How is the bus industrial landscape changing in Europe?

Body builders are experiencing a new golden age. The ‘electric race’ has shuffled the cards of a sector that has remained too tied to old entrepreneurial logics and dotted with large groups that are economically uncompetitive and poorly responsive to market developments. The pandemic acted as a catalyst for a process that was in any case changing the collective way of moving, especially in the tourism sector.

Below, an article we published on the September 2023 issue of Sustainable Bus magazine. It has been in the meanwhile updated with the latter developments happened in the meanwhile

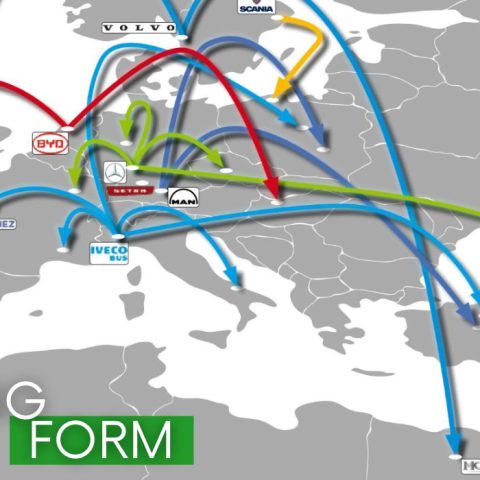

First Volvo, then Scania announced in 2023 radical changes of business model that seems to be destined to set an example. Iveco Bus and Daimler Buses have bucked the trend. Body builders are experiencing a new golden age.

If someone had asked us a couple of years ago if there was still room for bodybuilders, we probably would have answered no. But after the recent statements from various manufacturers who intend to downsize or even cease the production of complete buses, are we still of this opinion?

Undoubtedly, the ‘electric race’ has shuffled the cards of a sector that has remained too tied to old entrepreneurial logics and dotted with large groups that are economically uncompetitive and poorly responsive to market developments. The pandemic then acted as a catalyst for a process that was in any case changing the collective way of moving, especially in the tourism sector.

Furthermore, the appearance of many new (sometimes improvised) players is redistributing market shares. Finally, an increasing share has been taken by Chinese groups, which have never been so present in the old continent, with a technology already widely tested and much lower prices. And what about Turkish brands? Their current political and economic situation certainly doesn’t help them, but regardless of this, they continue to sell several hundred pieces a year in Europe. In the meanwhile, independent OEMs manufacturing in Western Europe are witnessing though times: Van Hool’s bankruptcy and VDL’s ‘challenging’ 2023 are a testament of it. And a come back to ‘made in China’ assembly is also the way chosen by Ebusco.

So, is this a sector destined to change? Yes, and quite a bit. But let’s see in detail what is happening today and try to understand where we are going.

VOLVO

In March 2023, the Swedish manufacturer, one of the first to believe in electric traction, announced its intention to cease the production of complete buses in Europe at the end of the first quarter of 2024, effectively closing the Polish plant in Wroclaw. The plant will then pass to Vargas Holding, which will reinstate part of the 1,500 employees.

This decision comes after years of losses, during which Volvo has never achieved significant market shares, except for some important contracts in northern Europe.

This maneuver will logically lead to a further lower income, which is estimated at around one billion euros, but from 2025 it will make it possible to restore competitiveness to one of the largest automotive groups on our continent. Production will continue in Sweden for all the technological parts, as well as for the chassis to be set up, just as assistance will be ensured for the entire fleet already on the road.

Looking at the future, Volvo will strengthen its partnership with the Egyptian manufacturer MCV, with which it had already supplied electric buses in the United Kingdom, by having the 12- and 18-meter electric 7900 manufactured and by developing a new project for the intercity bus. And also a partnership with Castrosua in Spain has been kicked-off.

The latter took shape in March 2024 when the group launched the BZR chassis for Low Entry and High Floor buses as well as its first application: a concept of the intercity Volvo 8900 Electric, which is set to be marketed starting in 2025.

In the field of touring coaches, Volvo confirmed its collaboration with coachbuilders, starting with Sunsundegui, for increasingly customized vehicles that conform to customer specifications.

SCANIA

Just over a year after the presentation of the new Interlink, in May 2023 Scania has stated its intention to stop the production of all its complete buses, including the Citywide, foreseeing the drastic downsizing of the Polish production site and the cutting of over 800 employees (partly relocated).

The fifth European manufacturer of buses over 8 tons comes from a three-year period of constant decline in original vehicles registered. This is quantifiable in a minus 35 percent since 2019, compared to a Scania bus turnover that for 90 percent is made of vehicles built through bodywork partnerships all over the world, as SVP Head of Bus & Coach Johanna Lind told us.

A painful but necessary choice, therefore, to concentrate investments on engines, chassis and technological parts, making more and more use of those partners who over the years have been able to make the most of robust, reliable and known everywhere mechanical groups, ensuring their marketing and assistance. Thus, the idea, which was repeatedly announced and never really implemented, of developing platforms common to MAN within the Traton group was definitely shelved.

On the other hand, the will remains to follow more paths in alternative tractions (electric, hybrid, hydrogen, gaseous and liquid methane) but leaving the task of ‘dressing’ the bus to others, so as to better accommodate the markets and distribute the investment costs. First application? A Low Entry intercity e-bus jointly developed with Castrosua: it was presented at Busworld 2023 in Brussels and presented to Spanish press in early 2024.

MAN

The Bavarian manufacturer has declared in late 2022 its intention to reduce the production capacity of the Polish plant in Starachowice, which is currently the reference for the entire urban range, in order to transfer the entire construction process of electric buses to it, moving all conventional fuel buses (including methane) in the recently expanded Turkish plant in Ankara. All with a cut of about nine hundred workers, half of whom will be immediately relocated to the new truck production unit near Warsaw.

In reality, this decision reduces the overall production capacity of MAN and Neoplan branded buses, going from over 7,000 units (although only a small pre-pandemic share) to just over 5,000, two thirds of which reserved for the Turkish factory, which is also in the process of qualifying it for electromobility production, with goal of starting production of high-voltage vehicles by end 2025.

On the other hand, the European market has fairly constant figures and MAN shares fail to increase, despite an almost completely new range. Therefore, it is essential to redistribute production, increasing the specialization of each plant and improving a margin that is still not sufficient.

DAIMLER BUSES

The last brand to build most of its buses in Germany, Daimler Buses has recently stated to relocate part of its production to the Czech Republic, specializing the current German plants in the design and manufacturing of alternative traction vehicles.

Basically, from 2024, Mannheim will be a center of excellence specialized in BEV and FCEV buses, while all traditional vehicles will be moved to Holýšov where, from 2028, all the bodies for all the group’s European plants will be manufactured. All with a precise investment plan in Germany (150 million) with the maintenance of minimum employment. The reduction in production in Mannheim will however be compensated for by an increase in the construction of components for the entire group and the Setra Top Class will remain in Neu-Ulm.

From the official press releases, however, it is not clear where the Citaro diesels will be manufactured starting next year: if Mannheim only makes electric buses, will production already go to the Czech Republic? What happens to the French factory in Ligny-en-Barrois, where also a 50 million € investment is underway? We will see it in the coming months. One thing is certain: the development of new technologies remains entirely in Germany, at least for the next ten years, and it will also concern battery and H2 coaches.

IVECO BUS

On sale for years, at least unofficially, Iveco has survived better than other manufacturers thanks to its most successful bus ever: the Crossway, which was intelligently also proposed in CNG and, lastly, electric variants.

The perpetually saturated production lines of Vysoke Myto in the Czech Republic have prompted the Italian-French group to collaborate with the Turkish Otokar, where a special line of KTL (cataphoresis) has been installed to create the normal-floor interurban and manufacture the Streetway, derived from the Otokar Kent.

For the other ‘surviving’ models (remember that Iveco has exited the Class III segment if not for some Evadys), it makes use (less and less) of the former Renault factory in Annonay as well as of the collaboration of Heuliez, which in the meantime has become a development center for electric buses. The new Foggia plant, in southern Italy, should also be mentioned.

It is the final assembly and customization point for buses destined for Italian market, but without body construction lines. This is perhaps a gamble from a strategic point of view, but also a transition point towards a future that is not clear to anyone, least of all to those who manage (quite well) the demands of today’s market but do not seem to declare any new medium-long term projects.

BYD

The only Chinese company with production plants located, at least partially, in Europe, is also the one who has shown the most discontinuity in recent years. After the plant in France which opened and then closed (once a large order had been completed) and the main one in Hungary, BYD gets around some European protectionist limits by assembling where it is most convenient, following that concept of ‘microfactories’ distributed throughout the territory, with the only task of producing close to the customer.

Whether it is a winning choice we do not know, but it is curious that, on the occasion of the last UITP congress in Barcelona, BYD presented an electric bus with a Castrosua body, the Nelec, declaring it technically and commercially suitable for all of Europe. Even more curious is the fact that the Nelec already existed on Scania parts, as if to confirm that the future is (again) in bodybuilders (that’s confirmed by BYD’s focus on ‘partnerships’ and the presentation of the B2 platform at Busworld). Will it really be like this?