138K electric buses sold in China in 2022. Small-sized buses grew 183%

Sales of new energy buses and trucks in China reached an all-time high of 238,000 units in 2022, an increase of 90% compared to the previous year, according to an article by Shirly Zhu, principal analyst at Interact Analysis. This growth was largely driven by the new energy bus market, which made up 58% of […]

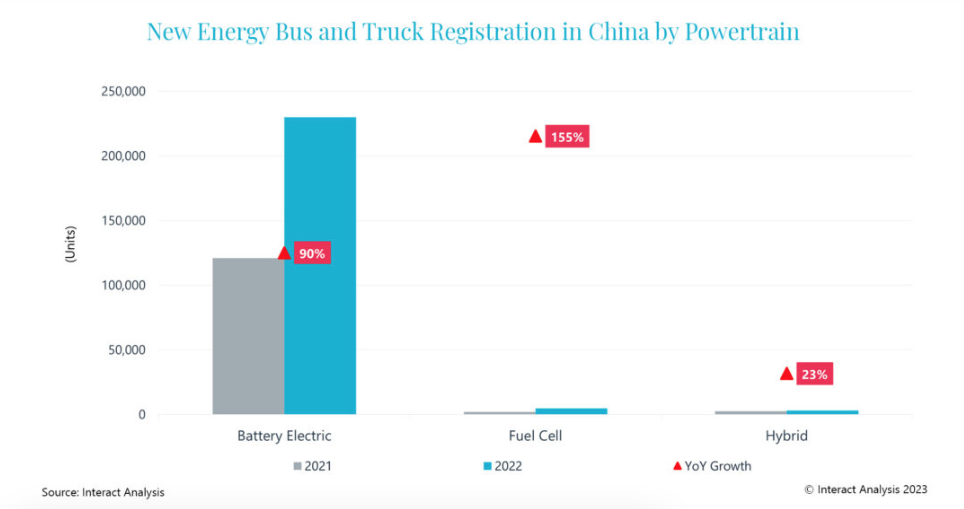

Sales of new energy buses and trucks in China reached an all-time high of 238,000 units in 2022, an increase of 90% compared to the previous year, according to an article by Shirly Zhu, principal analyst at Interact Analysis. This growth was largely driven by the new energy bus market, which made up 58% of total sales and totaled 138,000 units.

Ahead of the cancellation of national subsidies in January 2023, registration of new energy buses and trucks in December peaked at a total of 67,000 units, an increase of 121% year-on-year. Total registrations stood at 238,000 in 2022, accounting for 9.2% of total commercial vehicle registrations, up by 6 percentage points from 2021.

China cancels subsidies

“From January 1st, 2023, a decade-long national subsidy from the Chinese government for new energy vehicles was officially scrapped. This indicates that sales of China’s new energy buses and trucks are transitioning from policy-driven to market-driven. Coupled with the ‘last minute rush’ buying in December 2022 (registrations soared to 67,000 units) and the impact of the Chinese New Year holiday, sales of new energy commercial vehicles are anticipated to take a hit during the first couple of months of 2023. The market is expected to experience a ‘gradual upward’ trend throughout the year, reaching around 300,000 units”, Zhu writes.

And adds: “It’s worth mentioning that exports of new energy buses and trucks have accelerated in the past couple of years, reaching more than 35,000 units in 2022. This trend will maintain its growth momentum in 2023 and onwards”. The leading manufacturer in European electric bus market 2022 is the Chinese Yutong, by the way.

New energy bus and trucks market in China 2022

According to a the analysis, the market for new energy vehicles in China experienced a surge in sales in 2022, reaching an all-time high of 238,000 units, a significant 90% increase from the previous year. This growth was largely driven by the new energy bus market, which made up 58% of total sales and totaled 138,000 units.

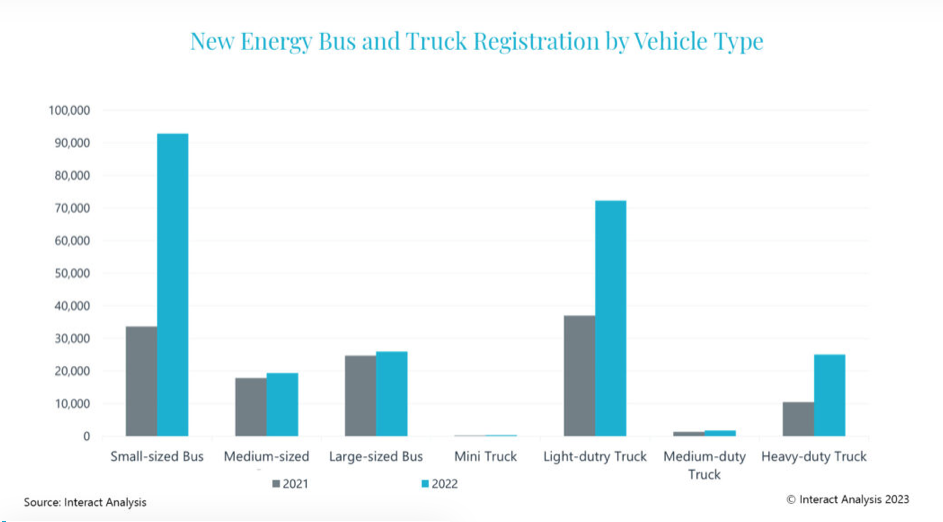

Interestingly, small-sized buses experienced the highest growth rate, with a staggering 180% year-on-year increase to nearly 93,000 units in 2022. In contrast, growth rates for large- and medium-sized buses were a mere 5% and 8%, respectively. These figures indicate a clear preference for smaller buses among Chinese consumers in the new energy vehicle market.

Battery-electric vehicles leading

Battery-electric remained the dominant powertrain choice for new energy buses and trucks, accounting for 97% of total units. Sales of fuel cell vehicles increased by 155% to 4,782 units in 2022 due to an uptick in demonstration projects nationwide.

Although the subsidy has been withdrawn, Shirly Zhu writes, “the Chinese government will still be devoting attention to the new energy industry. Favorable policies spanning purchasing tax exemption, right of way, subsidies for hydrogen vehicles, support for infrastructure construction and so on will remain in place to support development of the market. In 2023, new energy light-duty trucks and buses will retain the lead in terms of sales. Additionally, the fuel cell vehicle segment will remain robust in 2023 – with new projects rolling out in many regions”.