Lithium ion battery market, Asian players to support European growth

Lithium ion battery market is bound to grow in Europe, with Asian players expected to open European factories soon (Asian is now accounting for 72 % of the market). Transport will account for 68.4% of battery sales in 2023 to become the main demand-side market driver. It’s the result of a new research from Interact […]

Lithium ion battery market is bound to grow in Europe, with Asian players expected to open European factories soon (Asian is now accounting for 72 % of the market). Transport will account for 68.4% of battery sales in 2023 to become the main demand-side market driver.

It’s the result of a new research from Interact Analysis, a market intelligence provider for the intelligent automation sector with an office on bus and truck electrification. Europe is expected to show production capacity CAGR of 56% between 2018 and 2023.

Europe is the fastest growing lithium ion battery market

According to Interact Analysis, putting it simple, Europe will be the fastest growing market for lithium-ion batteries. The demand will be met thanks to the opening of local factories by big Asian players. Meanwhile, energy storage is expected to be the fastest growing lithium-ion battery market sector.

Unutilized capacity in lithium-ion battery market

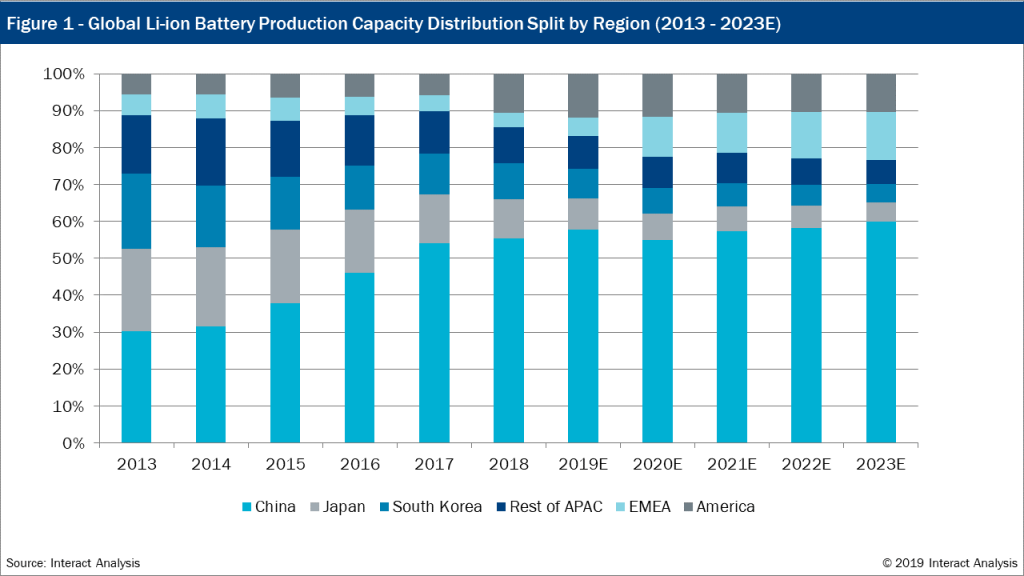

«On the supply side, global lithium-ion battery production capacity reached 327.5 GWh in 2018, a year-on-year increase of 35%, with production predicted to show a CAGR of 22.7% between 2018 and 2023. Production capacity for lithium-ion batteries will triple between 2018 and 2023», says Interact Analysis. The research indicates a strong possibility of unutilized capacity in the market. «Supply-side changes are most notable at the EMEA level – Interact Analysis adds -, with the region expected to show a radical production capacity CAGR of 56%, reaching 118.7 GWh in 2023. This implies growth for ancillary equipment, facilities and raw materials; while local procurement will bring huge opportunities to the EMEA industry chain. In APAC, general regional decline will be partially offset by growth in China».

Transport to become the main driver

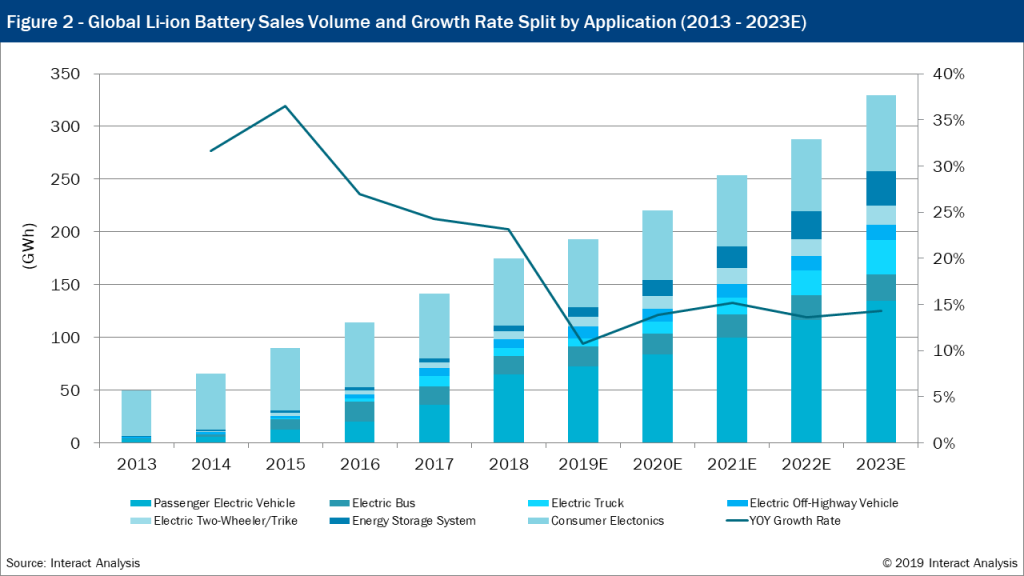

From a demand perspective, in 2018, according to Interact Analysis’ research, global lithium-ion battery sales reported year-on-year growth of 23.1% – to 174.5 GWh (see Fig. 2). Better to keep an eye on the energy storage market: «it is predicted radical growth with a CAGR of 40.4% over the next five years, driven by renewable energy».

«Transport is expected to account for 68.4% of battery sales in 2023 to become the main demand-side market driver, having first exceeded the consumer sector’s share of the market back in 2017 – still quoting Interact Analysis’ report -. Saturation of demand for lithium-ion batteries in consumer applications, and a failure to establish an advantage in transport, accounts for a predicted fall in the battery sales market share of Japan and South Korea. In spite of this, however, the lithium-ion battery market remains concentrated in Asia for the short term – with the region accounting for 72.6% in 2018, of which China contributed nearly half».

Asian suppliers looking to support growth in Europe

Maya Xiao, a lead analyst at Interact Analysis, says: “China will show steady growth, but the EMEA market is perhaps of most interest. The region will be the second-fastest growing, just after China, over the next five years. This is largely due to rapid growth in the electric truck and energy storage system markets.”

Adrian Lloyd, CEO at Interact Analysis, adds: “It is fascinating to learn, based on conversations with industry insiders, that Asian suppliers are looking to meet projected strong growth in Europe by opening local factories. From a wider perspective, political sentiment is important. In China, a desire for energy security explains much of the motivation to develop battery technology, while in Europe ambitious emissions reductions targets are key. Additionally, average battery price is predicted to drop by 30% by 2023, leading to soaring penetration in new applications.”