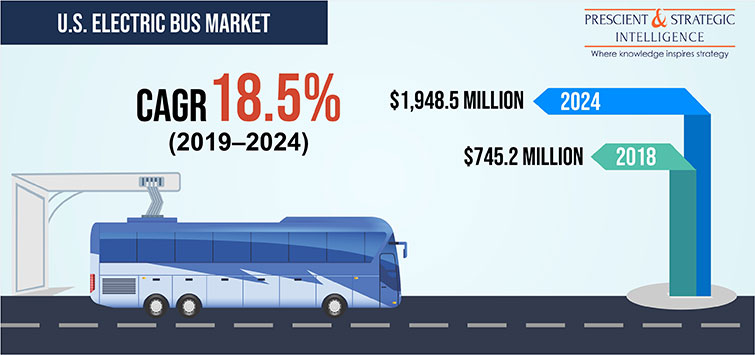

US electric bus market to grow 18.5% yearly till 2024

745 million dollars in 2018, 1,948 million by 2024. It’ll be the growth trend of US electric bus market according to P&S market research. The field will see a CAGR (Compound Annual Growth Rate) of 18,5 % during the mentioned period. A percentage that grow to 40 per cent with regards to battery electric buses only. […]

745 million dollars in 2018, 1,948 million by 2024. It’ll be the growth trend of US electric bus market according to P&S market research. The field will see a CAGR (Compound Annual Growth Rate) of 18,5 % during the mentioned period. A percentage that grow to 40 per cent with regards to battery electric buses only. The main drivers will be the support of the U.S. federal and local governments and the trend towards more stringent emission norms. But prices remain a problem…

Battery electric buses to grow of 40 % yearly

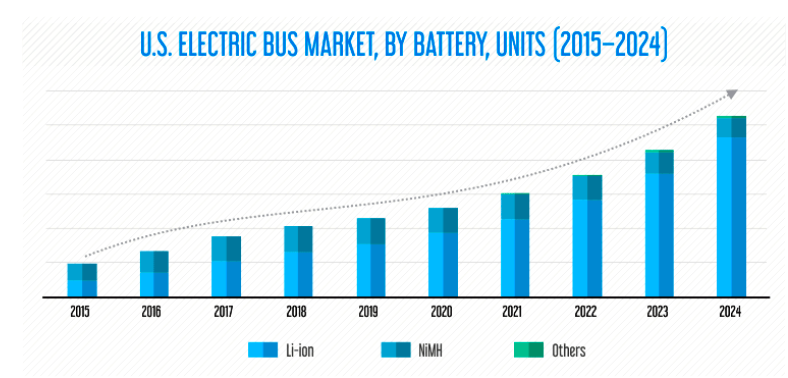

The report take into consideration three different technologies of electric bus: battery electric bus (BEB), plug-in hybrid electric bus (PHEB), and hybrid electric bus (HEB). Among these, as it is happening in Europe and China, the market for BEBs is expected to witness the fastest growth. The analysts foresee that «the CAGR of battery electric buses will be of 40.3 % in terms of volume» during the period 2018 – 2024. Li-ion battery technology is anticipated to continue leading the industry in the years to come. On the basis of charging type, plug-in has been the largest category so far, accounting for more than 75% revenue share in 2017, due to its early adoption in the country for personal transport vehicles. However, inductive charging type is anticipated to be the fastest growing category in the market during the forecast period.

California towards full electric bus fleets

Among the last electric bus orders in the US, we can mention the 18 Proterra Catalyst E2 purchased by the Port Authority of New York and New Jersey and the 22 units ordered by Florida State University. California is the state that is mostly pushing for the transition to electric buses: public transport bus fleets are expected to be zero emission by 2040. It’s the target of the Innovative Clean Transit rule, voted by California’s Air Resources Board (CARB), which public transit agencies to buying only zero-emission buses (battery electric or fuel cell) starting in 2029. This standard will ensure nearly 14,000 buses on California roads will be zero emission by 2040. A move that makes particularly sense, given the fact that California is the US leader in electricity generation from non-hydroelectric renewable energy source (geothermal, wind, solar).

US government programs for electric bus purchases

The US government, P&S Intelligence highlights, has introduced several incentives, such as tax rebates, grants, and subsidies, in the recent years to encourage the adoption of electric buses in the country. For instance, the Federal Transit Administration (FTA) offers a number of grant programs, many of which have been used to purchase electric buses. In 2018, the Low- or No-Emission Grant Program awarded grants to state and local governments, totally $84.5 million, continues the summary of the report by P&S Intelligence. But there are many other fundings programs, such as the Congestion Mitigation and Air Quality Improvement Program, State of Good Repair Program, School Bus Rebate Program, Urbanized Area Formula Funding Program, and BUILD Discretionary Grant Program. Additionally, improving charging infrastructure and declining battery prices are also expected to benefit the industry during the forecast period.

US electric school bus market

As widely known, the main restraints is the high upfront price of an electric bus, on average more than double than a conventional bus. Nowadays, 95 per cent of school buses run on diesel, a striking figure if compared with the 60 per cent of public transport buses. And U.S. electric bus market is strongly focused on the switch of school buses to electricity, as proved by the partnership signed by Daimler Buses and Proterra. According to P&S Intelligence, electric school buses have the potential for significant market penetration in the next 5–10 years. Pilot programs are now underway in states including California, Massachusetts, and Minnesota. In March 2018, the US EPA awarded $8.7 million to replace 450 diesel buses across 141 school bus fleets in 32 states.

US electric bus market, who are the players?

Proterra, BYD and New Flyer (that also launched a new branch dedicated to charging infrastructure for electric buses, called New Flyer Infrastructure Solutions) are the main players of US electric bus market, followed by Nova Bus (Volvo’s subsidiary) and Lion Electric. The latter is mainly focused on electric school buses. Recently New York State launched an electric school bus test fleet thanks to five LionC units. The research company also mentions companies such as GreenPower Motor Company Inc., Gillig LLC, Blue Bird Corporation.

In US electric bus adoption + 83% in 2017

According to a report by the consulting company Eb Start Consulting, during 2017 the number of electric buses delivered to US public transit agencies grew 83 percent (182 electric buses in service at 1/1/17, 383 one year later). Although market penetration remained low at about 0.5% of the total U.S. public transit bus market, 9% of all transit agencies either had electric buses in service or on order at the end of 2017. In 2018 Foothill Transit (that operate just outside Los Angeles) has ordered its first double decker electric bus (and first double decker as well). A double premiere on the streets of the Californian city. The buses will be realized by Alexander Dennis, a real authority in the field, with Proterra’s battery system and drivetrain technology, and will hit the road from 2019. IndyGo, the largest public transportation provider in the American state of Indiana, and BYD announced the delivery of the first K11 60-foot (18 meters) battery electric bus to serve Indianapolis. The bus is the first of 13 ordered for the Red Line by IndyGo (also 18 electric buses have been reportedly ordered for the planned Purple Line).

Electric bus in the US? A clean choice!

Across the United States, an electric bus has lower global warming emissions than a diesel and natural gas one, even in cities with power grids that depend on coal and natural gas power plants, according to an analysis released in 2018 by the Union of Concerned Scientists (UCS). The study found that an electric bus produce less than half of the global warming pollution of diesel or natural gas bus on average. If a diesel bus attained 12 miles (instead of 4,8) per gallon… then it would be as clean as an electric bus, according to UCS’s study.