ZE bus sales forecast to rise to 83% of the global market by 2040, BloombergNEF EVO 2021 says

600,000 e-buses on the road globally today (39% of new sales and 16% of the global fleet). 98% of e-bus sold in 2020 were in China, but by 2025, electric bus sales outside of China are expected to hit 14,000, up from 5,000 in 2020. «Buses and two- and three-wheelers are the biggest near-term opportunity for […]

600,000 e-buses on the road globally today (39% of new sales and 16% of the global fleet). 98% of e-bus sold in 2020 were in China, but by 2025, electric bus sales outside of China are expected to hit 14,000, up from 5,000 in 2020. «Buses and two- and three-wheelers are the biggest near-term opportunity for electrification in emerging economies», according to the newly issued Electric Vehicle Outlook 2021 by BloombergNEF.

Besides the calculation of $46 trillion market opportunity between now and 2050 for the EVs sector, the report outlines that «governments aiming for net-zero carbon emissions by 2050 must do more to spur their adoption. Achieving that goal will require decisive further policy action on all fronts, from accelerating electric car adoption, to expanding charging networks, pushing for battery recycling and new regulations on heavy trucks, as well as encouraging active modes of transport, such as cycling and walking».

According to the analysis, zero-emission bus sales are forecast to rise to 83% of the global market by 2040. Two/three wheelers and buses are the only road transport segments close to being on track to hit net-zero emissions by 2050.

The electricity used to charge electric vehicles on the road would add 9% to global demand by 2040. Most of the extra demand for electricity globally in the decades ahead will be met by building additional renewable energy capacity, according to BNEF forecasts.

BloombergNEF EVO 2021: focus on e-buses

The report calculates that «there are currently almost 600,000 e-buses on the road globally, representing 39% of new sales and 16% of the global fleet. China accounted for the vast majority of all e-bus sales in 2020, with over 74,000 units sold, and continues to account for 98% of the global e-bus fleet. This share begins to decrease as some Chinese city bus fleets start to saturate and adoption picks up in Europe, North America, South Korea, South East Asia, India and South America. By 2025, e-bus sales outside of China hit 14,000, up from 5,000 in 2020. Buses and two- and three-wheelers are the biggest near-term opportunity for electrification in emerging economies».

As highlighted during an interview we had with Aleksandra O’Donovan, Head of Electrified Transport at BloombergNEF, «Deployment of e-buses in the municipal environment continues to increase. We now expect municipal buses to go electric faster than any other segments of road transport, with e-buses comprising over 67% of the global bus fleet in 2040. (…) We expect municipal e-buses to rise from 417,000 units in 2019 to over 645,000 units in 2025 (about 39% of the global municipal bus fleet)».

BloombergNEF EVO 2021 Growth of electric vehicles accelerating

The Electric Vehicle Outlook analyzes in detail the economic and technology trends affecting the road transport sector by segment and countries up until 2040. For the first time in 2021 it examines what would be required to bring global road transport emissions onto a trajectory compatible with net zero by 2050.

The report shows the recent strong growth of electric vehicles in the passenger car, bus and two/three-wheeler segments continuing and accelerating, primarily on the basis of relative economics compared to internal combustion engine alternatives.

The window for achieving net-zero emissions in the road transport sector by 2050 is closing quickly. An immediate increase in policy action is needed to bend the curve toward net zero. Investments in public transit and active mobility are an important part of the solution mix for net zero, as they can reduce demand for vehicles and vehicle miles, while also delivering a public-health benefit. Likewise, at the municipal level, tighter regulations for vehicles entering urban areas will help make the economics of zero-emission vehicles more attractive, especially for commercial fleet operators

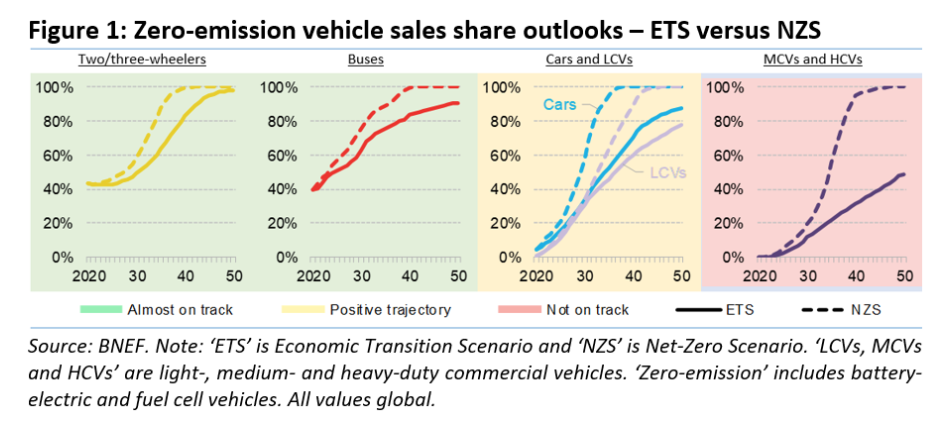

BNEF’s Economic Transition Scenario (ETS) – which assumes no additional policy measures – would see global sales of zero-emission cars rising from 4% of the market in 2020 to 70% by 2040. Leaders like China, the U.S. and European economies run far ahead of these numbers, but lower levels of adoption in emerging economies reduce the global average. The equivalent for buses sees their zero-emission sales rise to 83% by 2040. Zero-emission light commercial vehicles grow from 1% today to 60% of their market over the same time period, and medium and heavy commercial vehicles to just over 30%, from almost zero now.

BloombergNEF EVO 2021: more effort needed to reach net zero by 2050

Colin McKerracher, head of the advanced transport team at BNEF, said: “The growth of electric transport is an amazing success story to date, and the future of the EV market is bright. But there are still over 1.2 billion combustion cars on the road and the fleet turns over slowly. Reaching net zero by mid-century will require all hands on deck, particularly for trucks and other heavy commercial vehicles where the transition has barely started.”

In this year’s report, BNEF has added a Net Zero Scenario (NZS) for the road transport sector. The scenario shows that zero-emission passenger cars, for instance, would have to hit almost 60% of sales in their segment globally by 2030, not 34% as they do in the Economic Transition Scenario – that’s 55 million EVs sold in that year, as opposed to 32 million.

Lithium-ion battery demand from EVs is set to rise sharply, from the current 269 gigawatt-hours in 2021 to 2.6 terawatt-hours per year by 2030 and 4.5TWh by 2035.

McKerracher added: “2030 is only two model-refresh cycles away for automakers, so policy certainty will be needed very soon to make investments for a higher rate of penetration possible. This is particularly true for countries that do not already have tightening vehicle CO2 emissions or fuel economy standards. Early adoption is vital for building infrastructure and broader consumer interest.”

Focus on truck electrification

Nikolas Soulopoulos, commercial transport team lead at BNEF, said: “Policymakers need to take urgent action in the heavy truck segment, which is far from being on course for net zero. In addition to introducing tighter fuel economy or CO2 standards for trucks, governments may need to consider mandates for the decarbonization of fleets. They should also consider incentives to push freight into smaller trucks, which can electrify faster than larger ones.”

The charts below show that two segments within road transport – two/three wheelers, which are heavily used in developing countries, and buses – are close to being on track to hit net-zero emissions by 2050, just on the basis of established trends in relative economics.

The projections for cars and light commercial vehicles are shown as being on a “positive trajectory”, because even without further policy measures, current trends get the market to move a big step toward meeting net zero by 2050, even if timelines will have to be accelerated. The last chart shows that the outlook is far more problematic in the heavier commercial vehicle segments.

Focus on chargers

The report estimates that electric vehicles represent a $7 trillion global market opportunity between today and 2030, and $46 trillion between now and 2050, under the Economic Transition Scenario.

Meanwhile, by 2040 the charging network needs to grow to over 309 million chargers across all locations, under the same scenario. Home chargers alone would have to reach 270 million, public chargers 24 million, workplace chargers 12 million and bus and truck chargers 4 million. To install all of these would require over $589 billion of cumulative investment in the next two decades, according to EVO 2021. While that entails a dramatic increase from today’s levels, it is modest in comparison to current levels of investment in renewable generation, which hit over $300 billion in 2020 alone.

Electric vehicles market: $46 trillion market

The electricity used to charge electric vehicles on the road would add 9% to global demand by 2040 in the Economic Transition Scenario. Most of the extra demand for electricity globally in the decades ahead will be met by building additional renewable energy capacity, according to BNEF forecasts.

Lithium-ion battery demand from EVs is set to rise sharply, from the current 269 gigawatt-hours in 2021 to 2.6 terawatt-hours per year by 2030 and 4.5TWh by 2035. Demand under the Economic Transition Scenario for battery metals, such as lithium itself, cobalt, nickel and manganese, will also soar – the relative increases depending on the chemistries that are chosen. But supply of metals is projected to be adequate to meet that, although more investment will be needed, both in mining and refining.

Under the Net Zero Scenario, all the numbers above would have to be much larger. For chargers, $939 billion would be required in investment by 2040 to install 504 million units. For electricity demand, that scenario would take the extra megawatt-hours needed to 14% by 2040 and to just over 25% by 2050. For the electric vehicles themselves, the total market opportunity reaches $80 trillion cumulatively by 2050.

by 2040 the charging network needs to grow to over 309 million chargers across all locations, under the same scenario. Home chargers alone would have to reach 270 million, public chargers 24 million, workplace chargers 12 million and bus and truck chargers 4 million. To install all of these would require over $589 billion of cumulative investment in the next two decades, according to EVO 2021.

Battery metals recycling is a critical enabler for the Net Zero Scenario. Without it, cumulative lithium demand exceeds currently known reserves by 2050. With universal battery recycling, however, not only does primary lithium demand remain below known reserves, but there is also the prospect of a fully circular battery industry, with supply of recycled lithium exceeding total annual demand by mid-century.

BloombergNEF concludes: «The window for achieving net-zero emissions in the road transport sector by 2050 is closing quickly. An immediate increase in policy action is needed to bend the curve toward net zero. Investments in public transit and active mobility are an important part of the solution mix for net zero, as they can reduce demand for vehicles and vehicle miles, while also delivering a public-health benefit. Likewise, at the municipal level, tighter regulations for vehicles entering urban areas will help make the economics of zero-emission vehicles more attractive, especially for commercial fleet operators».