BorgWarner’s strategies for the e-bus market (now offering also LFP modules). Our interview with Andreas Vath

BorgWarner has expanded its e-mobility business after acquiring the German battery systems manufacturer Akasol. Now the group’s portfolio includes battery systems, charging solutions, drivetrains, motors, inverters, and eFans. BorgWarner main emphasis in commercial vehicles is on battery systems. Offering both NMC and LFP solutions (with the latter being a real news, as the focus of […]

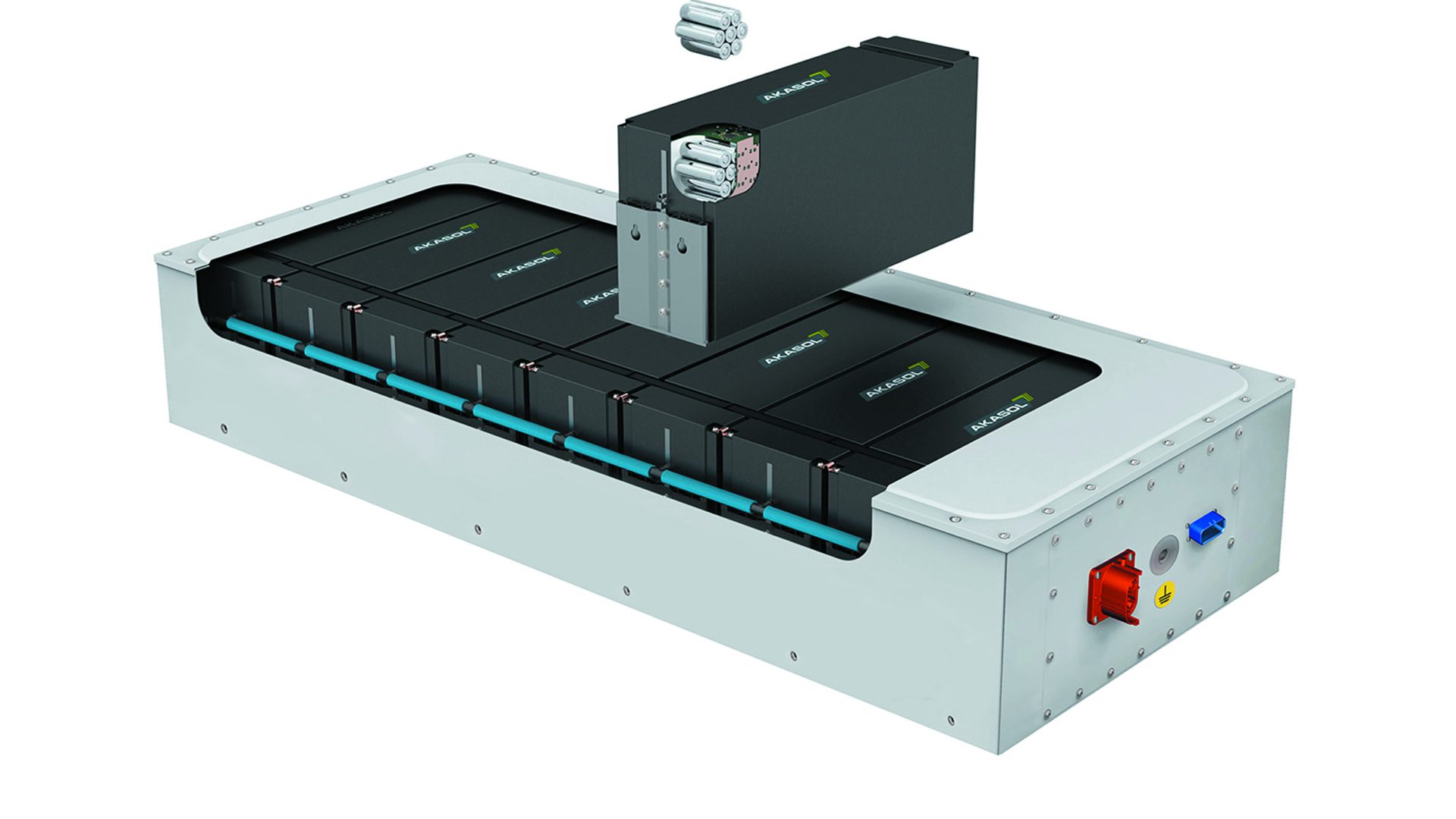

BorgWarner has expanded its e-mobility business after acquiring the German battery systems manufacturer Akasol. Now the group’s portfolio includes battery systems, charging solutions, drivetrains, motors, inverters, and eFans. BorgWarner main emphasis in commercial vehicles is on battery systems. Offering both NMC and LFP solutions (with the latter being a real news, as the focus of Akasol had been since the beginning on NMC formula), they prioritize higher energy density and exclude LTO technology for now.

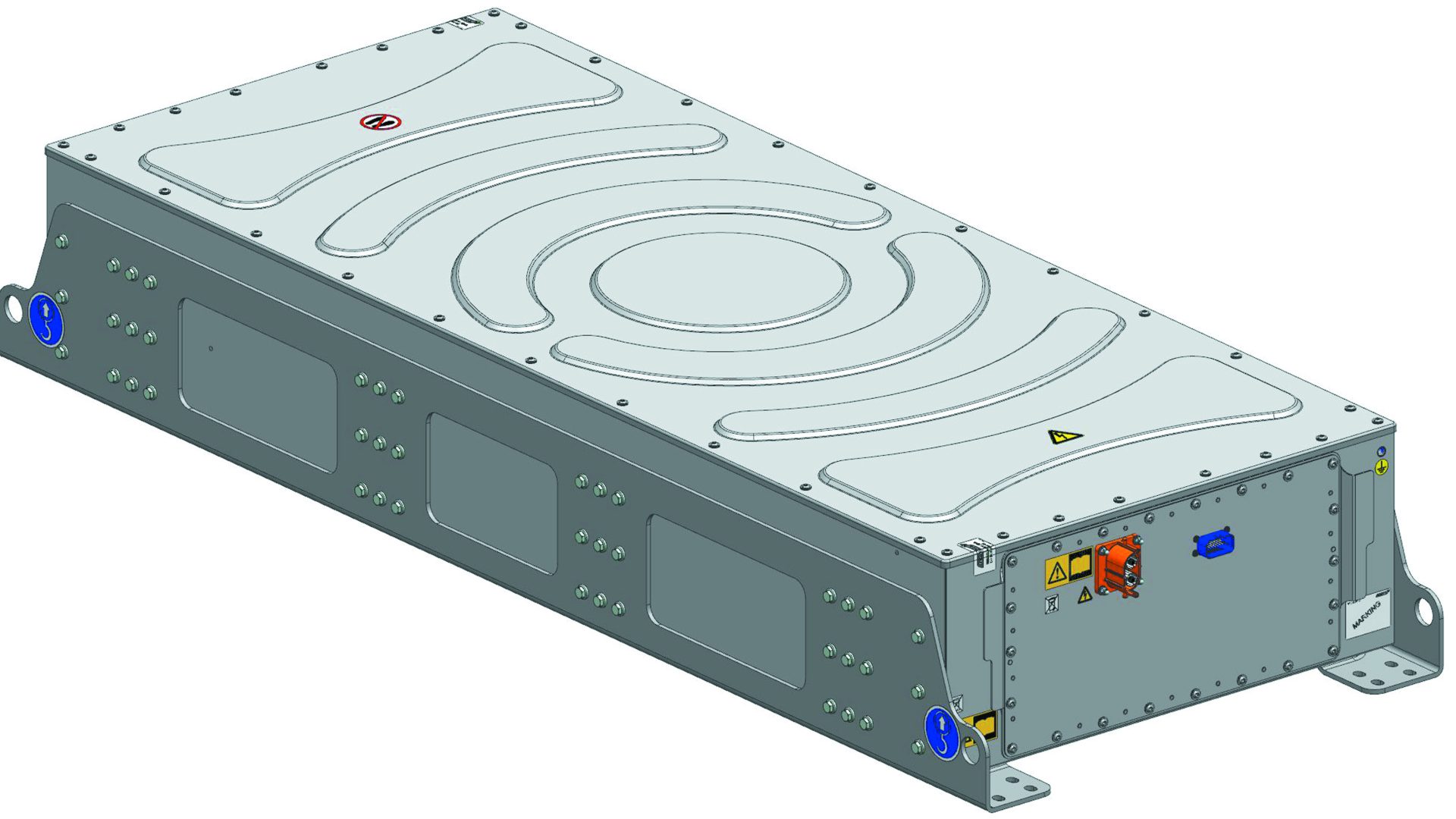

Battery facilities are located in Darmstadt and Detroit, with plans for a production line in Seneca (South Carolina), aiming for balanced production in Europe and North America. Their third-generation batteries (mounted on the eCitaro, for instance) is designed for second-life applications.

We interviewed Andreas Vath, Manager Advanced and Application Development, who outlines strategies, roadmap and goals of the group in the electric bus business.

In the field of LFP technology, there has been a significant increase in energy density, although it is still around 20% lower than NMC. However, it has now reached a level that is sufficient for many applications, and it is also cheaper on the cell level. As a result, we are now able to offer two solutions to our customers, even though the European commercial vehicle market is still primarily focused on NMC technology. For customers who require a higher energy density for longer routes, we can provide NMC technology. For those who do not require as much energy onboard, we can offer LFP technology

Andreas Vath, Manager Advanced and Application Development, BorgWarner

BorgWarner, Akasol, batteries for public transport

How is BorgWarner organized in terms of activities for the public transport and electric bus segment, following the acquisition of the Akasol brand?

“Following the acquisition of Akasol, we have integrated their activities into our e-mobility business. This includes their manufacturing facilities and engineering capabilities, which have helped us to expand our product portfolio and better serve the public transport and electric bus segment”.

Which is BorgWarner’s portfolio of solutions for the e-bus sector?

“Our portfolio of solutions for the e-bus sector includes complete battery systems and charging solutions, as well as drivetrains, motors, and inverters. We also offer eFans for cooling of BEV Trucks”.

Which are your main customers concerning drivetrains?

“We are currently in the startup phase and don’t have huge drive train volumes in commercial vehicles yet. It’s completely different than passenger cars, where we’re a global player for such components. In commercial vehicles, our main product are battery systems at the moment”.

Looking back at the past with quite stable raw material prices the battery prices decreased as a result of optimization in pack design, production, and economy of scale. The decrease in costs we achieved could not completely compensate for the current increase in raw materials costs. As a response, cell producers are now investing heavily in mining activities to secure their raw material supply. While raw material prices have started to decrease slightly, it is unlikely that we will reach the same level we had a few years ago

Andreas Vath, Manager Advanced and Application Development, BorgWarner

BorgWarner and the trends in battery business

Lithium-ion battery pack prices “increased by 7% from 2021 to 2022, up to $151/kWh”, according to the latest Bloomberg battery price survey. Do you agree with this figure? How do you forecast the future evolution of prices?

“Looking back at the past with quite stable raw material prices the battery prices decreased as a result of optimization in pack design, production, and economy of scale. The decrease in costs we achieved could not completely compensate for the current increase in raw materials costs. As a response, cell producers are now investing heavily in mining activities to secure their raw material supply. While raw material prices have started to decrease slightly, it is unlikely that we will reach the same level we had a few years ago”.

“By 2025, we expect that 80 per cent of all newly registered city buses in Europe will be electrified”, said Akasol founder Sven Schulz in an interview with Sustainable Bus in late 2019. Do you think this is still a plausible forecast?

“We believe that the electrification of city buses in Europe will continue to accelerate in the coming years, as more cities and transit agencies set aggressive emissions reduction goals. If we do not reach the 80 per cent goal in 2025, then we will reach it a few years later. We are committed to helping our customers meet these goals by providing innovative and reliable e-mobility solutions”.

BorgWarner bets (also) on LFP technology

“LFP batteries have gained significant market share in the last three years”, reads the latest BloombergNEF report. The consultancy expects LFP to account for around 40% of global EV sales in 2022. Any insight about which trends are underway?

“In the field of LFP technology, there has been a significant increase in energy density, although it is still around 20% lower than NMC. However, it has now reached a level that is sufficient for many applications, and it is also cheaper on the cell level. As a result, we are now able to offer two solutions to our customers, even though the European commercial vehicle market is still primarily focused on NMC technology. For customers who require a higher energy density for longer routes, we can provide NMC technology. For those who do not require as much energy onboard, we can offer LFP technology”.

This is quite a news, given that the initial focus on Akasol had been stated as being NMC. Are you going to offer also LTO?

“Not at the moment. Our current focus is on achieving higher energy density, rather than higher power, so we are not currently planning to offer LTO technology.”

Battery re-use is a significant issue, and BorgWarner’s current generation of batteries, the third generation, was designed for second-life applications. What is important to mention is that reuse of batteries should be addressed starting with the design of the new product. If a battery is to be used in second-life applications, certain design requirements must be met. If the battery is to be used for 6-10 years in mobile applications, BorgWarner would take the entire battery pack out, test them, upgrade the software, and reduce power and C-rate limits before repurposing it for second-life applications

Andreas Vath, Manager Advanced and Application Development, BorgWarner

What trends do you see in demand for charging solutions?

“Mixture is the best solution. Our batteries are typically used for depot charging, but if you have a particularly long route, maybe in the countryside, and in the end, there is a possibility for fast charging, then you can partially charge the battery in ten minutes.”

Isn’t this stressful for batteries?

“If you charge according to the opportunity standard profile within a certain temperature and SOC range, this doesn’t stress NMC batteries so much.

Back on LFP technology, how are these dealing with high power charging?

“We see there are new developments from LFP suppliers with applications that can charge from 10 to 80 per cent in 45 minutes. This is typically the time of mandatory break for commercial vehicle drivers in EU. Charging in 30 to 45 minutes is a requirement for our applications that will be marketed for truck and long haul applications”.

What about second-life of batteries?

What are BorgWarner’s strategies in North America?

“BorgWarner has one facility in Darmstadt and one in Detroit, Michigan. There will be a further production line in Seneca, South Carolina. The company plans to have the same production volume in Europe and North America”.

What is BorgWarner’s approach to battery second-life and recyclability?

“Battery re-use is a significant issue, and BorgWarner’s current generation of batteries, the third generation, was designed for second-life applications. What is important to mention is that reuse of batteries should be addressed starting with the design of the new product. If a battery is to be used in second-life applications, certain design requirements must be met. If the battery is to be used for 6-10 years in mobile applications, BorgWarner would take the entire battery pack out, test them, upgrade the software, and reduce power and C-rate limits before repurposing it for second-life applications”.

Could the second-life battery market become an interesting new business for your group?

“The company is exploring the possibility of entering the second-life market with either a new business model or a partnership with an existing storage provider for stationary applications”.