390 on-demand transit projects launched in 2024, 1,300 projects are currently active. Via keeps leadership

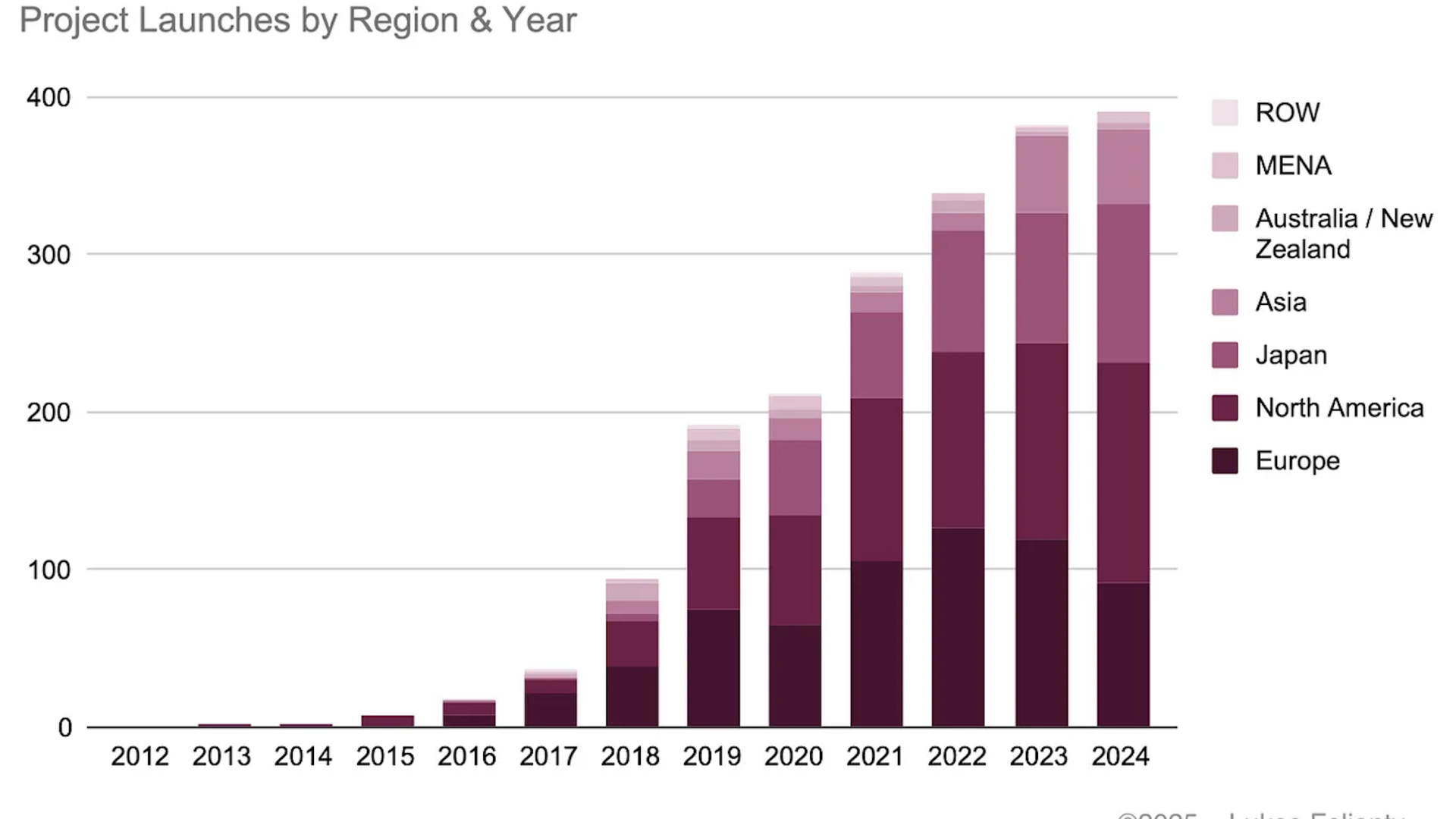

The on-demand transit sector experienced notable expansion in 2024, with over 390 new projects launched globally. According to Lukas Foljanty’s latest On-Demand Transit 2024 Market Report (with interactive world map available), the total number of services introduced since 2012 surpassed 2,000, with over 1,300 currently active. However, while some regions saw strong momentum, others faced […]

The on-demand transit sector experienced notable expansion in 2024, with over 390 new projects launched globally. According to Lukas Foljanty’s latest On-Demand Transit 2024 Market Report (with interactive world map available), the total number of services introduced since 2012 surpassed 2,000, with over 1,300 currently active. However, while some regions saw strong momentum, others faced setbacks.

U.S. market is developing DRT projects

This steady expansion underscores the strong momentum of on-demand transit in North America, where supportive regulatory frameworks and sustained investment have allowed services to scale effectively. The U.S. market, in particular, has benefited from a mix of public and private sector initiatives, with transit agencies and technology providers collaborating to optimize operations and expand service coverage.

The net growth of +100 reflects both the successful launch of new projects and the ability of existing services to transition from pilot programs to long-term mobility solutions. As highlighted in Lukas Foljanty’s On-Demand Transit 2024 Market Report, this trend suggests a growing confidence in the viability of on-demand transit as a complementary solution within urban and suburban transportation networks.

The state of on-demand transport in Europe: grants needed

However, still based on the data provided by Foljanty’s On-Demand Transit 2024 Market Report, Europe presented a more challenging picture. Once a leading region for on-demand transit growth, it faced a sharp slowdown in 2024. While around 100 new services were launched, net growth dropped to just +30 — half the figure from 2023. Germany, a former frontrunner, barely managed a positive balance, with only three more projects starting than ending.

A key factor behind this decline was the discontinuation of various European, federal, and state-level grants, which forced municipalities to reevaluate their pilot programs. Many opted not to transition their initiatives into permanent revenue services. A striking example is Berlin’s Muva, an open-to-all ridepooling service and successor to BerlKönig, which is now set to be discontinued in early 2025, as Foljanty notes.

New entrants in the on-demand transit market

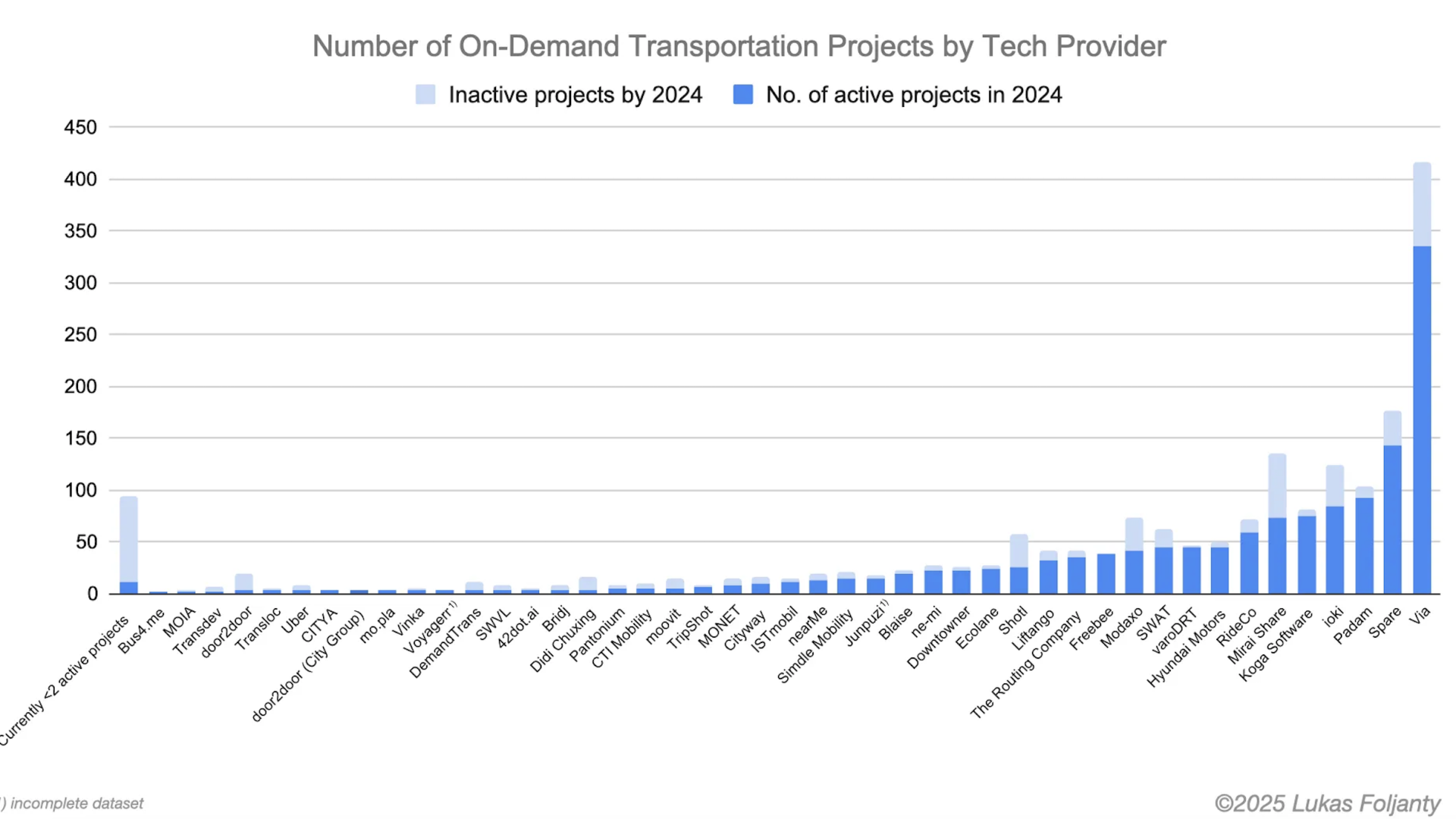

Looking ahead, new entrants are expected to shake up the industry. In January 2025, Canadian-based Blaise is projected to break into the top 10 providers, backed by a large multi-service contract in Nova Scotia.

Another notable newcomer, Argo, founded by former Uber executives, aims to redefine public transit by making it “faster than driving a car but as affordable as taking the bus.” Argo’s first public service is scheduled to launch in Bradford West Gwillimbury, Canada, in the spring of 2025, and the industry will closely watch whether their model can prove economically viable and scalable.

Despite regional disparities, Via remains the dominant player in the global on-demand transit market, holding a 24% share. Its strongest presence is in North America, DACH, and Europe, but it commands the highest market penetration in MENA and Australia/New Zealand. In Asia, however, Via faces tougher competition from regional operators and strategic partnerships. One example is Spare-powered Next Mobility, a collaboration between Nishitetsu and Mitsubishi in Japan, which has leveraged the reputation of both companies to build a solid presence in the public on-demand bus market.