Daimler Truck results 2023, 9% more buses sold (and almost 3,500 zero emission trucks and buses sold globally)

With 526,053 units, 1% more trucks and buses were sold worldwide in 2023 compared to prior-year level (520,291 units). As for ZE vehicles, Daimler Truck sold 3,443 zero-emission trucks and buses, 277% more than in the previous year (914 units). The Group’s revenue increased by 10% to a record level of €55.9 billion in 2023 (previous year: […]

With 526,053 units, 1% more trucks and buses were sold worldwide in 2023 compared to prior-year level (520,291 units). As for ZE vehicles, Daimler Truck sold 3,443 zero-emission trucks and buses, 277% more than in the previous year (914 units). The Group’s revenue increased by 10% to a record level of €55.9 billion in 2023 (previous year: €50.9 billion), according to the results shared by the group.

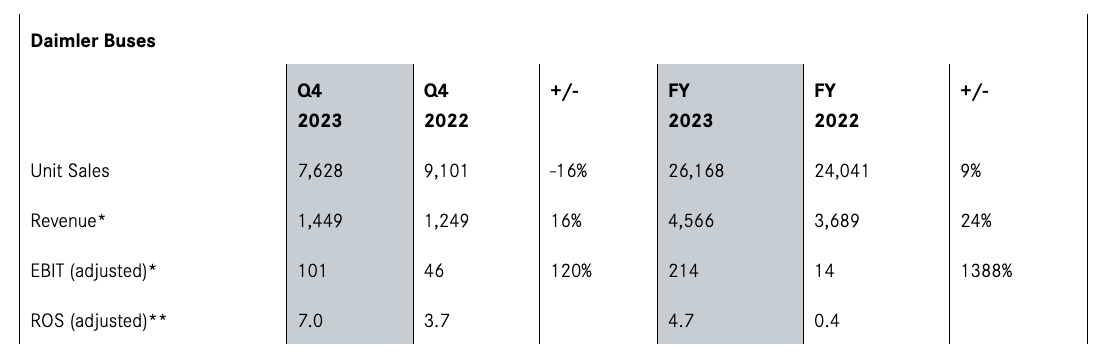

Concerning buses, the group sold 9% more vehicles than in 2022 with an increase in revenue of 24%.

2023 also showed a very positive development for earnings and return on sales, further driven by strong financial results in Q4. The adjusted EBIT jumped by 39% in 2023 to a record level of €5,489 million (2022: €3,959 million). With a peak of 10.6% in Q4, the adjusted ROS of the Industrial Business reached 9.9% in the full year 2023 (2022: 7.7%).

The bus business within Daimler Truck results 2023

In 2023 Daimler Buses introduced the Mercedes eCitaro fuel cell, launched at 2023 UITP Summit. The all-new Setra MultiClass 500 LE was launched 2023, too (we have been focusing on this in the latest Sustainable Bus magazine, February 2024).

Daimler Truck Financial Services completed its initial global rollout with the commencement of operations in France in 2023. The segment also started a cooperation in Romania and is now active in 17 markets worldwide with financial and mobility services. With a contract volume of €28.3 billion, the segment is one of the world’s largest financial services providers for commercial vehicles.

Daimler Truck: what about electric trucks?

Looking at zero-emission vehicles, in 2023, Daimler Truck expanded its global product portfolio to ten different zero-emission models. In North America, the new and fully-electric Freightliner eM2 was launched for urban delivery applications. In Europe, the battery-electric long-haul truck Mercedes-Benz eActros 600 celebrated its world premiere.

Daimler Truck’s Asian affiliate FUSO handed over first units of its FUSO Next Generation eCanter to renowned customers like Japanese retail giant Yamato, and launched the battery-electric medium-duty RIZON trucks in the U.S. With the record run of the fuel cell Mercedes-Benz GenH2 Truck, which covered 1,047 kilometers with one fill of liquid hydrogen, Daimler Truck marked another milestone in its dual strategy of offering customers both battery- and hydrogen-powered trucks.

Results in North America, Europe, Asia

As a Group, Daimler Truck managed to sell about 6,000 more units compared to 2022 (526,053 vs 520,291). EBIT adjusted reached 5,489 billion euro. Looking at the various geographical areas, Trucks North America grew by 4% in terms of sales and 7% in terms of revenues. Mercedes-Benz experienced a decrease by 5% as for sales with +7% in terms of revenue, with EBIT adjusted growing by 35%. On the other hand, Trucks Asia had unit sales increased by 3% and revenue growing by 9%.

Last year, the market share of Mercedes-Benz in Europe fell by 1% from 20 to 19 percent, as stated by Martin Daum, Chairman of the Board of Management of Daimler Truck. As for next year, Daimler Truck expects market normalization, both in Europe and in the U.S., with quite cloudy market conditions is Asia at least for the first half of the year. In figures, Daimler Truck expects market contraction in a range between -3 and -16% in North America and between -12 and -24% in Europe. In terms of unit sales, Daimler Truck expects slight decrease in 2024 compared to 2023, nearly everywhere.

Chairman of the Board of Management Martin Daum speaking

Here’s Martin Daum: “2023 was a record year with outstanding financial results. We achieved an adjusted operating profit of 5.5 billion euros and an adjusted return on sales in the Industrial Business of almost 10%. This means, we are in very close reach of our 2025 ambition. This is a great achievement our global Daimler Truck team can be very proud of. Going forward, we remain determined to unlock our full potential and to deliver strong profitability even in normalizing core markets.”