European OEMs’ market share in the EU e-bus segment has declined 20% since 2017, Rabobank says

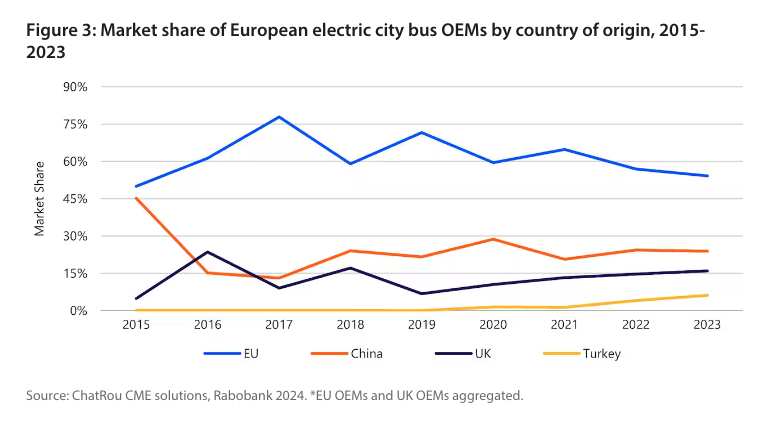

Rabobank's analysis is that it put down in black and white, with figures, the trend of increasing present of Chinese manufacturers in the European e-bus sector. "After 2017, market share of EU manufacturers declined from 74% to 54% in 2023. In the same period, Chinese manufacturers have increased their market share from 13% to 24% in the European market. Turkish OEMs have acquired 6% of the market since 2022", reads the report.

Since 2017, EU manufacturers’ market share in the electric bus segment has declined from 74% to 54%, while Chinese manufacturers have risen to 24%. Rabobank‘s latest analysis “Electric city buses: Trade and technological dynamics shape the sector“, authored by Pablo Ruiz and Josè Serrano, underscores these trends, showing also how energy density of batteries has been growing 116% within the last 14 years.

Market share of EU manufacturers declining…

What is quite interesting in Rabobank’s analysis is that it put down in black and white, with figures, the trend of increasing present of Chinese manufacturers in the European e-bus sector. “After 2017, market share of EU manufacturers declined from 74% to 54% in 2023. In the same period, Chinese manufacturers have increased their market share from 13% to 24% in the European market. Turkish OEMs have acquired 6% of the market since 2022″, reads the report.

The report also notes that the 12% depreciation of the Chinese yuan renminbi against the euro since 2022 has made Chinese electric city buses more affordable for European buyers. Chinese manufacturers benefit from operating in the world’s largest domestic market for these buses (85% of these vehicles operate in China), allowing them to scale production and achieve lower costs.

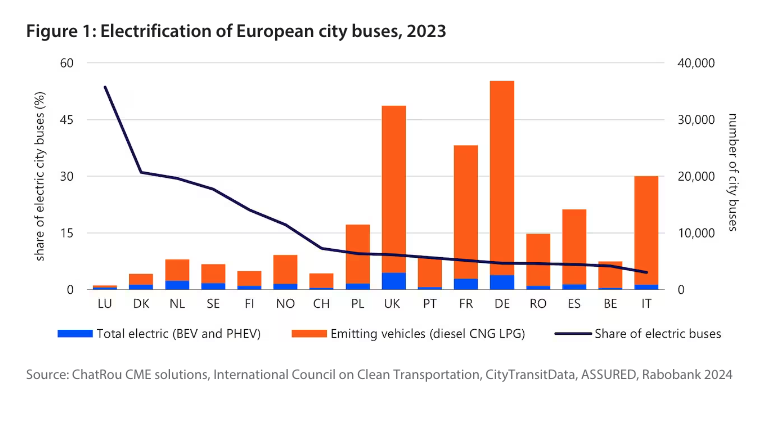

More e-buses for wealthier countries

When examining the distribution of electric buses across Europe, a clear pattern emerges favoring smaller, wealthier nations. Denmark, Luxemburg, and the Netherlands, known for their robust economies and proactive climate policies, have consistently led in electrification efforts. These countries not only boast some of the highest GDP per capita figures in the EU but also prioritize climate change as a top concern among their citizens.

“The size of the fleet matters too; Luxemburg with less than 2,000 vehicles, gains 2%-5% market penetration with each 50-100 new vehicles, to make similar progress Germany would need 725-1,750 new vehicles”, the report says.

In terms of total fleet size, Germany, France, and the Netherlands lead the pack with substantial numbers of electric city buses already in operation. Remarkably, the Netherlands emerges as the frontrunner in both market penetration and total fleet size.

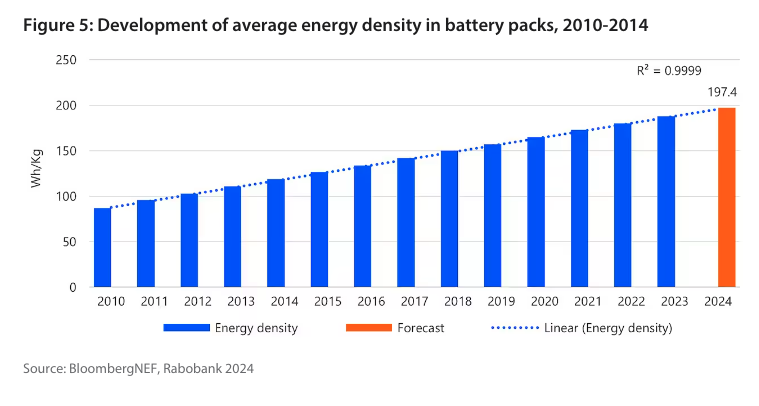

Energy density growing steadily

Rabobank focuses also on the increase in energy density of battery packs, showing as in 2010, the typical battery pack provided 87 watt-hours per kilogram (Wh/kg). By 2023, this figure had risen to 188 Wh/kg, marking a significant 116% increase over the 14-years period.

This improvement in energy density has largely been driven by advancements in battery design, including innovations like BYD’s blade batteries, which are anticipated to achieve an energy density of 190 Wh/kg.

Conclusions? “With 85% of the world’s electric buses operating in China, the sheer size of the Chinese market, combined with overcapacity and a depreciating renminbi, poses significant competition for European manufacturers. On the technology side, the trend indicates lower prices for batteries and a higher density – good news for consumers as they can expect better and cleaner buses running in European cities”