Italian bus market broke all records in 2024 with nearly 5,000 units registered (1,000 e-buses)

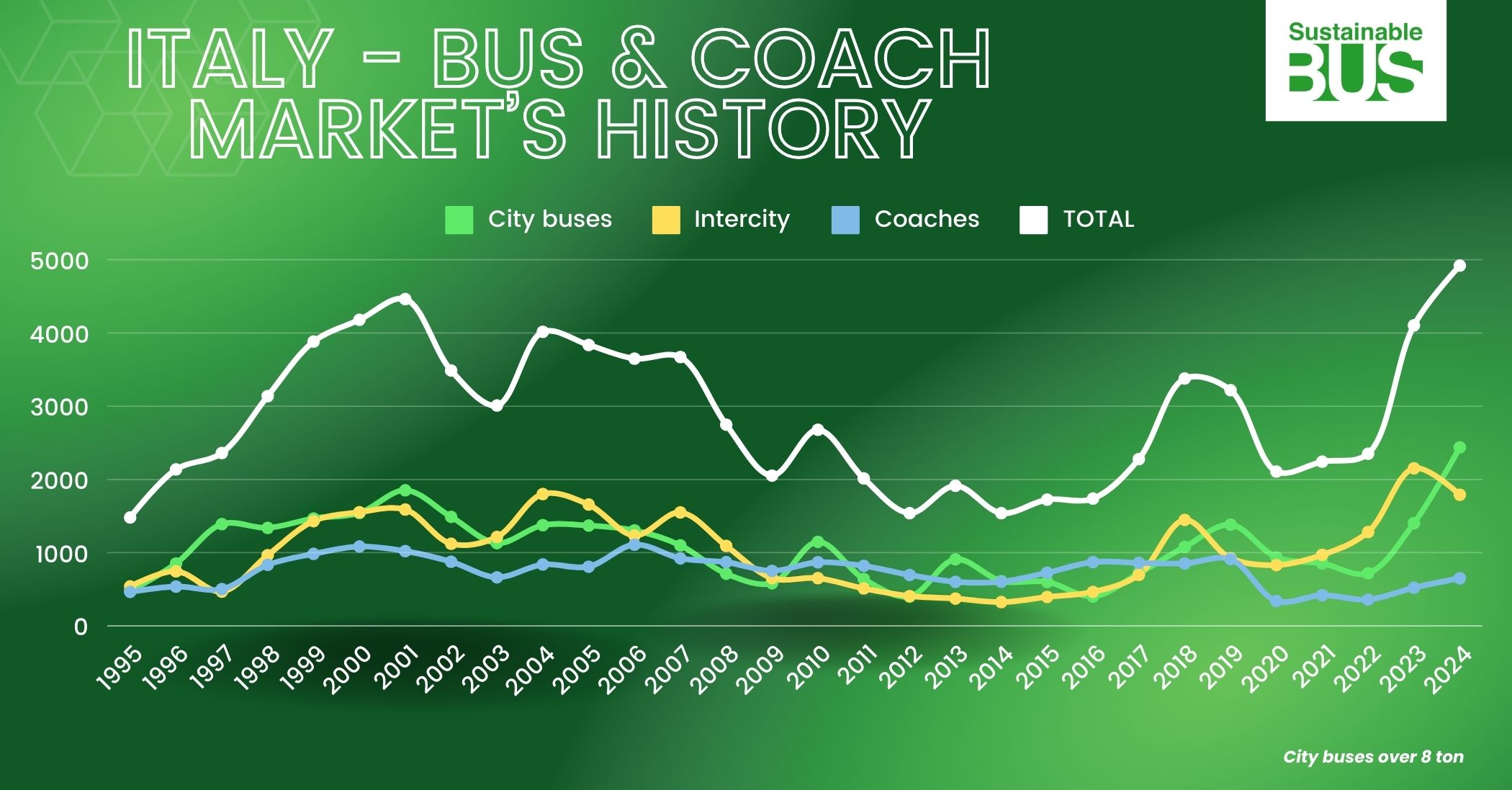

4,920 buses and coaches were registered in Italy during 2024, up 20% on 2023, according to data provided by industry organization ANFIA and reported on Italian trade media Autobusweb (our sister media). This marks a true record in the country: the highest figure reached before 2024 was the 4,400 units registered in… 2001. In the […]

4,920 buses and coaches were registered in Italy during 2024, up 20% on 2023, according to data provided by industry organization ANFIA and reported on Italian trade media Autobusweb (our sister media). This marks a true record in the country: the highest figure reached before 2024 was the 4,400 units registered in… 2001.

In the same 2024, as just reported, Swedish bus market experienced a 30% drop in new registrations.

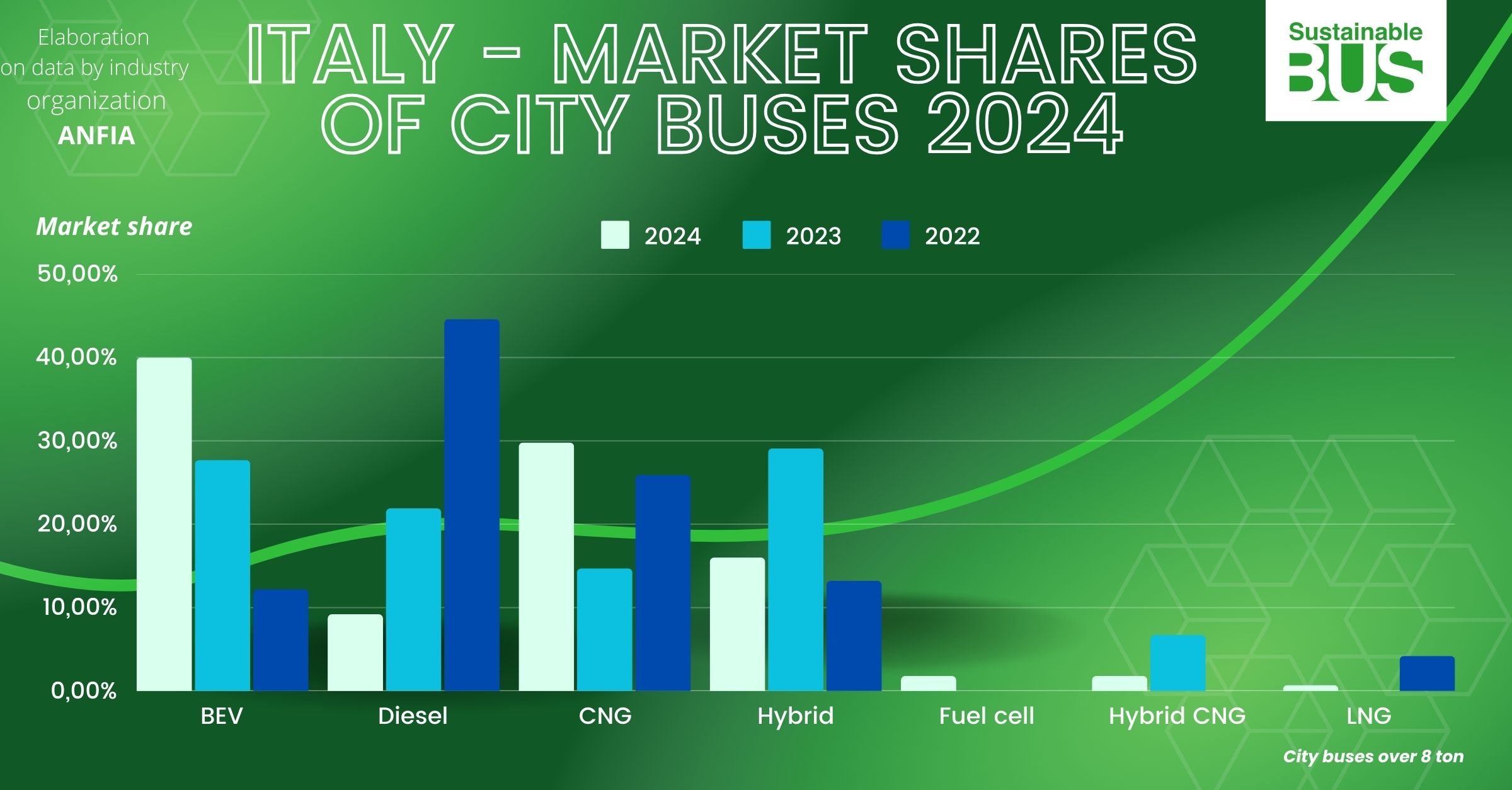

40% of city buses are battery-powered

The largest slice of the cake is represented by city buses, which have risen dramatically (+73.9%) from 1,403 to 2,440, of which as many as 994 are electric: this means that 40% of new city buses are powered with electricity.

Intercity buses, on the other hand, fell from 2,156 units in 2023 to 1,796 in 2024 (-16.7%). Coaches grew by 25.1%: from 526 to 658, proof of the recovery of a sector that has shaken off even the latest Covid and post-pandemic ills.

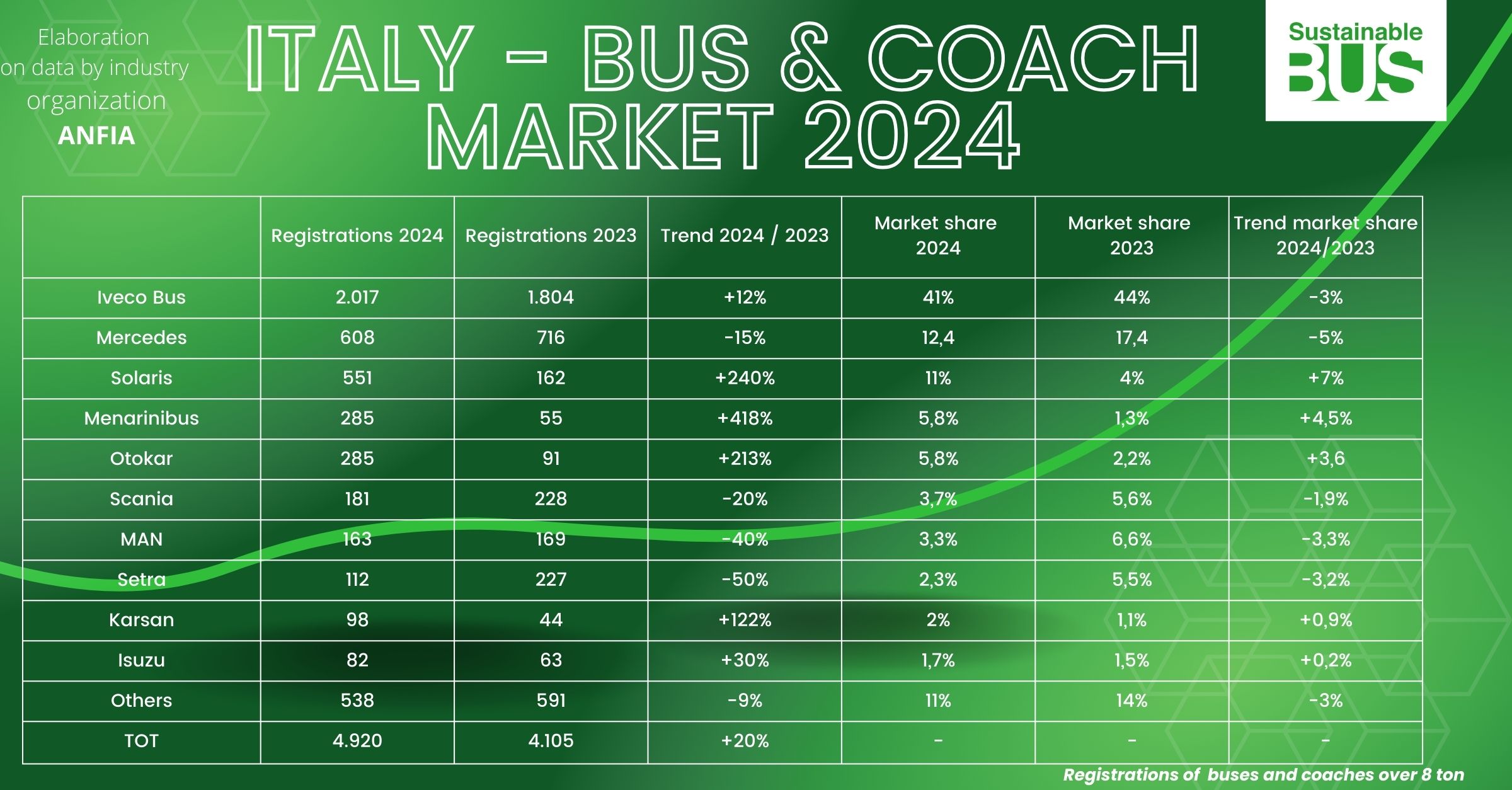

Bus market Italy 2024: the manufacturers’ ranking

Iveco Bus broke through the ceiling of 2,000 registrations, with 2,017 units, equal to a market share of 41%. Second place for Daimler Buses, with the combined figure of Mercedes-Benz (608 units) and Setra (112), for a market share of 14.7%. Solaris, with 551 vehicles (11.2%), was in the leading three group.

Just below the podium we find Menarini, following change of ownership and recovering after the black year of 2023, and Otokar, the protagonist of an exploit during the first year under direct control of the group: the two manufacturers are tied at 285 vehicles placed (5.8% market share). Then Scania with 181 (3.7 per cent) and MAN with 163 to which are added the 48 Neoplan coaches (total share of 4.3 per cent).

Below the 100 mark are Karsan at 9, Isuzu at 82, BYD at 69, Temsa 61, Yutong at 58, Irizar at 54 (but for Irizar’s figure it must be taken into account that in the 181 units belonging to Scania are counted also Irizar coaches on Scania chassis), King Long at 49, Rampini at 48, Ayats and BMC at 42, Higer and Volvo at 22, Guleryuz and Van Hool at 4, TAM-Europe at 3, VDL at 1.

Diesel remains the dominant traction technology with 1,740 buses, but lost 600 units compared to 2023 (when there were 2,339). Natural gas, on the other hand, is having a golden moment: 1,246 gas buses (plus 49 LNG) were registered in 2024, equal to a growth of 76.5%.