Ebusco’s shareholders will meet today. The company expects Turnaround Plan will be completed in 2025, but now seeks liquidity

Today is the day of truth for Ebusco. At today’s general meeting of shareholders Ebusco will present further details of its Turnaround Plan. But the main decision to be taken today is that about the rights issue that the company hopes it allows to raise EUR 36 million in new equity. An initiative that appears […]

Today is the day of truth for Ebusco. At today’s general meeting of shareholders Ebusco will present further details of its Turnaround Plan. But the main decision to be taken today is that about the rights issue that the company hopes it allows to raise EUR 36 million in new equity. An initiative that appears partially undermined by yesterday’s court judgement stating that Qbuzz was allowed to terminate an agreement with bus manufacturer Ebusco and therefore does not have to purchase 45 electric buses.

UPDATE 24TH OCTOBER, 16.00

Local media report that the Financial Markets Authority (AFM) has decided to suspend trading in Ebusco shares until further notice. The regulator’s decision coincides with the currently ongoing extraordinary shareholders’ meeting that is seen as all-important for the future of the ailing bus company.

UPDATE 24TH OCTOBER, 11.45

Ebusco states that “On 17 October 2024 a pre-judgment attachment was placed on some of Ebusco’s bank accounts. In agreement with Qbuzz, the attachments have been lifted. This allows Ebusco to access its bank accounts again“

The rights issue is directed at the existing Ebusco shareholders. They will be offered the opportunity to buy new shares in Ebusco at a discount. However, the company says that “in the event not all rights are exercised, Ebusco will issue the relevant shares to other investors. Ebusco is currently in discussion with a number of interested parties that are willing to subscribe for these shares, at the same discount as offered to the existing investors. If the rights issue does not raise the full amount of EUR 36 million, it is expected that Ebusco will cancel the offering“.

Ebusco shares have today a value of 0.50 €, and witnessed a -91% decrease in the last 12 months. The loss compared to the time when the company went public (October 2021) is -98%, as Ebusco’s shares value at that time was around 23 euros.

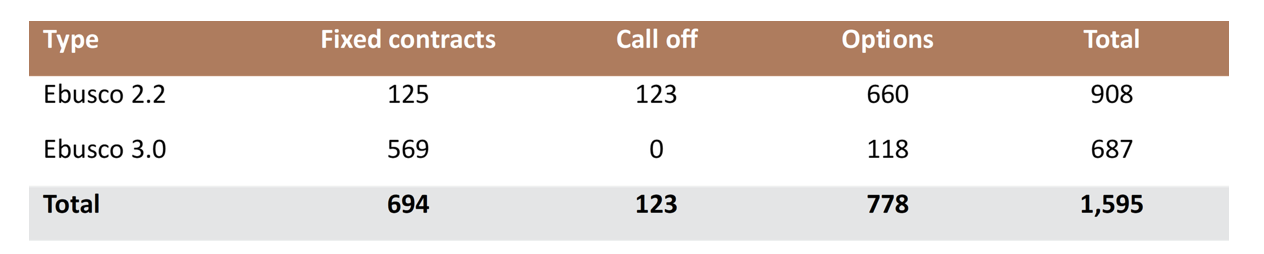

In the first 9 months of 2024, Ebusco delivered 135 buses, of which 37 were delivered in the last quarter. The orderbook as at 30 September 2024 is set out below.

Ebusco Turnaround Plan

The company announces it has decided to fully adopt an Original Equipment Design (OED) manufacturing model, in which buses are designed and engineered by the company, but are assembled by contract manufacturers.

Through the implementation of the Turnaround Plan, Ebusco aims to achieve the following targets by the end of 2025: first, a gradual increase of the monthly run rate to 40-50 buses (from c. 15 buses on average per month in 2024 year to date); secondly, a structural annual cost reduction of approximately EUR 30 million.

Ebusco will rationalize its footprint of production locations by reducing the number of locations from seven to five, including through combining the facilities in Deurne and Venray into one. Following the footprint rationalization, Ebusco will have one location in the Netherlands, one in France (Rouen) and three contract manufacturers.

Ebusco says it “expects that effectively all of the actions under the Turnaround Plan will be completed before the end of 2025”.

Ebusco focus on licensing technology and new partnerships

Ebusco’s aim is to also tap new sources of revenue. Ebusco “is in negotiations to license its Ebusco 3.0 lightweight technology. Opportunities are sought outside Europe, mainly in North America. If successful, this will add revenue and liquidity in 2024 and beyond”, the company states.

Also, Ebusco is negotiating a partnership with one of its strategic suppliers. The terms of the partnership provide for an equity injection into Ebusco strengthening its balance sheet, and cementing a long-term strategic partnership. Ebusco expects to finalize the negotiations and announce details of the partnership ahead of the launch of the rights issue.

Working capital is an issue at Ebusco

The third quarter of 2024 saw a continuation of the operational difficulties Ebusco has been facing. Ebusco states that production of new buses has now come to an almost standstill, which means that buses are hardly being delivered, further exacerbating the company’s financial position and leading to a severe cash shortage.

As a result of the production that has come to an almost stop, the cancellations of orders by customers, claims of late delivery penalties and direct damages, Ebusco’s most recent liquidity forecast shows that the lowest point in working capital in 2025 will occur in Q1 2025. In response, Ebusco says it has initiated the following measures:

- In active dialogue with various existing customers on sale of 61 cancelled buses;

- Conversion of account payable positions of a key supplier and strategic partner into equity;

- Sell-down of inventory to traders and suppliers;

- Further managing overdue supplier credit; and

- Acceleration of production and delivery of Ebusco 2.2 buses.

Quoting Ebusco’s press release, the company “has overdue accounts payable positions, in the amount of approximately EUR 33 million, for which it is actively engaging with its critical creditors to discuss payment schedules and alternative settlements options due to the company’s current financial situation, and these accounts payable positions have caused production to be almost fully at standstill as discussed above. In addition, Ebusco is facing penalties and direct damages claims for late delivery of buses. Based on the company’s production planning in place, many orders will not be delivered on time. Ebusco is currently in settlement negotiations on these penalties and claims and has assumed related cash-out in its liquidity forecast. Through a combination of these working capital measures and the rights issue, Ebusco expects to be able to bridge the working capital gap to provide the company with sufficient working capital to meet its obligations up to Q1 2025 and beyond. This assumes completion of the rights issue in November 2024″.

Ebusco, new CEO to be named today

The Chief Executive Officer, to be appointed at today’s EGM, will lead the implementation of the Turnaround plan.

The tasks of the Chief Technology Officer are combined with that of the Chief Operating Officer, to achieve a leaner organization and reduced management team size.

Mr. Jurjen Jongma, the Chief Financial Officer (CFO) of Ebusco has announced that he will leave the company after the completion of the intended rights issue. Jurjen has by that time led two capital injection rounds for Ebusco and is looking forward to a new challenge.

Christian Schreyer, CEO of Ebusco, comments: “Ebusco is going through a very difficult phase. Despite being aware of the difficulties, I chose to join Ebusco in September, driven by the company’s potential. The Ebusco buses have shown excellent performance, including through the lowest energy consumption in the market. With my deep familiarity and experience in this industry, I can confidently say that Ebusco’s products have tremendous potential. However, I recognize that this potential has not been properly utilized, as Ebusco is facing financial challenges along the way. We need to turn Ebusco around. Together with the Ebusco team, we have developed a plan to create a leaner organization, restore the trust in Ebusco as a company for all our stakeholders and restore our financial health. With the shift in manufacturing strategy, Ebusco will concentrate on the engineering of its products and in-house casco production, while outsourcing the assembly activities to experienced contract manufacturers. I am fully focused on implementing the Turnaround Plan. I believe that with this approach, our proven products and the support of our shareholders and the capital markets, Ebusco is well-positioned to meet the ongoing high demand for electric buses in the European market.”