Electric bus deployment speeding up in Latin America [TUMI E-Bus Mission #3]

At first glance, Latin America appears to be a performance leader when it comes to electric bus deployment. As of April 2022, there were 3,209 electric buses in operation across Latin America according to the E-Bus Radar launched in May 2020. Of the 2,162 battery-powered electric buses counted, two cities dominated, comprising nearly 85% of the total battery electric buses: Santiago, Chile has 776 and Bogotá, Colombia counts 1061 battery electric buses.

Below, a contribution from

TUMI – Transformative Urban Mobility Initiative.

It’s the third of a series of articles focusing on TUMI E-Bus Mission.

Funded by the German Ministry for Economic Cooperation and Development (BMZ) and participated by organizations such as C40 Cities, GIZ, ICCT, UITP and WRI,

it has the target of accelerating the transition to electric buses in the Global South.

Sustainable Bus is TUMI E-Bus Mission media partner.

Feedbacks, questions and contributions are welcome (at info@sustainable-bus.com).

At first glance, Latin America appears to be a performance leader when it comes to electric bus deployment. As of April 2022, there were 3,209 electric buses in operation across Latin America according to the E-Bus Radar launched in May 2020.

A closer look, however, reveals there are caveats to that high number: 1047, or nearly one-third of these are trolley buses operating in routes that had already been put into service in the last century. Of the 2,162 battery-powered electric buses counted, two cities dominated, comprising nearly 85% of the total battery electric buses: Santiago, Chile has 776 and Bogotá, Colombia counts 1061 battery electric buses.

Electric buses in Latin America: Santiago e Bogotà lead

One reason why Santiago and Bogotá are at the forefront is their approach to procurement and implementation. They have awarded large electric fleet contracts using a strategy that separates operations from the fleet provision; they do this by either setting leasing mechanisms, through public-private-partnerships, or via direct public investment. These models have opened a door for decision-makers to ease operators’ liquidity needs while providing the institutional arrangements to introduce these new technologies. In the case of Santiago, private companies are providing the electric buses to be operated by a public company.

The two cities also benefit from having national stakeholders strongly committed to GHG mitigation. In Chile as well as in Colombia there are national policies in place that from 2035 on, all new urban transit buses must be electric.

There is a third element that should be considered when using Santiago and Bogotá as best practice cases: Chile and Colombia are importing most of their buses and only assembling buses in some cases. Thus, there is less need for pushing the industry towards a transformation that needs investments.

What about Brazil and Mexico?

Cities in Brazil and Mexico face a much more challenging context. Without strong national strategies for a zero emission urban mobility and industrial policies in place, Brazil and Mexico still need to define which way to go to not fall behind in the global trend towards electric bus deployment.

But there are signals that the largest bus producing countries in Latin America are getting on track: Scania is adopting an electric bus model to the local Mexican market, the Brazilian company Eletra is investing into a plant to manufacture 1,800 electric buses a year and Mercedes-Benz announced orders for their electric bus chassis in Brazil. Only few weeks ago, a private bus operator providing services in the city of São Paulo acquired 100 electric buses for 2022 and 2023. And this may be only a first example out of many to follow. To be in line with the City Climate Law and the chronogram for electric bus deployment, the operators will need to incorporate about 2,600 electric buses until the end of 2024.

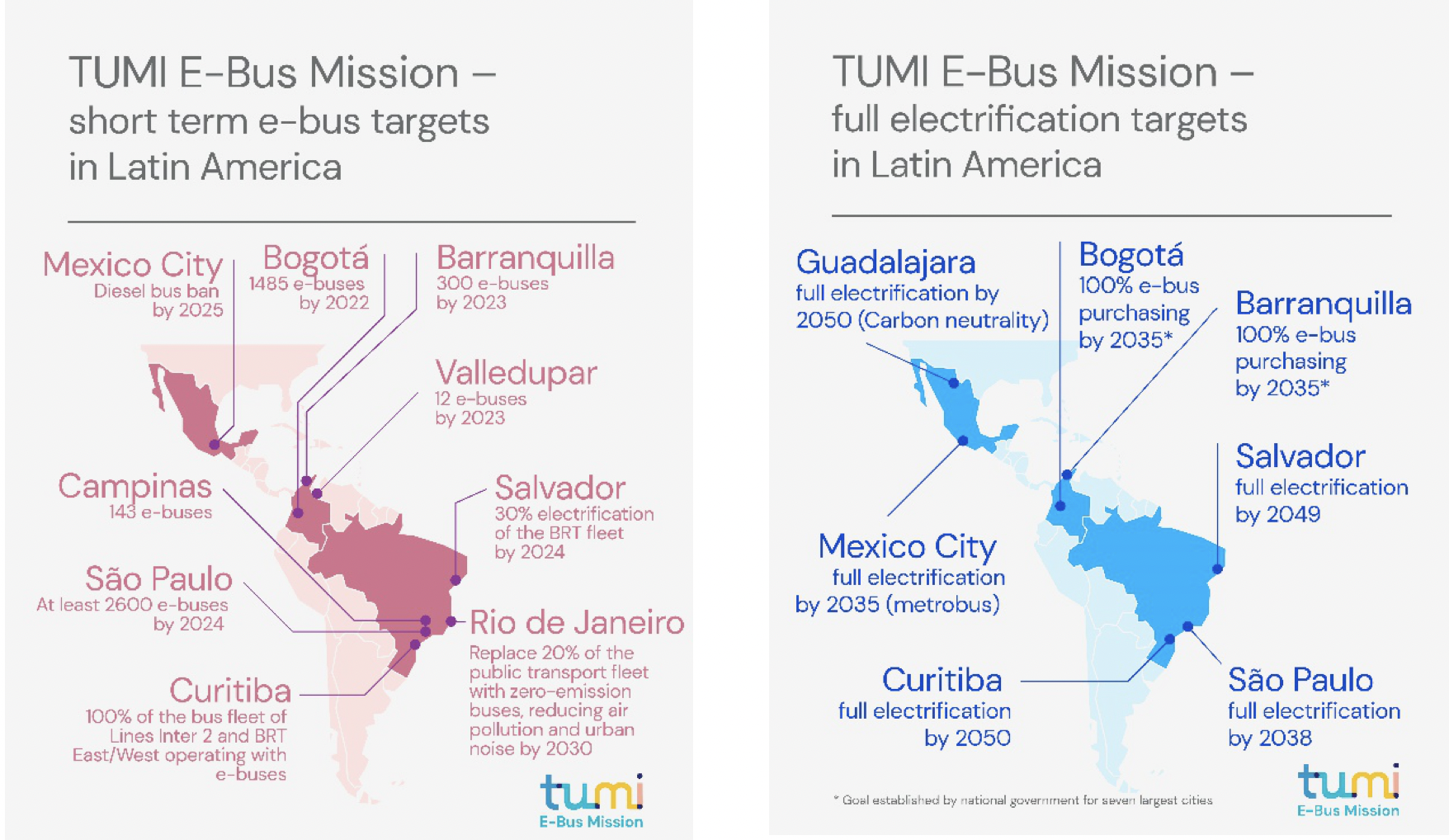

Thus, the lack of national policies is being compensated by subnational targets for electric bus adoption. Several cities supported by the TUMI E-Bus Mission have set ambitious short-term and long-term targets for electric bus deployment as can be seen below in the tow figures.

While Bogotá and Santiago are still at the forefront, other cities may close the gap and rapidly adopt electric buses. Medium-sized cities such as Cuenca, Ecuador, Barranquilla, Colombia, and São José dos Campos, Brazil also have set ambitious targets for e-bus adoption.

Looking at these examples it becomes clear that the inspiring work done in some Latin American cities to identify and implement new business models needs to come together with political commitment on a city level and a national industry willing to provide electric buses. Bringing all these stakeholders together to accelerate the roll-out of electric buses in the Global South is the main objective of the TUMI E-Bus Mission.

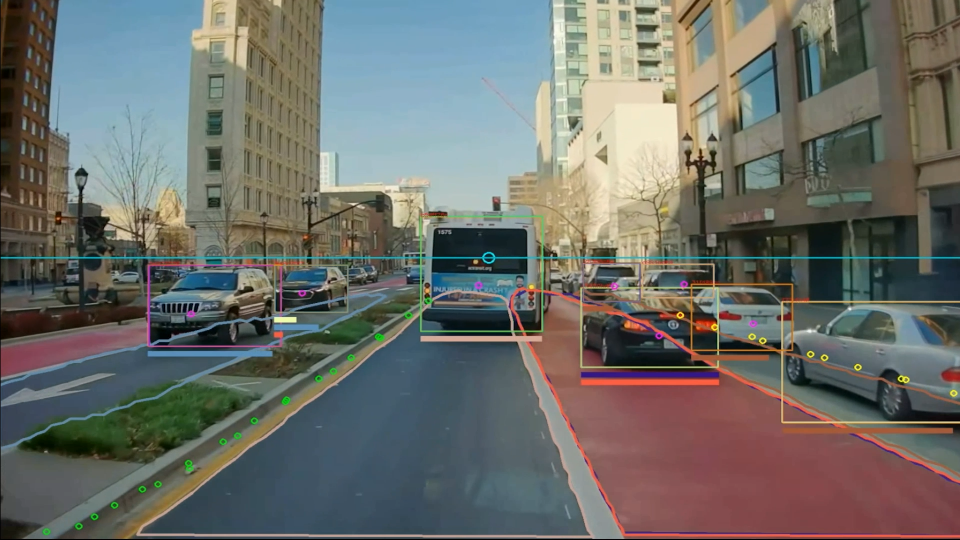

Please learn more under this video: TUMI E-Bus Mission – TUMI for you – YouTube