Bus services in India: Covid, FAME, financing. A talk with Rupa Nandy ahead of UITP India Bus Seminar 2021

Less than one week left for UITP India Bus Seminar 2021, that will take place between 15 and 18 June. Good occasion to discuss with the head of UITP India Rupa Nandy, ahead of the meeting, the main issues of Indian public transport and to outline a view on the future of the sector, which is today still hit […]

Less than one week left for UITP India Bus Seminar 2021, that will take place between 15 and 18 June. Good occasion to discuss with the head of UITP India Rupa Nandy, ahead of the meeting, the main issues of Indian public transport and to outline a view on the future of the sector, which is today still hit by the Covid crisis.

«The seminar already has more than 450 registrations from 240 companies and continues to garner interest from the sector. I would encourage everyone to join us as we move the debate forward at a crucial time for the sector», says ms Nandy.

So far, tenders for 2,490 e-buses have been closed and were sanctioned for subsidy by DHI, covering bus agencies across 13 states. This includes 2,210 buses to be deployed in urban services across 30 cities and 180 buses for intercity operations across 4 State STUs

Rupa Nandy, Head of UITP India

May you give us a picture of Indian bus market and the relevance of bus services within Indian mobility mix?

«Buses are a very important component in the mobility mix of India and still cater to a large percentage of mobility needs in our urban areas. Buses are primarily run in an organized manner by Government bus operators or State Transport Undertakings (STUs). Right now, there are around 70 STUs in the country and they together run about 1.6 million buses.

On the other hand there is a huge market of private bus operators and they are estimated to be ten times that of the organized bus sector. However, one of the biggest challenges of having this as an organized sector is that about 95% of the private bus operators have a fleet of less than five buses.

This year, the India central budget has allocated INR 180bn ~ €EUR 2 bn for the augmentation of bus transport in urban areas. It will facilitate deployment of innovative public private partnership (PPP) models to enable private sector players to finance, acquire, operate and maintain over 20,000 buses. The scheme will boost the automobile sector, provide economic growth, create employment opportunities for young people and enhance ease of mobility for urban residents. Public transport contributes to all of these areas and investment incentives are always welcome.

Previous large scale schemes for the augmentation of buses has been the JNNURM launched in 2005 and for electric buses there has been FAME I in 2015 & II in 2019. The FAME scheme is ongoing and will continue to impact the sector in augmenting clean buses».

Covid crisis and Indian public transport

To what extent the Covid crisis impacted on Indian public transport and which are your expectations for the recovery?

«The Covid-19 crisis has greatly impacted India and unfortunately the country is still not out of the pandemic with around 100k new cases a day and 5k deaths per day.

Ridership across public transport has gone down and people have moved to personal vehicles. This is of course never good news for our cities. This shift is extremely challenging to reverse as the fear of pandemic is going to keep passengers away from public transport for a long time.

Even in the phases outside of lockdown, the frequency wasn’t kept to pre-pandemic due to the lack of passengers and hence passengers did not consider public transport as a reliable transport mode due to unavailability, it became a vicious cycle leading to a shift to personal vehicles.

Most of the state transport undertakings STUs i.e. Government bus operators are in financial crisis. The STUs had to bear almost 70 per cent of their operational costs during lockdowns when most of them didn’t run one single bus.

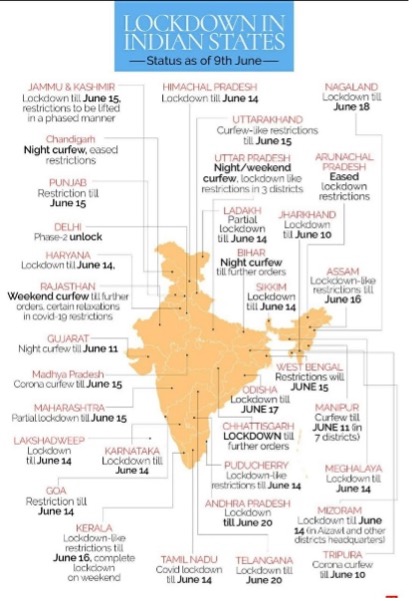

Certain countries around the world are looking towards life beyond the pandemic, but unfortunately most of India is still under lockdown and handling a healthcare situation much worse than throughout last year. Current restrictions in most of the states as below can be seen here in this graphic, making it clear what is happening right now in India».

Bus services in India, lack of authority-operator relationship

Besides Covid repercussions, which are the main challenges today Indian public transport companies are facing?

«In relation to Covid-19, with multiple lockdowns, the reduction in ridership to the extent of 90%, as of right now, none of the bus agencies are operating full services as there are multiple lockdowns in various states, technology implementations have a huge challenge due to less technology adoption by its riders.

The financial condition is the biggest challenge in this as all the Government bus operators were in a very poor state of finance in pre-pandemic conditions, and the pandemic has ripped them apart and many are struggling to pay salaries of their staff for months. The situation is much worse for private players. It is estimated that almost 30 million people in India earned their living from bus services and 90 per cent of them are from private sector. Therefore the revival of the sector is important not only to cater to the mobility demands of the citizens, but also for the earnings and livelihood of millions.

Most of the state transport undertakings STUs i.e. Government bus operators are in financial crisis. The STUs had to bear almost 70 per cent of their operational costs during lockdowns when most of them didn’t run one single bus.

Rupa Nandy, Head of UITP India

For non-Covid-19 related issues, there’s the lack of an Authority-Operator relationship similar to the EU-where Authority determines the service levels and pays for it while the operators (Govt. of private) deliver the service. Many cities have the same agency defining and delivering service thereby limiting accountability.

The procurement-led approach is taken by the Government and Government operators when any such programme comes into play instead of treating it as bus reforms programme that can completely overhaul the public transport scenario in the city.

The lack of continued financial support to cover OPEX costs is also an issue. Currently 90% of bus funding is through fares which isn’t practical post-Covid. There is a need to pitch for additional measures. The lack of city level capability on service planning, contract management, ITS based performance management and more, also remain concerns.

And finally, the cost of operating buses has also increased due to fuel price hikes and pandemic protocols. Transit agencies have to bear an additional Rs 1.7 mn (including capital and operational expenditure including cost of additional manpower engagement) per 100 buses every month only to meet the safety protocol, according to an estimate provided by Bus and Car Operators Confederation of India».

Rupa Nandy: FAME and energy transition in Indian bus fleets

Regarding energy transition, which are the results so far achieved by FAME schemes and how/when do you expect adoption of e-buses to scale up? Along with new technologies emerging (and higher investments needed), which innovative business model do you think should be adopted to help speed up the transition? Are there any key study you may be willing to mention?

«The FAME-I scheme of GoI sanctioned 390 e-bus spanning across 11 cities under two different business model i.e., outright purchase and GCC. Five cities (Indore, Lucknow, Kolkata, Jammu and Guwahati) procured buses under the outright purchase model while five others (Bengaluru, Mumbai, Hyderabad, Ahmedabad and Jaipur) procured through Gross Cost Contract (GCC) model, i.e., where the bus is owned and maintained by the operator-who gets paid in proportion to km of service delivered. Buses having different specifications were sanctioned as requested by city. The cities selected have different operational conditions ranging from metropolitan city e.g. Bangalore to tier-II city e.g. Jammu. Pune and Ahmedabad have taken up city level deployment efforts during the period of implementation of FAME-1, i.e., 2015-2019.

The lack of continued financial support to cover OPEX costs is also an issue. Currently 90% of bus funding is through fares which isn’t practical post-Covid. There is a need to pitch for additional measures. The lack of city level capability on service planning, contract management, ITS based performance management and more, also remain concerns.

Rupa Nandy, Head of UITP India

Similarly, in the FAME-II scheme, approximately 3,500 e-bus are at different stages of tendering and implementation across the country[1]. So far, tenders for 2,490 e-buses have been closed and were sanctioned for subsidy by DHI, covering bus agencies across 13 states. This includes 2,210 buses to be deployed in urban services across 30 cities and 180 buses for intercity operations across 4 State STUs. The majority of the tenders floated and awarded under FAME-II have been for midi (9m) buses with only 21% of the total 2490 buses which awarded the tenders are standard sized (12m) buses. Key studies done by UITP can be found HERE»

Towards to UITP India Bus Seminar 2021

Between 15 and 18 June all these topics (and more…) will be addressed during the UITP India Bus Seminar 2021. May you be willing to outline any crucial issues and goals of this year edition of the event?

«The Seminar will have a wide variety of topic matters and expert speakers bringing the conversations around the sector in India to the digital table. It’s a very important time in India and this is an important event for our sector.

The Seminar encompasses key national and international speakers sharing their knowledge and experiences on various topics of national programmes to transform bus services, technology driven transformations in bus operations, transitioning to electric buses and innovations in bus sector.

The topics of this year are all the latest in the sector in South Asia and not just India. This year we have promoted the seminar in India extensively but also in South Asia.

The panel discussion on national programmes to transform bus services aims to bring out key strategies required to bring a such (described in 1st answer) a large national level programme, what are the key factors to keep in mind to design implement and execute such programmes. The idea is also to hear about some international lighthouse case studies from which India can learn from and adapt for its local conditions.

The seminar already has more than 450 registrations from 240 companies and continues to garner interest from the sector. I would encourage everyone to join us as we move the debate forward at a crucial time for the sector».

[1] Electric Bus Procurement under FAME-II: UITP & Shakti (2020) (Online)