Battery analytics firm TWAICE raises 26 million dollars in Series B funding

Battery analytics company TWAICE has raised 26 million dollars in Series B funding. Led by global alternative investment manager, Energize Ventures, the heavily oversubscribed round received follow-on participation from all existing investors, bringing TWAICE’s total financing to USD 45 million. In January 2022 TWAICE and ViriCiti have published a white paper on the benefits their predictive maintenance program provides in terms of vehicle battery life and significant […]

Battery analytics company TWAICE has raised 26 million dollars in Series B funding. Led by global alternative investment manager, Energize Ventures, the heavily oversubscribed round received follow-on participation from all existing investors, bringing TWAICE’s total financing to USD 45 million.

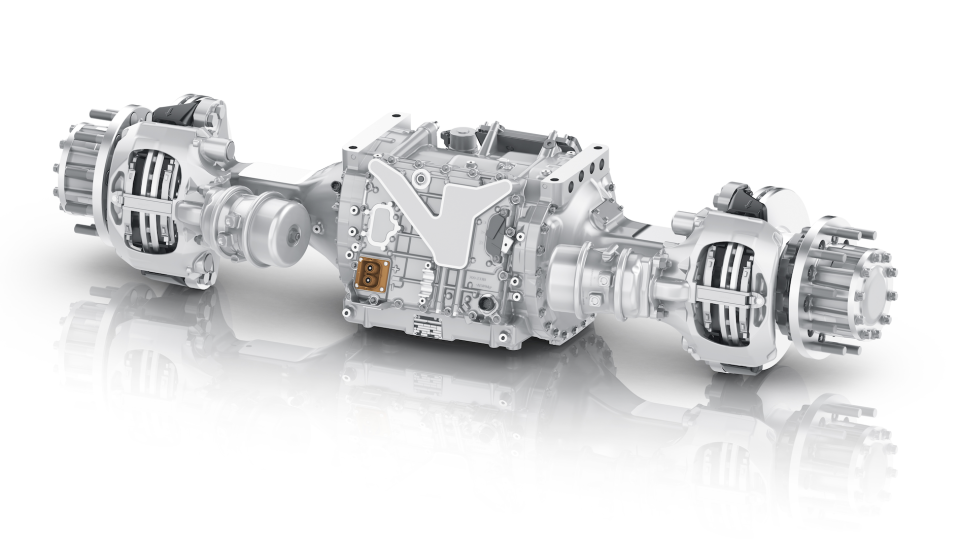

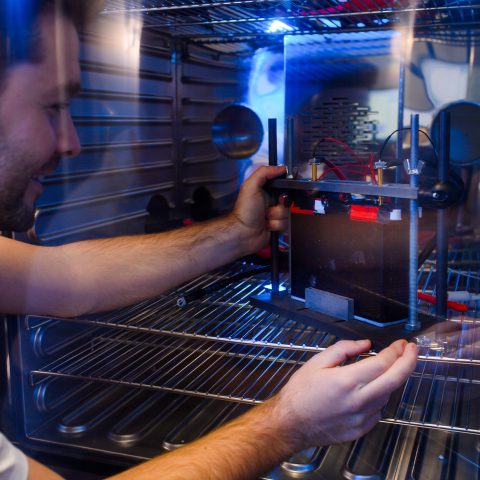

In January 2022 TWAICE and ViriCiti have published a white paper on the benefits their predictive maintenance program provides in terms of vehicle battery life and significant reduction in operating costs for e-bus fleets. TWAICE is into a partnership with retrofit expert pepper motion and semiconductor company Analog Devices.

The funds will be used to “expand core capabilities such as the analytics platform and fuel international expansion to target electric vehicle and energy companies“, TWAICE says.

TWAICE, funding, battery market potential

The investment by Energize is only the latest vote of confidence for TWAICE and underlines the company’s strong trajectory toward capitalizing on the battery sector’s market potential, which is estimated to reach USD 168 billion by 2030.

TWAICE customers already include automotive giants Audi, Daimler and Hero Motors as well as energy companies such as Verbund. To increase the value even further, TWAICE is working with its extensive partner network including Munich Re (insurance solutions), TÜV Rheinland (certifications), and ViriCiti (fleet management) to offer battery-related services.

“We have heavily invested in our battery analytics software to address the challenges in the battery lifecycle. Our solution portfolio is now leveraged in the development, operation and potential second use by leading players in the mobility and energy industry”, said TWAICE Co-CEO Michael Baumann.

TWAICE: North America in the spotlight

TWAICE Co-CEO Stephan Rohr emphasized, “With the rapid acceleration toward electrification globally, we are now keen to grow in key markets. North America is the logical next step to become a true global player. Energize is the ideal partner with its impressive portfolio of energy and mobility companies and strong footprint in the United States”.

“After years of closely monitoring the energy storage ecosystem, we recognize that software will be crucial to helping the battery industry achieve scalability – whether that is batteries powering electric vehicles or the grid”, said Tyler Lancaster, principal at Energize Ventures. “Our investment in TWAICE is the culmination of the ideal market conditions, technology, and team, and we expect to see escalating demand for the company’s proprietary battery analytics platform.”