Ebusco has relocated 74 previously-cancelled buses and obtained €22 million in debt financing

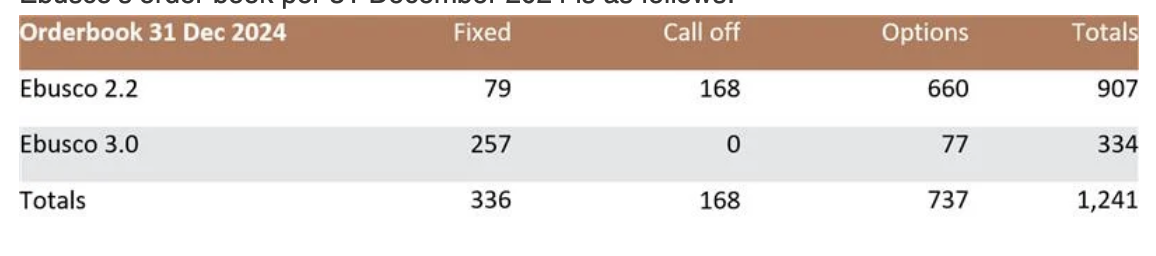

Ebusco is actively engaged in the relocation of previously cancelled bus orders. Anticipating a cash shortfall in early 2025, the company announces it has now successfully obtained €22 million in debt financing. However, as of end 2024 Ebusco still had over 1,200 buses in order book, while in 2024 it lost market share: from 3% […]

Ebusco is actively engaged in the relocation of previously cancelled bus orders. Anticipating a cash shortfall in early 2025, the company announces it has now successfully obtained €22 million in debt financing. However, as of end 2024 Ebusco still had over 1,200 buses in order book, while in 2024 it lost market share: from 3% in 2023 to 2%, when just 153 e-buses were registered according to DVV Media data.

The Dutch company is implementing a turnaround plan focusing on switching to an Original Equipment Designer (OED) model and rationalizing its production footprint, as CEO Christian Schreyer discussed with Sustainable Bus in this interview.

Potrebbe interessarti

Ebusco, from revolutionary promises to the race for survival

Ebusco secured 22 million debt financing

To address its expected cash shortfall in the first quarter of 2025, Ebusco announces it has secured a total of EUR 22 million in debt financing. This has been confirmed through fully signed agreements with three entities: Green Innovation International Co. Ltd., a Taiwanese company specializing in battery production machines (Green Innovation), CVI Investments Inc., managed by Heights Capital Management, Inc. (Heights), and De Engh B.V. (De Engh).

The financing breakdown is as follows: €10 million from Green Innovation, €10 million from Heights, and €2 million from De Engh. These loans will enable Ebusco to complete the modification of reassigned buses and maintain production at its contract manufacturers, thereby converting working capital into cash.

The loans must be fully repaid by Ebusco by 15 August 2025, and they include standard terms and conditions for such financing arrangements.

The loans are to be fully repaid by August 15, 2025, and include standard terms and conditions. Additionally, a total of €2.2 million in fees will be payable at maturity. Green Innovation and De Engh have the option to convert their loans, including fees, into Ebusco shares at either €0.50 per share or the market price five business days before conversion. Green Innovation will gain a Management Board nomination if it converts its full loan amount.

Furthermore, Ebusco has amended its convertible bond terms with Heights Capital. This includes resetting the conversion price to €0.75, reinstating previously deferred payment schedules, and extending the equity raise reset period by 12 months. Shareholder approval will also be sought for these amendments.

“In the event of conversion by Green Innovation and/or Heights in line with the arrangements set out above, both parties will ensure that their respective shareholding in Ebusco following such conversion will not exceed 29.9%”, Ebusco stresses.

Ebusco has reassigned 74 cancelled buses somewhere else

An important measure to improve the company’s working capital position is the acceleration of the sale of previously cancelled buses. Ebusco has indeed reassigned 21 buses to NIAG, 22 buses to Métropole Rouen Normandie (where 100 Ebusco buses were already supposed to be supplied) and 31 12-meter to EBS, that opted to convert their existing order of 13.5 meter buses to this nearly completed batch, the total number of reassigned Ebusco 3.0 buses now stands at 74.

The buses were originally intended for Qbuzz and are in the process of being modified to the agreed specifications of EBS and will be put into service on EBS’s IJssel-Vecht concession starting from this summer.

The cash flow from these bus reassignments will be generated over time once delivery of the buses begins, which is expected early in Q2 2025.

However, in 2025 to date, Ebusco has received cancellation notices for a total of 55 buses. “Most of these buses are not yet in an advanced stage of production and therefore, are expected to be relatively easily assigned to other customers, and arrangements to this effect are already underway. The company expects to reallocate the buses that are in a more advanced stage of production to existing customers in the second half of 2025, in a similar manner as it has reallocated the Qbuzz buses, amongst others”, the company states.

Christian Schreyer, CEO of Ebusco (we interviewed him HERE), stated: “First of all, I want to express my gratitude to EBS for their collaboration. The reassignment to them of 31 buses, which were already in an advanced stage of production, marks an important step for the company. I’m pleased that we accomplished this in a relatively short time, reinforcing the strong market potential of the Ebusco 3.0. Additionally, I am extremely thankful for the support from Green Innovation, Heights and De Engh to commit financing with an aggregate amount of EUR 22 million. Heights and De Engh are shareholders that have supported us already in the EUR 36 million rights issue late last year. This new liquidity injection will allow us to get our backlog of bus shipments and bus deliveries moving again, and ultimately, this will result in a considerable conversion of working capital into cash. Their contribution and ongoing support helps us to navigate a challenging period for Ebusco, allows us to continue with the implementation of our turnaround plan, and to get more sustainable buses on the road.”