Electric city buses outpaced diesel bus sales in Europe in Q1 2023

More electric city buses than diesel-only buses have been sold in the first quarter of 2023 in Europe (EU+UK). It’s a paradigm shift highlighted by ICCT. However, it should be mentioned that diesel and hybrid buses (most of those are mild hybrid ones) together still make up the majority of the city bus market. Earlier […]

More electric city buses than diesel-only buses have been sold in the first quarter of 2023 in Europe (EU+UK). It’s a paradigm shift highlighted by ICCT. However, it should be mentioned that diesel and hybrid buses (most of those are mild hybrid ones) together still make up the majority of the city bus market.

Earlier this year, a study by Rabobank contained the prediction that, across the EU, “the sales of electric city buses should overtake those of vehicles running on diesel this year”.

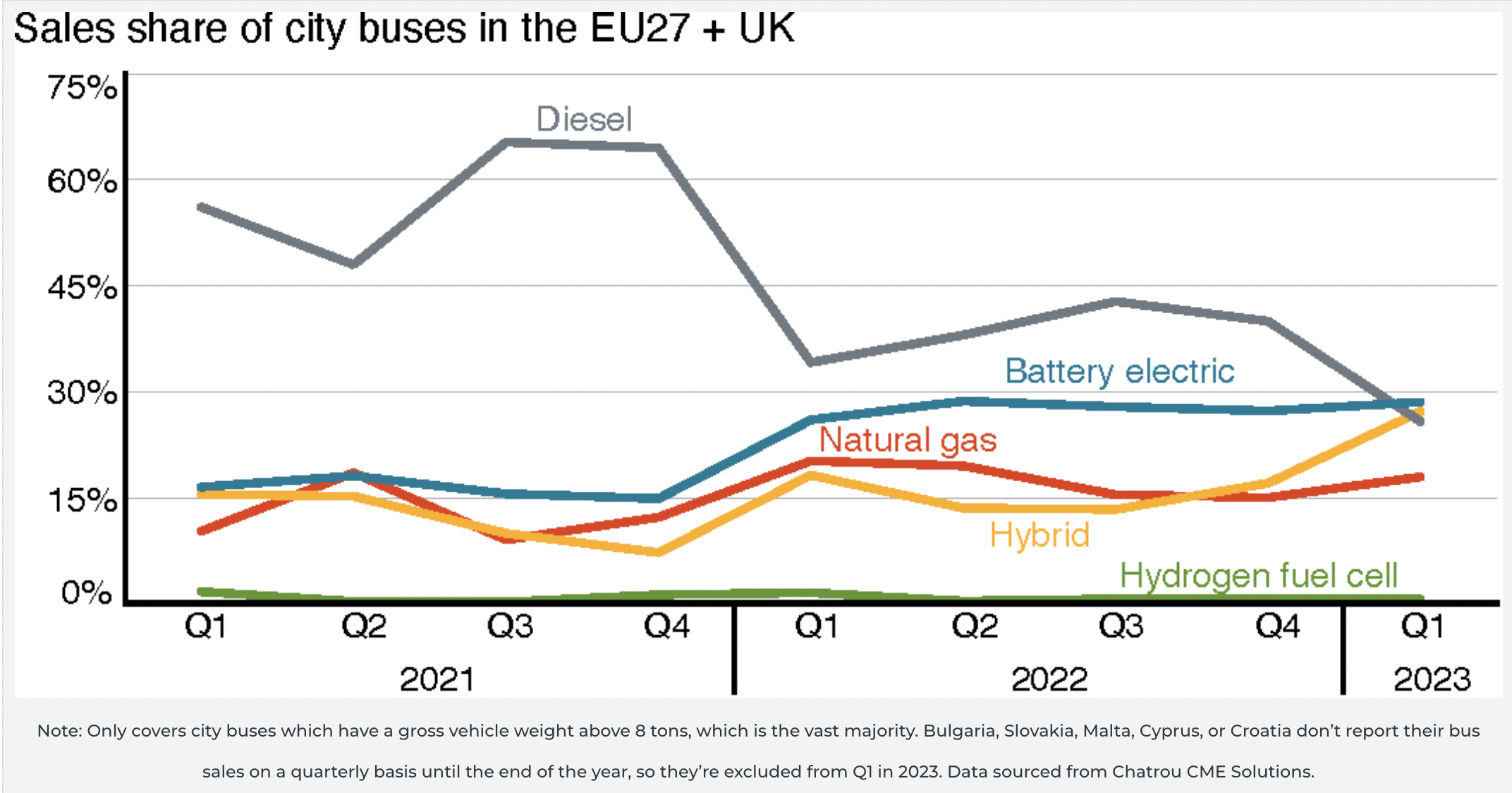

In the latest quarterly sales data for buses this year (sourced from Chatrou CME Solutions), the share of diesel-only vehicles sold has declined below the majority stake, making way for battery-electric buses to emerge as the leading choice. This development represents a historic milestone as zero-emission technology takes the dominant position in the European road transport sector for the first time. In the chart we can see that zero emission buses accounted for a rough 30 per cent of city bus sales (same share as in the whole 2022), while pure diesel bus sales decreased to a value between 25 and 28 per cent.

For well over one hundred years, the internal combustion engine has reigned supreme over our roads. For one small but significant transport sector, the humble city bus, its reign has neared its end

ICCT

More electric buses than diesel buses sold in Europe

ICCT stresses that “this switch hasn’t so much emerged due to a significant rise in zero-emission sales—which has hovered around 30% for the last year—but rather from a fall in diesel-only sales giving way to a hybrid buses, which also overtook the share of diesel this year“.

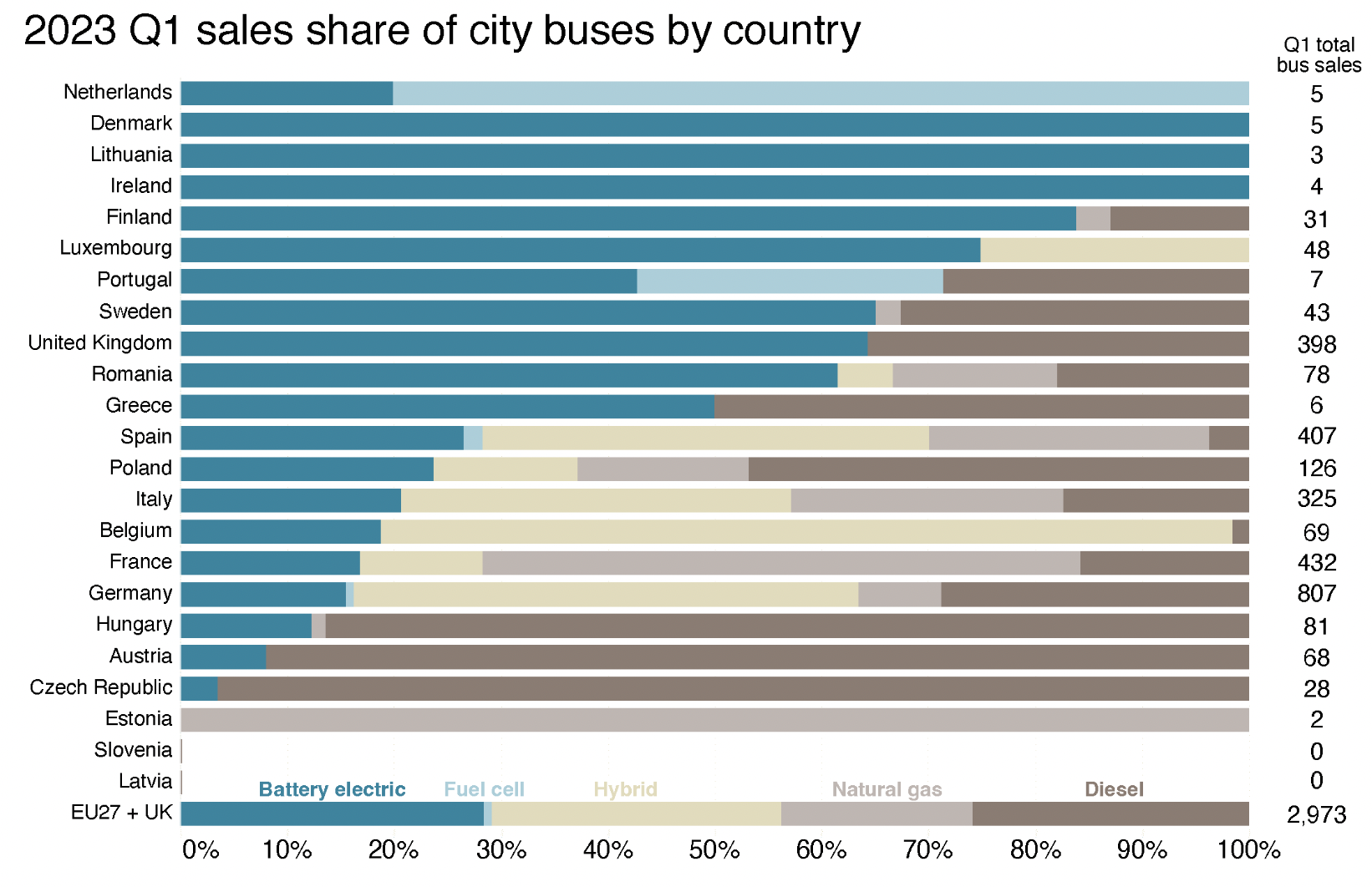

Hybrid vehicles (also mild hybrid are included) are playing a strong role in Europe’s largest countries, and a number of investments in natural gas engines are being made in France, Spain, and Italy.

The implementation of the Clean Vehicles Directive in August 2021 has exerted a significant influence on the market dynamics. This directive mandates Member States to procure a range of alternatively fueled buses, accounting for 24% to 45% of their total bus purchases between August 2021 and December 2025. Consequently, there has been a noticeable decline in the sales of diesel-only buses by the end of 2021. Moreover, half of these procurement targets must be met through zero-emission powertrains. Looking ahead, as the targets increase to 33% – 65% in 2026, it is anticipated that there will be another decline in diesel bus sales in the coming years.