Market conditions, company’s strategies, EV bus demand and competition. Our interview with Isuzu’s MD Tugrul Arikan

Market conditions in 2023, expectations for 2024, rising demand for electric buses, challenges in zero-emission bus deployment, competition with Chinese industry players: these were just a few key topics discussed by Tugrul Arikan, Managing Director of Anadolu Isuzu, in this interview. It follows a previous talk we had in October 2022. He noted the success […]

Market conditions in 2023, expectations for 2024, rising demand for electric buses, challenges in zero-emission bus deployment, competition with Chinese industry players: these were just a few key topics discussed by Tugrul Arikan, Managing Director of Anadolu Isuzu, in this interview. It follows a previous talk we had in October 2022.

He noted the success of the Isuzu Novo Volt EV bus and plans for serial production in 2025: “After 2025, with a complete portfolio of EV buses, we will achieve significantly higher sales figures in Europe”. In the meanwhile, investments are being carried out at the plant: “Our ultimate target is to make our own battery packing in the factory”.

Our 12-meter EV bus model with new CATL batteries is coming at the end of 2024. Our first hydrogen bus will be presented next year. 18-meter EV bus will come at the end 2025. At that time our portfolio of EV buses and trucks will be complete.

Tugrul Arikan, Managing Director of Anadolu Isuzu

Isuzu’s Tugrul Arikan: 10% growth expected in 2024

Could you describe the market conditions Isuzu faced in 2023?

2023 was a good year demand-side in European and non European markets. The impact of inflation has been very negative in 2021 and 2022, 2023 has been quite better on this side. Interest rates have become more attractive. One of the drivers has been the demand for EV buses. We saw a significant demand starting in 2023 for EV buses, of course limited to the public transportation segment. When it comes to intercity and coaches, transition to electric mobility will take time. There are many factors to consider, such as reduced payload due to battery equipment.

Which are your expectations on 2024?

Up to now it looks like a very active year. We have many projects running in many countries. We are expecting roughly a 10 percent increase in our overseas business. Sales units will increase between 5 and 7 percent.

I expect good sales in all Europe for the Isuzu Novo Volt EV bus. Many cities in Europe are introducing zero emission zones and moving to ZE strategies. In 2025 we are starting serial production of this model. If you look at the touristic bus market, in countries such as Spain, Greece, France, Italy, this model will have good demand.

As we are at Next Mobility Exhibition in MIlan, what about the Italian market?

When it comes to Italy, since the beginning we started with small coaches and midibuses and we keep being very active especially on the school bus side, that makes around 20 percent of our sales here. However, in the last 2-3 years the team here is switching to other technologies. Now we are focusing on public transportation buses, especially the Novociti Life 8-meter public transportation bus is achieving very successful sales, for instance in the Tuscany area. I see that in the near future there will be more activities in the intercity bus market.

Isuzu: the fast pace of technology…

Which are the main challenges from the OEM’s perspective for the ramp up of deployment of zero emission buses? It’s more a topic of economics, infrastructure, mileage?

Main challenges we are dealing with are range and charging infrastructure. For the latter, I see huge investments in many countries. Range-wise it’s not easy. It’s very difficult to switch trucks to EVs because payload reduction is significant. And this applies also to coaches. Net range should be at least 200 km in order to achieve successful operations. With our Novo Volt we are targeting 225 km range. But there’s another challenge we have to deal with…

Please…

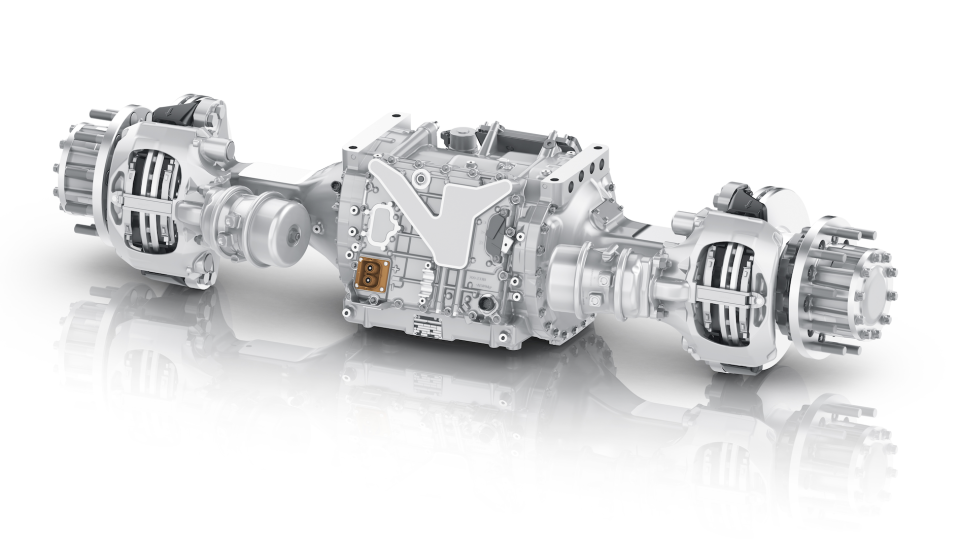

Battery technology is developing year on year. have to be very careful and very close with battery suppliers. We are mainly working with CATL, but we are trying to work with alternative battery suppliers as well.

However, our ultimate target is to make our own battery packing in the factory. Then buying cells and making modules and packs in our plant. Now we are making an analysis for this investment. If feasibility seems to be ok, next year we will start. This will bring us flexibility.

I assume such a project will have consequences on the truck business as well…

Sure. Same batteries are not fitting both trucks and buses. We need to be more flexible and our own battery assembly activity will be key in achieving that.

Still on the Italian market, which bus in your offering might be the winning card to conquer more market share?

The 8-meter public transportation bus is now our best selling model. It is also widely sold in Class II versions.

Last year we sold around 2,000 buses, both for the local market and export (800 and 1,200 respectively). If we were producing only buses, our volumes might be up to 9,000, because buses require much more effort than manufacturing light trucks. Our truck business is going very well, but we see a growing demand on the bus side for the next few years. After 2025, with a complete portfolio of EV buses, we will achieve significantly higher sales figures in Europe.

Tugrul Arikan, Managing Director of Anadolu Isuzu

The future of Isuzu in Europe

Can you provide a few figures on EV sales in Europe, as of now?

In Europe we started EV sales in 2022 and have over 100 units sold so far. We are working hard in our R&D department and I expect that as of end 2025 our portfolio for EV buses will be in a very suitable position.

Our 12-meter EV bus model with new CATL batteries is coming at the end of 2024. Our first hydrogen bus will be presented next year. 18-meter EV bus will come at the end 2025. At that time our portfolio of EV buses and trucks will be complete.

And these efforts go along with investments in the plant. This year we have renewed our cataphoresis unit, making it automated. It will start operations in July. Solar panels have been put on the roof of the plant. We expect 70 percent of our energy consumption to come from solar energy. The main change is in the organization and skills of people. We now have 40-45 software developers out of 300 workers in R&D, skills that we didn’t have before, due to more regulations on cybersecurity.

Turgrul Arikan, Isuzu’s way to hydrogen

A question on hydrogen. Do you see it more for urban buses or coaches?

As a first step it’ll be for public transportation. The question is if such technology will remain limited to the city bus segment. I personally think that hydrogen might be a better solution than EV for long distance coaches.

Do you refer only to fuel cell technology or hydrogen-powered combustion engines may play a role?

I mean EV technology, therefore with fuel cell modules. But we are checking various options. Things are changing fast: whatever you develop, can turn out to be nothing in just two years.

What has been the market response concerning the intercity Kendo?

We think it’s a very good product but we have to review it for the Italian market. We had it available with a diesel and CNG engine. Now we are making feasibility analysis for an EV version, our plan is to offer it within two years. We clearly see a demand for the Kendo in Italy, but we see our model has too many specs, we will review it in order to have a model with specs aligned with demand from the Italian market.

The competition in the EV bus market

Which is your production capacity at the moment?

19,000 units all together, buses and trucks (light and medium) according to our current mix of technologies. Last year we sold around 2,000 buses, both for the local market and export (800 and 1,200 respectively). If we were producing only buses, our volumes might be up to 9,000, because buses require much more effort than manufacturing light trucks. Our truck business is going very well, but we see a growing demand on the bus side for the next few years. After 2025, with a complete portfolio of EV buses, we will achieve significantly higher sales figures in Europe.

Competition is quite high on the EV bus side. Which do you think will be the main factors to consider in order to navigate successfully in the market?

We have to consider China as a big competitor. The question is: should we compete or cooperate with Chinese industry players? I think everybody is now reviewing answers to this question. Chinese companies have started with e-mobility many years ago, they have long experience and now they have big capacity, they need to export. They started to adapt themselves to European regulations. Chinese competition will be tough in the next few years. We have to be very productive, on time, and our offering on the aftersales side should be unique and must be differentiating us. We must be able to deliver to customers tailor-made products.