Steering Ebusco on track: focus on design and engineering. But cash management comes first. Our interview with CEO Christian Schreyer

Christian Schreyer has been at the helm of Ebusco since September 2024. He took over the reins of a company that until then had been led by founder (and shareholder) Peter Bijvelds. The Supervisory Board of Ebusco decided to hand over the management of the company to an outsider. A move deemed necessary in order […]

Christian Schreyer has been at the helm of Ebusco since September 2024. He took over the reins of a company that until then had been led by founder (and shareholder) Peter Bijvelds. The Supervisory Board of Ebusco decided to hand over the management of the company to an outsider. A move deemed necessary in order to be able to implement a tough restructuring plan aimed at getting back on track a company whose survival was being challenged by severe liquidity problems and balance sheets in serious disarray (half 2024 financial results show EBITDA loss of €60.7 million).

A crucial challenge was played (and won) at the end of October, when Ebusco lost a court case against customer Qbuzz, which was then allowed to cancel an order for 45 buses whose delivery was coming late. However, the next day Ebusco’s shareholders adopted all resolutions to pursue the company’s restructuring, driven by a Turnaround Plan whose details, challenges and expectations are explained by Christian Schreyer in this interview with Sustainable Bus.

In the last years we were not profitable but it had a lot to do with the fact that, instead of delivering buses, we built up inventory and work in progress massively. We only receive customer payments the moment we deliver the bus to the customer. This leads to the fact that if you produce a lot of inventory your PNL looks horrible, and that’s where we are now and we are working to change it.

Christian Schreyer, CEO, Ebusco

First (achieved) steps were the collection of 36 million euros via right issue and the partnership put in place with supplier Gotion (that became an Ebusco’s investor).

“We have been having cash issues in the last 1.5 years with disturbances in production, and the reason was a combination between external factors affecting the whole market and ‘homemade’ mistakes – that’s how Christian Schreyer sums up the recent history of Ebusco –. In 2019 Ebusco was still a well performing startup, I was in charge of Transdev Central and Northern Europe and was one of their customers. Then the pandemic came and disrupted the supply chain between Europe and China and within Europe itself. The IPO in 2021 was successful but supply chain was already becoming an issue. Then, when the supply chain recovered, the company’s processes also in terms of procurements or parts were not under control“.

Christian Schreyer: “Ebusco has been overpromising in the past”.

Your experience revolves around the world of public transport operations. Then you have a clear view about what a customer of Ebusco would demand from a manufacturer. How is this having an influence in your decision as Ebusco’s CEO?

I know very well what customers need and know how Ebusco has been overpromising in the past. Now my job is to make realistic promises, especially in terms of timing. What I’d like to stress is that innovation is of course important, but not during production processes. If we have a project in place, the focus must be on delivering on time more than to make many little improvements anytime. We continue to collect learnings and continue to develop new products so that improvements will be integrated to the next product, not during production.

A Turnaround Plan is in place. Where is this leading the company to?

We are not going to make any in-house assembly. We will produce composite monoparts and cascos, so part of the production is still in-house. We are focusing on engineering & design and outsourcing manufacturing processes. Plus, we will improve parts recovery and aftermarkets.

How are you going to enhance the aftermarket business?

The issue was that we couldn’t receive spare parts in time, due to cash issues that affected payments. Now we are again in the condition of paying suppliers, but parts need time to be provided…

Our focus today is only on Europe, with a selective approach to tenders. And we are also completely changing our commercial model. In the past we tried to produce anything we can sell, now we sell only what we can produce. It’s written in our Turnaround Plan: we’ll accept customer orders based on production slot availability.

Christian Schreyer, CEO, Ebusco

One facility in the Netherlands will be closed

As production will not take place in the Netherlands, which activities are you going to keep in the Dutch facilities?

Here we are keeping all the engineering and are completing some final bus assembly projects. That however, will be stopped at the end of Q1 in 2025. After that, we will focus on headquarter activities, monopart casco production and Pre-Delivery Inspections. In our site in Rouen, France, we will keep some production of parts such as side walls and roof for the cascos of Ebusco 3.0. However, I want to be clear on this point, the buses will always be assembled in buses by partners, it can be in China or somewhere else. We also have a partner in Portugal. We will not do any assembling in-house after Q1 2025. And out of two facilities we have in the Netherlands, Deurne and Venray, one will be closed.

How much capacity are you having now – and planning to have – in Rouen for casco production?

Our aim written down in the Turnaround Plan is to reach a Production run rate between 40 to 50 buses per month. In Rouen at the moment we can realize a few cascos per week, but we will ramp up. In any case, in France we’ll produce just a part of our Ebusco 3.0’s cascos.

Models, supply chain, a new focus on Europe

Will the Ebusco 2.2 remain on offer?

Yes, we will keep these two products in our portfolio. The model 2.2 is easier to manufacture and has well established manufacturing processes. The 3.0 is a real game changer for those willing to take a further step, but needs more time to be produced.

Can you help us quantify the difference in timing/efforts of the production of the two models?

On the 2.2 we have well standardized the supply chain, it has always been produced in China, never in house. Once we will have better industrialized the production of the 3.0 model, we will be able to make it in the same time as the 2.2.

After Q1 2025 in the Netherlands we will focus on headquarter activities, monopart casco production and Pre-Delivery Inspections. In our site in Rouen, France, we will keep some production of parts such as side walls and roof for the cascos of Ebusco 3.0. However, the buses will always be assembled in buses by partners. We will not do any assembling in-house after Q1 2025. And out of two facilities we have in the Netherlands, Deurne and Venray, one will be closed.

Christian Schreyer, CEO, Ebusco

Are you planning to rely on the same partners for both models?

We need more than one partner for the 3.0, and it can be that one of these partners will be the same in charge of the 2.2.

Which changes are you planning in the company’s commercial structure?

Our focus today is only on Europe, with a selective approach to tenders. And we are also completely changing our commercial model. In the past we tried to produce anything we can sell, now we sell only what we can produce. It’s written in our Turnaround Plan: we’ll accept customer orders based on production slot availability.

One day we want to grow, but first we have to do our homework. And we announced that we could consider selling out of Europe but only in the licensing model. We will not be responsible for sales and production out of Europe. There’s a lot of work to do in Europe before we look outside the continent.

Profitability in zero emission bus production?

In Europe we are witnessing a real change in the industrial landscape… it looks like industrialization of zero emission buses faces great barriers and profitability is very tough..

I don’t agree that you only have a chance to survive if you build zero emission buses plus diesel buses. On one hand, by also producing conventional buses you make more cash with aftermarket, more aftermarket revenue streams… but on the other hand you have to invest in two parallel developments. We are talking about two different products. Our e-bus is not just a diesel bus with an electric drivetrain. We are completely focusing in electric bus development. I wouldn’t say that producing only ZE buses makes it difficult to be profitable. In the last years we were not profitable but it had a lot to do with the fact that, instead of delivering buses, we built up inventory and work in progress massively. We only receive customer payments the moment we deliver the bus to the customer. This leads to the fact that if you produce a lot of inventory your PNL looks horrible, and that’s where we are now and we are working to change it.

We see a tendency to favor European products. Even if we do assembly in China or somewhere else, ours are still European products: we control software and design, we define all the work instructions and have a lot of European suppliers. Very important: all the data are in Europe. Electric buses produce a massive amount of data. Related to the topic of cybersecurity, the place where data are located is becoming an increasingly important criteria.

Christian Schreyer, CEO, Ebusco

Ebusco has for years promised that it’ll be building buses in the Netherlands. Also supply chain issues put the company in a critical situation, however you are now switching to a model that provides for outsourcing of manufacturing in China. Is this due to a matter of labour costs, of skills that are lacking in Europe, or whatever?

In our case, we made the key decision to transform into an engineering and design company and we will remain so. But we don’t exclude the possibility of having manufacturing partners in Europe. In Europe we have the competencies as well. Yes, it’s more expensive but if you work with higher efficiency and a well organized supply chain, why not in Europe again? We keep every option open.

“We will never be a mass producer but we want to do a good job”

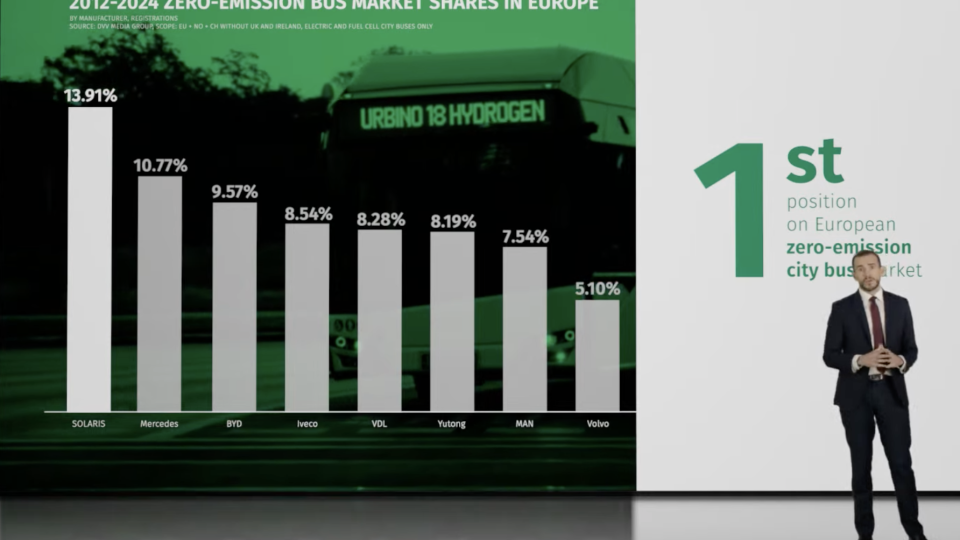

Looking at Ebusco sales figures of the last eight years, it’s striking how volumes of registrations went up and down, but market share from 2019 to 2022 has been going steadily down (from 6 to 2 percent)…

Yes, and we want to turn this around. We will never be a mass producer but we want to do a good job. We see a place for us in this market. The market is dramatically growing, and it will keep doing so even if we won’t see the same subsidies we saw in the last few years. But for countries buying diesel buses is not sustainable anymore because they would have it in operation for 12 years.

As you mentioned, subsidies are being reduced in many countries, and we should deduct that price pressure in tenders will become higher and thus favor companies that are not producing in Europe?

Yes, but on the other hand we see a tendency to favor European products. Even if we do assembly in China or somewhere else, ours are still European products: we control software and design, we define all the work instructions and have a lot of European suppliers. Very important: all the data are in Europe. Electric buses produce a massive amount of data. Related to the topic of cybersecurity, the place where data are located is becoming an increasingly important criteria.

How is the division of duties between you, CEO, and the founder Peter Bijvelds?

All the business is led by me. Peter Bijvelds, as founder and board member, is my advisor. For instance, he helps me connect with his network of partners and with important stakeholders.

Which changes are underway concerning the workforce?

We started the year with approximately 900 people, the last reported figure is around 600 and we will further have to reduce the workforce. In the future the focus of our workforce will be in engineering, in managing the supply chain and, very important: aftersales is our future focus. It’s what we need to promise to our customers: a well-designed product and a good aftersales. These are the two pillars that will make us successful in the future.

Though final question: where do you see Ebusco in 5 years-time?

Our short term focus is on cash management. Then we will keep on doing what we do, maintain focus on innovation, and be a front runner for innovative buses with the best Life Cycle Costs. If we’ll be fulfilling this target, we will surely find a market for us.