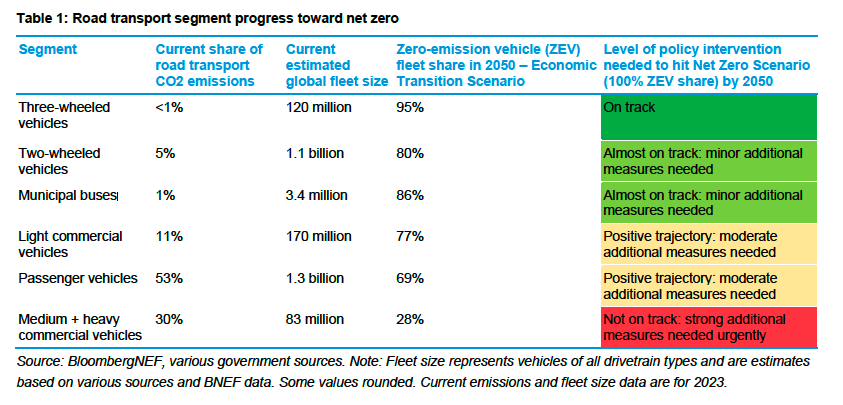

Today municipal buses, estimated to be 3.4 million worldwide, emit no more than 1 per cent of road transport CO2 emissions globally. Electric buses are expected to represent 86% of the global fleet as of 2050. The segment is said to be “Almost on track: minor additional measures needed” by BloombergNEF analysts concerning the level of policy intervention needed to achieve the Net Zero Scenario of 100% ZEV share by 2050.

Bloomberg New Energy EVO 2024

The report highlights how the global push towards decarbonization has gained significant traction in the commercial vehicle sector, particularly within the public transportation segment.

As mentioned above, the report highlights that by 2030, more than 60% of new municipal bus sales will be electric worldwide, escalating to an impressive 83% by 2040. This shift is particularly noticeable in regions with stringent environmental policies and robust governmental support, such as China, Europe, and several cities in the United States.

China leads the global market in electric bus adoption, a testament to its aggressive policies and substantial investments in electric vehicle infrastructure. European countries are following suit, propelled by the European Union’s CO2 emissions targets, which mandate significant reductions in greenhouse gas emissions from transportation sectors.

The rise of LFP batteries

The battery landscape for electric vehicles, particularly buses, is undergoing significant transformation driven by technological advancements and market dynamics. Lithium-iron-phosphate (LFP) batteries are at the forefront of this shift, gaining prominence due to their enhanced safety, longer life cycles, and lower costs compared to traditional lithium-ion batteries.

“In the Chinese market, EV lithium-iron-phosphate (LFP) cell prices have averaged $53/kWh between January and April 2024, a 44% year-on-year drop. Planned battery production capacity in China is almost seven times demand by 2026″, the report states.

According to BloombergNEF, “LFP reaches over 50% of the global passenger EV market within the next two years. Nickel and manganese are among the biggest losers from the advancements in LFP batteries”.

As a result, the anticipated need for nickel and manganese in EV batteries has been revised downward significantly, reflecting the growing dominance of LFP batteries in the market: “Nickel consumption in lithium-ion batteries reaches 517,000 metric tons in 2025, while manganese reaches 131,000 metric tons. These are 25% and 38% lower than our previous estimates in EVO 2023 for nickel and manganese, respectively, due to the shift toward lower-cost chemistries”.