Traton sees a 8% growth in bus orders as overall vehicle sales declined in 2024

In 2024 Traton achieved a 1% increase in sales revenue, reaching €47.5 billion. Despite slightly lower unit sales, the group states it benefited from a favorable market mix, effective pricing strategies, and strong performance in its financial services segment, which saw a 22% rise in revenue. What is interesting, the bus segment was the one […]

In 2024 Traton achieved a 1% increase in sales revenue, reaching €47.5 billion. Despite slightly lower unit sales, the group states it benefited from a favorable market mix, effective pricing strategies, and strong performance in its financial services segment, which saw a 22% rise in revenue.

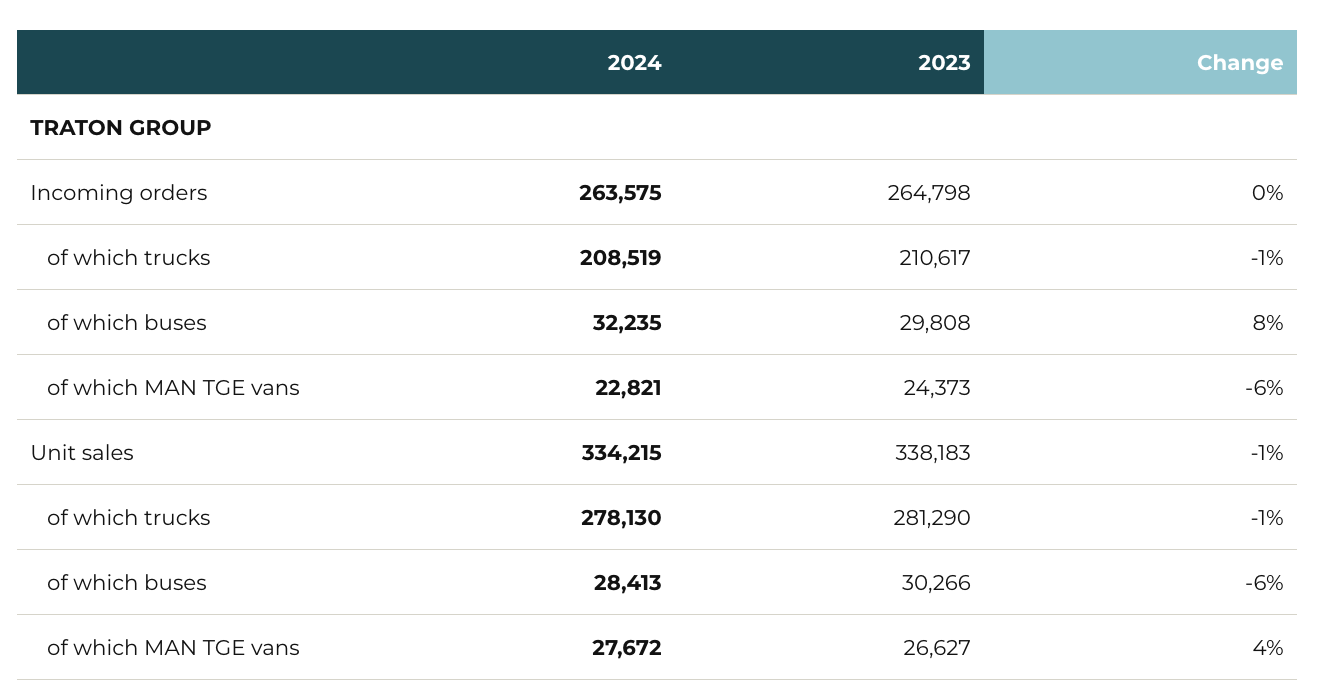

What is interesting, the bus segment was the one reporting the best results in terms of incoming orders.

In 2024, the share of bus orders in Traton’s total incoming vehicle orders increased to 12.2%, up from 11.3% in 2023. This shift reflects a growing demand for buses, despite a slight overall decline in total vehicle orders, from 264,798 in 2023 to 263,575 in 2024.

On the other hand, in 2024 Traton sold 28,413 buses out of a total of 334,215 vehicles, representing 8.5% of total vehicle sales. This is a slight decrease from 2023, when 30,266 buses were sold out of 338,183 total vehicles, accounting for 8.9%.

Traton results 2024

The adjusted operating result of the Traton group in 2024 was €350 million higher at €4.4 billion (2023: €4.0 billion). At 9.2%, the adjusted operating return on sales not only exceeded the previous year’s figure (2023: 8.6%) but was also slightly higher than the forecast range of 8.0% to 9.0%, the group states. This increase was due to effective price management, combined with improved cost discipline in the industrial business. The book-to-bill ratio, or the ratio of incoming orders to unit sales, remained unchanged at 0.8 in the reporting period.

Traton: e-mobility in the bus sector

Traton’s push towards electromobility was evident in the continued development of electric bus models across its brands. Scania, in addition, made considerable progress by founding Erinion, a company specializing in charging solutions for electric commercial vehicles. Through this initiative, Scania aims to support the establishment of 40,000 charging points at customer depots, facilitating the shift towards electric bus fleets.

Meanwhile, MAN registered strong interest in its battery electric heavy-duty trucks.

In North America, International (formerly Navistar) continued to expand its electric vehicle offering, including electric school buses and medium-duty trucks. This move aligns with Traton’s commitment to providing a full range of electric solutions, enhancing their presence in the zero-emissions transport market.

Meanwhile, Volkswagen Truck & Bus made important strides with its electric bus production, including the first e-Volksbus models, which began production in the second half of 2024.

Traton results 2024, looking towards 2025

Looking to the future, Traton expects global economic conditions to be slightly weaker in 2025, with demand for trucks and buses likely to decline in core markets. Traton states: “we expect demand for trucks to decline in our core markets. Across all brands and all vehicles, we expect that unit sales development will range between –5% and +5%. Sales revenue of the Traton group and Traton Operations should also come in within a range between –5% to +5%. The TRATON Group’s adjusted operating return on sales is forecast between 7.5% and 8.5%. Net cash flow of Traton Operations is expected to come in between €2.2 billion and €2.7 billion. Our 2025 full-year outlook is subject to future geopolitical developments, particularly in the USA, and their impact on Tratons group’s business”.

Christian Levin, CEO of Traton: “We look back on a year full of significant milestones and crucial groundwork. In 2024, we at the Traton made great strides on our way toward becoming a stronger, more efficient Group. Progressing with the introduction of our Traton Modular System was pivotal in this regard. At the same time, we are systematically driving the merger of significant sections of our brands’ research and development departments into a cross-brand organization. This will lead to considerably more effective collaboration and agility. In doing so, we continue to strongly drive our most important ambition and purpose: “Transforming Transportation Together. For a sustainable world”. Although unit sales of battery electric vehicles were down year-on-year in 2024, the outlook for 2025 is promising. Incoming orders in this segment jumped by almost 60% to just under 4,000 electric vehicles. At the Traton group, we firmly believe that the future of transportation is electric and sustainable. We focus the lion’s share of our energy on driving this development. By joining forces with network providers and energy suppliers, we aim to make the transformation to sustainable transportation smoother for our customers. To do so, we also need policymakers on our side. The European Union recently sent out a clear signal by allocating €422 million to support the charging infrastructure under its Alternative Fuels Infrastructure Facility (AFIF) funding programme, awarding approximately €112 million to our joint venture Milence. As chair of the ACEA Commercial Vehicles Board, I will ensure that we stay on this path. Because it is the right way to a sustainable future. The Traton group will continue to play its part in supporting the Paris Agreement. Nonetheless, we need a clear framework and the support of policymakers, particularly for the ramp-up of green electricity, grid capacity and the charging infrastructure.”

Michael Jackstein, CFO and CHRO of Traton: “We managed to lift the Traton’s sales revenue to €47.5 billion in 2024, despite slightly lower unit sales. With our adjusted operating return on sales of 9.2%, we were even able to exceed our forecast and strategic margin target of 9%. Our net cash flow in the Traton Operations business area was €2.8 billion. As a result, we reduced once again the net financial debt of the Traton Operations business area, including Corporate Items, by €874 million to €4.9 billion. In a market that proved challenging at times, we kept our customers supplied with very good products while creating value for our shareholders. We are proposing to increase the dividend for fiscal year 2024 to €1.70 per share, after paying out €1.50 per share for fiscal year 2023. We expect the global economy to lose some momentum in 2025. Against this backdrop, our diversified business model and the enhanced collaboration within Traton will be key pillars of our success. Together as a Group, we are well prepared to effectively navigate any challenges the market will pose this year.”

Traton brands, one by one

Scania recorded sales revenue of €18.9 billion (2023: €17.9 billion) in fiscal year 2024, primarily thanks to the very strong growth in the New Vehicles business in South America. Adjusted operating return on sales climbed to 14.1% (2023: 12.7%), 1.4 percentage points higher than in the previous year. This was due to the volume-driven increase in sales revenue, a favorable price and product mix, and lower product costs. Scania improved its unit sales by 6% to 102,100 vehicles (2023: 96,700). Incoming orders declined by 4% to 81,000 vehicles (2023: 84,100), the group says.

MAN Truck & Bus benefited in 2024 from its successful realignment program, maintaining an adjusted operating return on sales of 7.2% (2023: 7.3%), on a par with the previous year. However, customers in the European market remained cautious, particularly in Germany, MAN’s home market. Furthermore, MAN says it was able to limit the decline in sales revenue to 7%, which totaled €13.7 billion (2023: €14.8 billion), notwithstanding a drop of 17% in unit sales to 96,000 vehicles (2023: 116,000). At 77,100 vehicles (2023: 86,800), incoming orders were down 11% year-on-year.

International (formerly Navistar) increased its revenue by 1% to €11.1 billion (2023: €11.0 billion), despite the moderate downturn in new truck registrations in North America. Adjusted operating return on sales was up by 0.5 percentage points to 7.1% (2023: 6.6%). International improved unit sales by 2% to 90,600 vehicles (2023: 88,900). Incoming orders at International fell by 7% to 56,600 trucks and buses (2023: 61,000), primarily due to the lower transportation activities in the USA and the weak demand for heavy-duty trucks.

Volkswagen Truck & Bus grew its sales revenue in 2024 by 18% to €2.9 billion (2023: €2.5 billion), while adjusted operating return on sales climbed 3.2 percentage points to 12.0% (2023: 8.8%). Unit sales increased by almost a quarter to 45,800 vehicles (2023: 37,200), with incoming orders up by as much as 45% to 48,900 vehicles (2023: 33,700). In South America, the positive economic development in Brazil in particular drove robust sales growth.