Electric bus market 2024 in Europe: Yutong, Mercedes, Iveco Bus and VDL see triple-digit growth

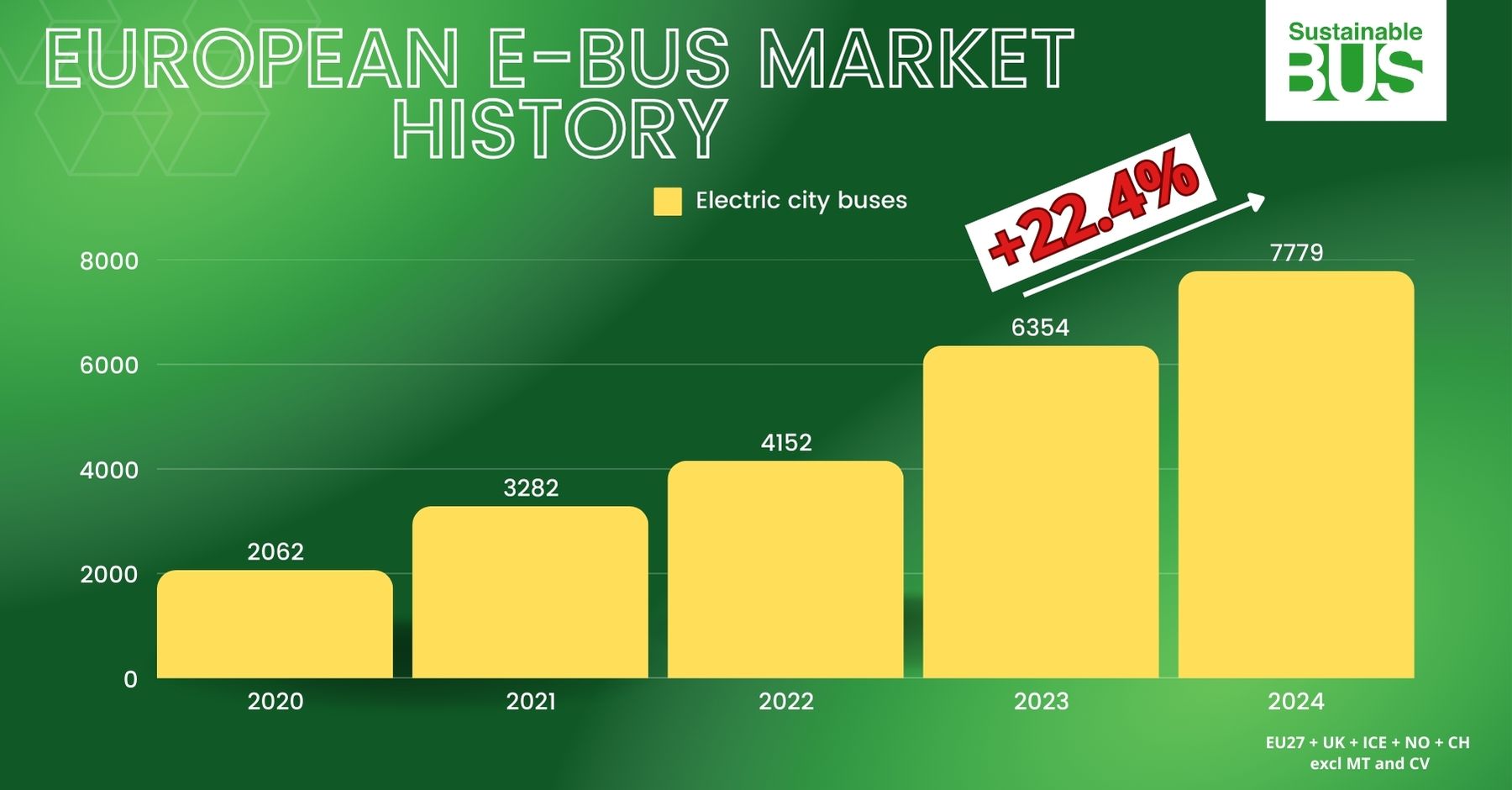

In 2024, the electric city bus market in Europe (including the UK) grew 22% on 2023, reaching the figure of 7,779 electric bus registrations (over 8 ton). The contribution of UK market to the overall picture is a major one: while the e-bus market in EU27 saw Daimler Buses and Iveco Bus (the strongest-growing OEM […]

In 2024, the electric city bus market in Europe (including the UK) grew 22% on 2023, reaching the figure of 7,779 electric bus registrations (over 8 ton).

The contribution of UK market to the overall picture is a major one: while the e-bus market in EU27 saw Daimler Buses and Iveco Bus (the strongest-growing OEM in the chart, after VDL) achieving the first two positions, two of the three top sellers such as Yutong and Wrightbus reached such position thanks to the good performance in the market of Great Britain. The figures are coming from European national statistics bodies and elaborated by DVV.

Yutong, Mercedes, and Wrightbus leading the market

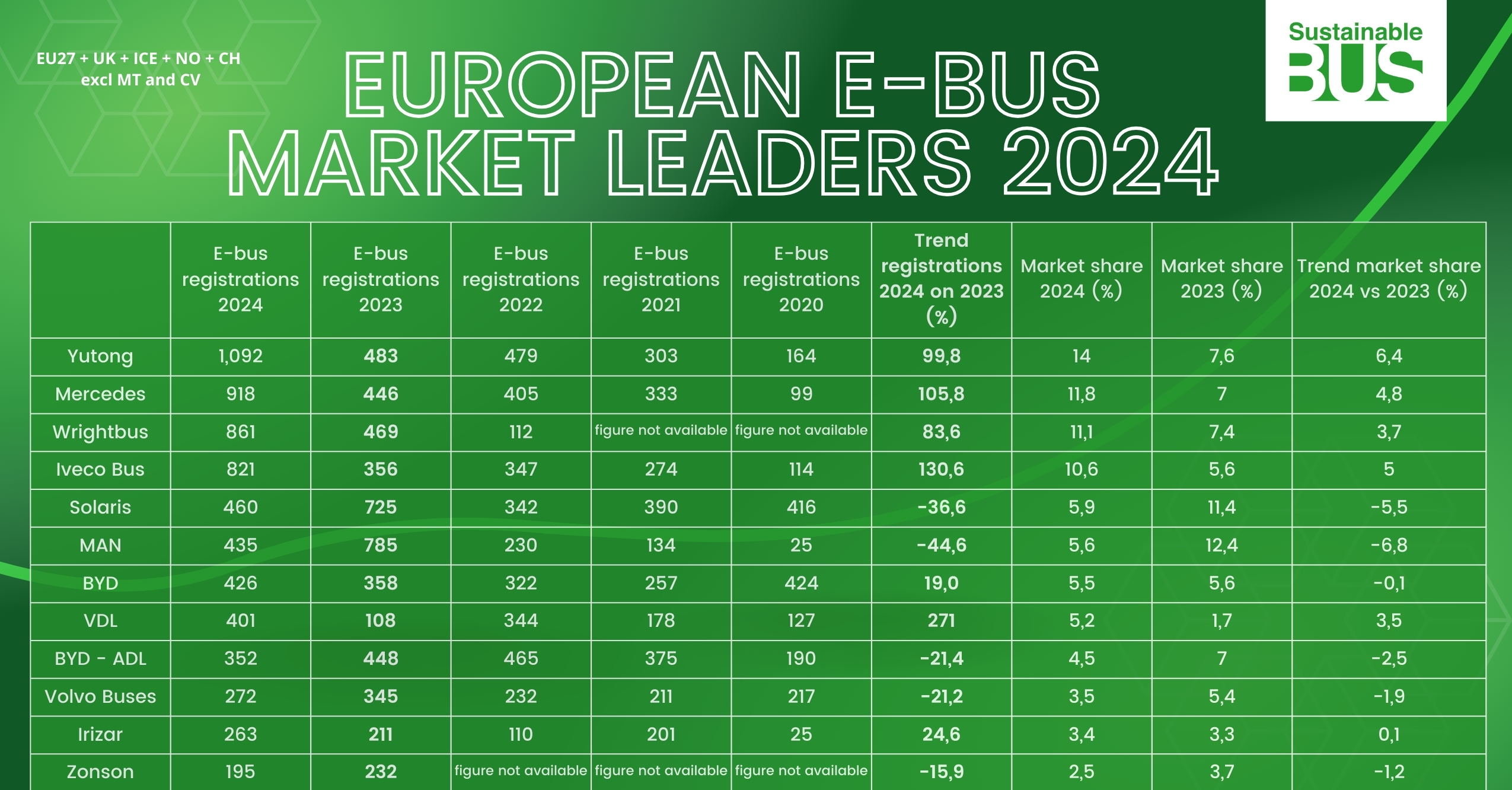

Leading the charge in 2024 is Yutong, which saw a staggering 99.8% increase in registrations, reaching 1,092 electric buses, up from 483 in 2023. This sharp rise has catapulted the Chinese manufacturer to a 14% market share in Europe, a notable jump from 7.6% in 2023. Similarly, Daimler Buses has grew 105.8%, registering 918 buses compared to 446 in 2023. This growth has earned Mercedes an 11.8% market share, up from 7%.

The stronger leap ahead over the last three years has been made by Northern Irish Wrightbus, with 861 electric buses registered in 2024, a 83.6% increase from the previous year. And 2023 saw the manufacturer growing 4-folds.

Iveco and Irizar grew in the electric bus market 2024

Iveco Bus reported strong growth, with registrations rising by 130.6%, reaching 821 buses, up from 356 in 2023. Its market share increased to 10.6%, up from 5.6%. BYD, despite a modest 19% increase, maintained a strong presence with 426 registrations, securing a 5.5% market share.

Irizar also showed positive performance with a 24.6% increase, registering 263 buses, a rise from 211 in 2023, and holding steady at a 3.4% market share.

Quite remarkable performance was achieved by VDL, that grew +271% reaching 401 e-bus registrations.

Solaris, MAN and Volvo: volumes are decreasing

On the flip side, Solaris experienced a sharp 36.6% decrease in registrations, falling from 725 in 2023 to just 460 in 2024. Consequently, its market share shrank from 11.4% to 5.9%. However, it should be noted that 2023, for the Polish OEM, marked a quite extraordinary year in terms of e-bus registrations (785). MAN also saw a significant decline of 44.6%, with registrations dropping from 785 in 2023 to 435 in 2024, resulting in a market share drop from 12.4% to 5.6%. And the same considerations just made for Solaris can be applied to the Munich-based group.

Out of the chart we find the ailing Ebusco losing shares: from 3% in 2023 to 2% in 2024, when 153 e-buses were registered (the Dutch OEM had over 1,600 e-buses in order book as of mid-2024…).

Also slightly decreasing is Karsan with 141 registrations (-24%), but the vehicles over 8 tons are just a part of the total Karsan’s sales, having in the e-Jest a top seller in the mini segment.