Daimler Buses led sales growth of Daimler Truck in Q2 2023: +22%

Daimler Buses has been leading the sales growth of Daimler Truck in Q2 2023. All segments of the group are experiencing positive developments, but the bus business is witnessing a particularly strong growth: +22% on Q2 2022. These developments result in an increased Group revenue guidance between €56 billion and €58 billion (previously: €55 billion […]

Daimler Buses has been leading the sales growth of Daimler Truck in Q2 2023. All segments of the group are experiencing positive developments, but the bus business is witnessing a particularly strong growth: +22% on Q2 2022.

These developments result in an increased Group revenue guidance between €56 billion and €58 billion (previously: €55 billion – €57 billion).

Daimler Truck towards the next level

“Daimler Truck is doing very well. We are increasing our guidance for 2023. We are firmly on track to deliver on our 2025 ambitions. And we are ready to take Daimler Truck to the next level by 2030 – aiming for above 12% adjusted return on sales for the Industrial Business in sunny conditions. We are initiating a share buyback program of up to two billion euros over a period of up to two years to make sure our shareholders fully benefit from our successful development. Our flexible technology strategy enables us not only to navigate the historic transformation of our industry, but to capture all opportunities associated with it. In short: Daimler Truck is transforming for sustainable growth – to the benefit of our employees, our customers and our shareholders,” says Martin Daum, Chairman of the Board of Management of Daimler Truck.

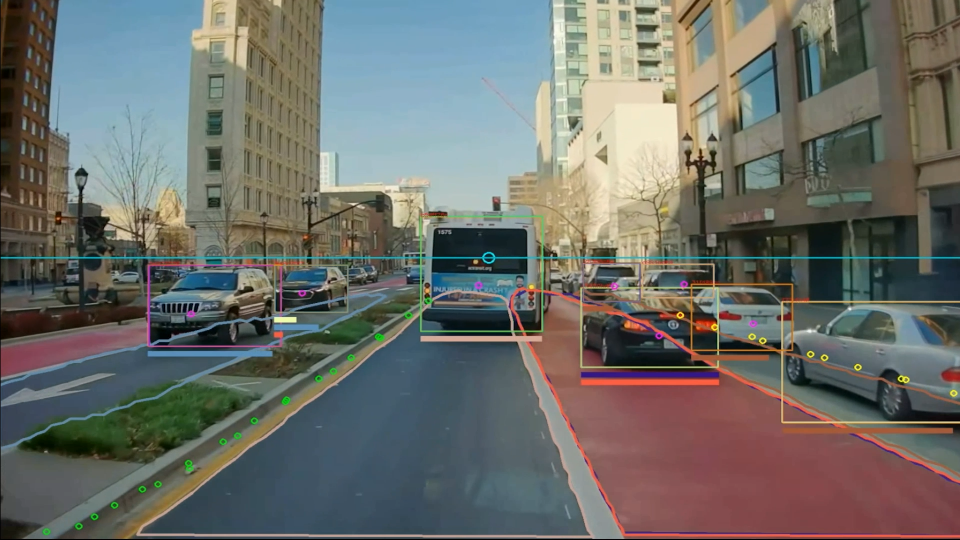

After a strong first quarter in 2023 and an increase in unit sales in Q2, Daimler Truck continues to see a positive momentum for the remaining financial year. In the second quarter of 2023, worldwide unit sales of the Group increased by 9.0% versus the prior year quarter, selling in total 131,888 units (Q2/22: 120,961). All segments contributed positively to this year-over-year increase: Trucks North America +14.7% with 50,618 units (Q2/22: 44,124), Mercedes-Benz +1.1% with 39,236 units (Q2/22: 38,812), Trucks Asia +9.2% with 40,097 units (Q2/22: 36,704) and Daimler Buses +21.8% with 6,181 units (Q2/22: 5,075).

Daimler Truck, focus on ROI

The adjusted ROS guidance for the Industrial Business for the financial year 2023 increases to a range of 8.5-10% (previously: 7.5-9%). The Group also raises its outlook for each industrial segment. The adjusted ROS guidance for Trucks North America is lifted to the range of 11-13% (previously: 10-12%). For Mercedes-Benz, the Group now expects an adjusted ROS between 8-10% (previously: 7-9%). Trucks Asia is now expected to reach an adjusted ROS between 4-6% (previously: 3-5%). For Daimler Buses the adjusted ROS target corridor is raised to between 3-5% (previously: 2-4%). The main drivers are stronger core markets accompanied by an improving supply chain situation, robust pricing and a strong development of the services business.

“Looking beyond 2025, we see multiple growth opportunities in our industry and we are fully equipped to exploit these opportunities. This should translate into a 40-60% increase in revenues between 2025 and 2030 and an above 12% adjusted return on sales for the Industrial Business in sunny conditions. At the same time, we will be relentlessly focused on cost discipline and smart capital allocation,” says Jochen Goetz, Member of the Board of Management and CFO of Daimler Truck.