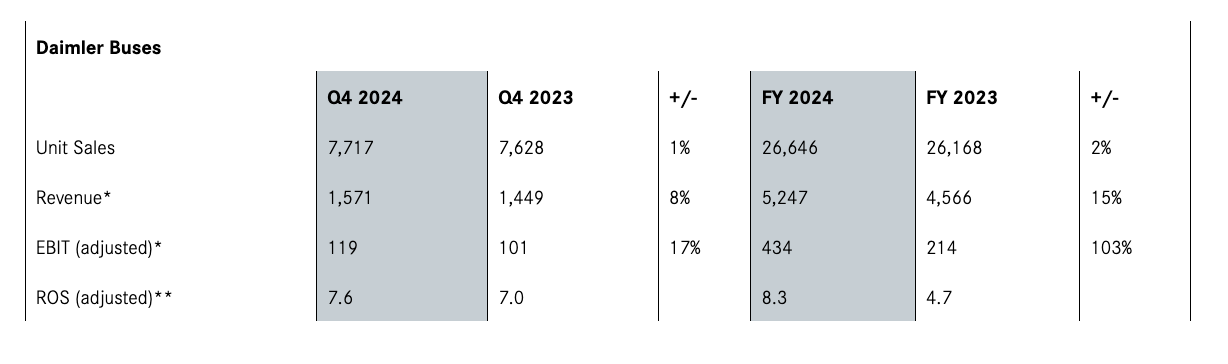

Daimler Buses was the best performing — and almost the only growing — division of Daimler Truck in 2024

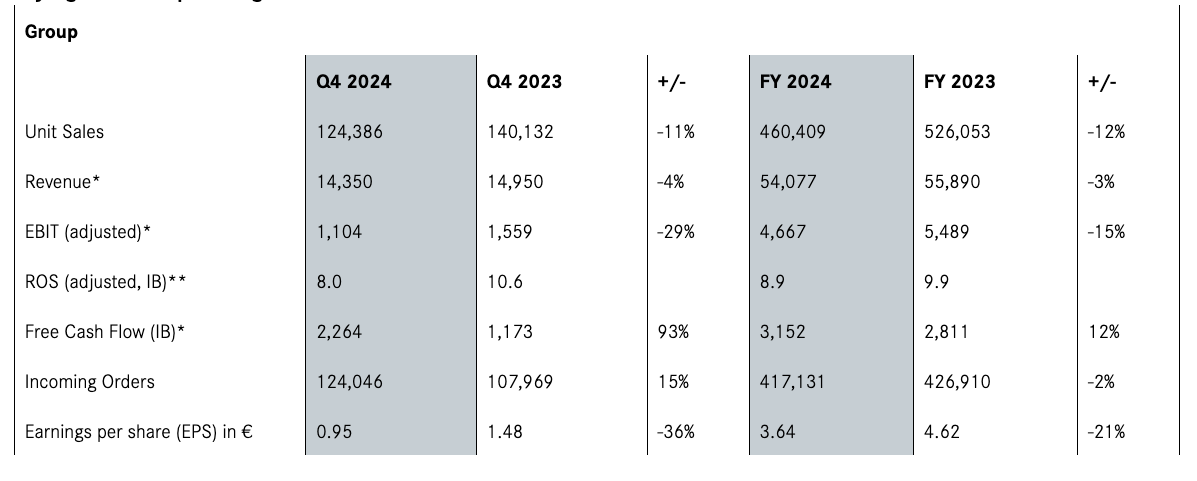

Daimler Truck’s total unit sales declined by 12% in 2024, reaching 460,409 vehicles compared to 526,053 in the previous year. However, within this broader downturn, the bus segment remained resilient. Daimler Buses division sold 26,646 buses worldwide, an increase from 26,168 units in 2023, marking a growth of 2%, with revenue increasing +15%, from 4,566 […]

Daimler Truck’s total unit sales declined by 12% in 2024, reaching 460,409 vehicles compared to 526,053 in the previous year. However, within this broader downturn, the bus segment remained resilient. Daimler Buses division sold 26,646 buses worldwide, an increase from 26,168 units in 2023, marking a growth of 2%, with revenue increasing +15%, from 4,566 to 5,247 million euros.

A similar situation occurred at Traton, that saw a 8% growth in bus orders as overall vehicle sales declined in 2024.

The Daimler Truck group reported a total revenue of €54.1 billion, a 3% decrease from €55.9 billion in 2023. EBIT stood at €4,667 million, a 15% decline compared to the previous year. Despite these challenges, Daimler Truck saw an increase in free cash flow from its industrial business, which rose by 12% to €3,152 million. Also orders were decreasing -2% on a group level.

In the meanwhile, the group underlines that unit sales of battery-electric trucks and buses increasing by 17% to 4,035 units (2023: 3,443 units).

Daimler Buses: the perspectives

Daimler Buses stood out as the strongest-performing segments within Daimler Truck in 2024, with +15% revenue and +103% EBIT.

Among its notable developments, Daimler Buses presented a near-series prototype of the Mercedes eIntouro intercity bus, with customer deliveries planned for 2026. Additionally, in Latin America, the articulated variant of the battery-electric bus chassis eO500U was introduced, with series production also scheduled for 2026.

The North American market saw significant progress as Daimler Buses delivered its 1,000th battery-electric Jouley school bus.

Looking ahead, Daimler Truck anticipates an operationally stable 2025, with an adjusted return on sales for its industrial business projected between 8% and 10% and forecasts the adjusted EBIT with an increase of 5% to 15% compared to 2024.

The market for heavy-duty trucks in the EU30 region, Daimler Truck says, “is expected to remain weak throughout 2025 and range between 270,000 and 310,000 units (2024: 315,000 units). The Group projects unit sales to range between 460,000 and 480,000 units this year (2024: 460,409 units)”.

Karin Rådström, CEO of Daimler Truck, says: “In the past year, we achieved an adjusted EBIT of 4.7 billion euros and an adjusted return on sales in our Industrial Business of 8.9 percent. This makes 2024 another solid year – and I look at it from two sides: We are proud of what we have accomplished, and I would like to sincerely thank our global Daimler Truck team for their dedication and great work. At the same time, 2024 varied across our segments. Trucks North America and Daimler Buses continued very strong. Mercedes-Benz Trucks did very well in Brazil but was affected by weak demand in its European core markets. Trucks Asia delivered solid operating results despite continued weak markets. In sum, we are convinced that we can do even better, and we are committed to unlocking even more of our potential.”

Eva Scherer, CFO of Daimler Truck, states: “While 2024 was a solid year with strong cash generation on Group level, performance and resilience are not satisfying in Europe. We have already started to address this and are fully committed to lift our European business to the next level. With our proposal of an unchanged dividend of €1.90 per share, we are reaffirming our commitment to delivering consistent returns to our shareholders. This proposal aligns fully with our capital allocation strategy and our target payout range of 40% to 60%. We remain dedicated to maintaining a strong balance sheet, prioritizing cash generation, and ensuring a value-driven capital allocation.”