Van Hool: crisis, bankruptcy, VDL new ownership. An emblematic story on the trends on the European bus industry

The crisis of the Belgian bus manufacturer Van Hool, its bankruptcy and subsequent takeover by the Dutch group VDL is a story that has monopolised the interest of the bus and coach industry in a 2024 that sees the European bus industry changing shape dramatically. The Van Hool – VDL story ties in with many […]

The crisis of the Belgian bus manufacturer Van Hool, its bankruptcy and subsequent takeover by the Dutch group VDL is a story that has monopolised the interest of the bus and coach industry in a 2024 that sees the European bus industry changing shape dramatically.

The Van Hool – VDL story ties in with many others: the difficulties of industrial players in the post-pandemic recovery, the competitiveness of vehicle manufacturing (buses, in this case) in Western Europe (Van Hool has always kept part of its production in Belgium), the strategic and financial upheavals caused by the transition to electric drives. It’s no mystery that European OEMs’ market share in the EU e-bus segment has declined 20% since 2017.

Let’s just mention, as epiphenomenons of such trend, Volvo‘s and Scania‘s decision to move back from complete bus production towards the supply of chassis to bodybuilders (which is easier said than done) and the come back to ‘made in China’ assembly chosen by Ebusco.

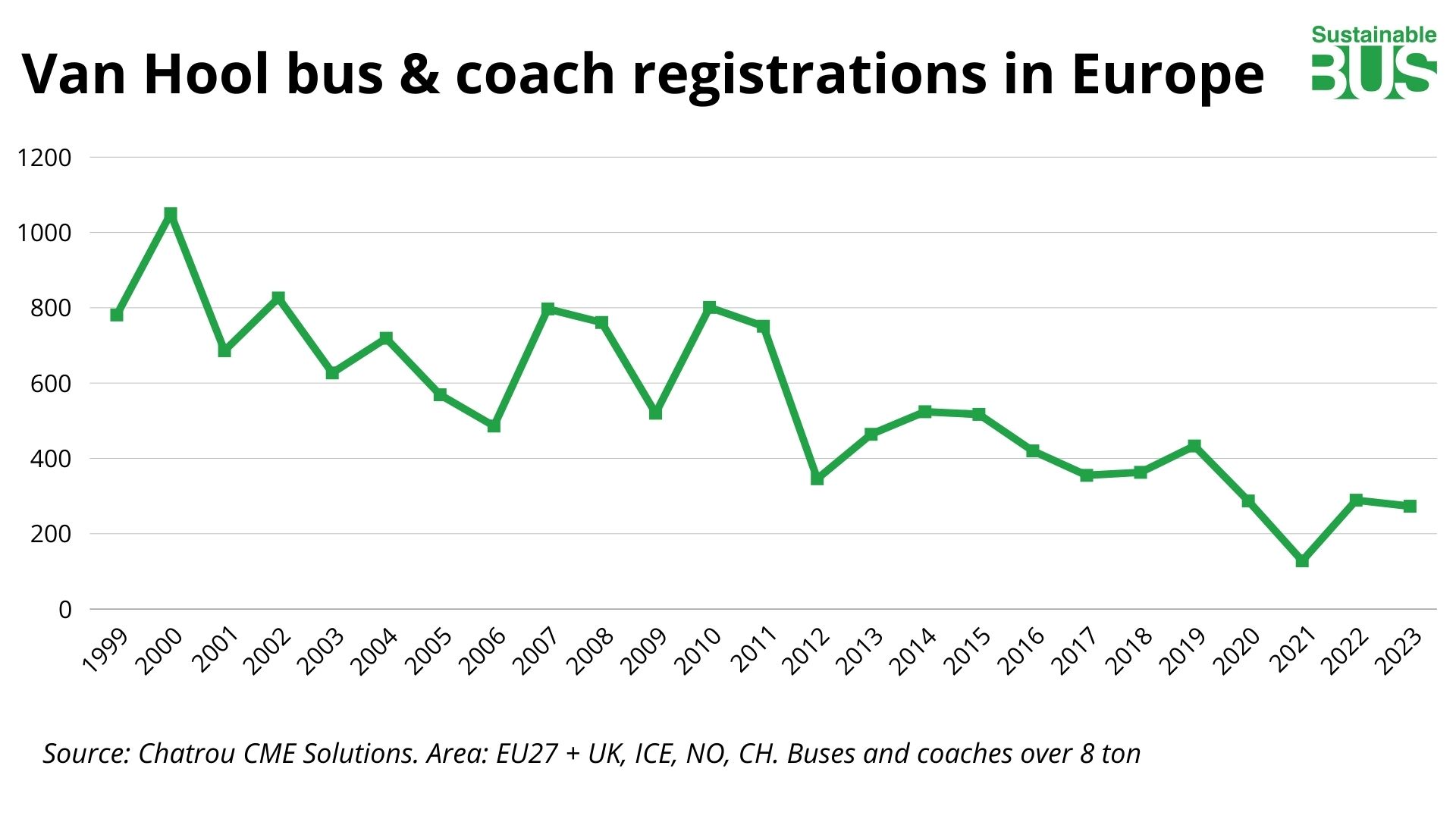

Van hool experienced a very erratic trend in relation to market data in Europe during the years (while figures on the North America market are more difficult to track). The company registered as many as 1,050 vehicles in Europe in 2000, for instance, and stayed above the 500-units figure until 2012, when it delivered no more than 350 units in the continent. The average registrations’ figure in the 2012 – 2019 period was a mere 427. Then the pandemic came, with a heavy impact for a company such as Van Hool, with a strong background in touristic coaches: in 2020 Van Hool registered 287 vehicles in Europe, 128 in 2021, 289 in 2022, 273 in 2023.

| Van Hool registrations in Europe | n |

| Yearly average 1999 – 2011 | 721 |

| Yearly average 2012 – 2019 | 427 |

| 2020 | 287 |

| 2021 | 128 |

| 2022 | 289 |

| 2023 | 273 |

Van Hool under VDL’s ownership: what is going to happen now?

Well, what is now going to happen?

What is quite interesting is that VDL stated that it “has not taken over the warranty obligations on Van Hool buses and coaches already delivered”.

According to media reporting from the UK, most of the models in the Van Hool T coach range (unveiled at the end of 2022) look set to be discontinued. In fact, VDL has stated that the North American market and the double-decker segment will be its main focus, according to the British trade media Routeone.

In particular, the Astromega double-decker seems destined to remain in production and complete the VDL range, since the new VDL Futura ‘family’ (scheduled to go on sale from 2025) does not seem to have included a double-decker model.

“One customer in the UK has been advised that a T16 Astron on order will not be delivered because that model has no part of VDL’s plans for Van Hool” reads the website of the British magazine Routeone. Which continues: “Another has been told that the T15 will also ultimately be dropped, although it is understood that T range models that do not compete directly with VDL product could be retained by VDL. But that is not yet certain and the T line-up in its entirety could eventually be discontinued”.

Let’s now make some steps behind and review the entire story of the crisis of Van Hool and its subsequent acquisition by VDL.

Van Hool: reasons for a crisis

During the pandemic, Van Hool experienced a significant collapse in both production and profits. This initial downturn was exacerbated by successive crises, including rising inflation and disrupted supply chains, which further squeezed the company’s already pressured profit margins.

A further reason for crisis at Van Hool was reportedly the competition from Asian groups or European large automotive groups. “Van Hool does not manage enough parts such as batteries to be competitive. As a result, it lost a big contract at De Lijn to BYD, which turned out to be 20 per cent cheaper than all the other European bus makers competing for the order”, PVMagazine wrote.

According to Flemish newspaper ‘De Tijd’, the debt burden at Van Hool amounted to almost 400 million euros. And as reported on the same media, that debt burden is solely at the expense of the limited liability company Van Hool. However, part of the family, with the family holding company Immoroc, still owned the factory buildings and factory sites in both Lier (near Antwerp, Belgium) and Macedonia. These fixed assets were not covered by the impending bankruptcy and this had been complicating the takeover and relaunch.

In early 2024, Van Hool began to publicly show signs of financial difficulty. Co-CEO Marc Zwaaneveld was appointed in order to “accelerating and intensifying the recovery” of the company.

March 2024: the choice to stop production of city buses

Marc Zwaaneveld drew up a crisis plan with the intention of saving the company for the time being. Under that plan, Van Hool would build only touring coaches in the future. His plan was an ultimate attempt to save the company and for that he needed fresh capital.

By March 2024, Van Hool announced its “intention to strategically refocus its activities towards market segments where customers consciously choose the high quality of Van Hool products”. And again: “this change means that the company will be more selective in accepting new orders from public transport“.

Between the lines, the company was choosing to to stop the production of city buses. Plus, “Production of buses and coaches would mainly take place at the plant in Skopje, northern Macedonia”. Such a plan would result in the departure of about 1,100 workers based in Koningshooikt during the period 2024 – 2027.

Van Hool put the deadline for relaunch on 31st March

Crisis manager Marc Zwaaneveld set 31 March as the deadline to know by then whether his relaunch plan is supported by the institutions, as it reportedly needed 45 million euros. He was looking at the Flemish government and the banks. Without an agreement by 31 March, Van Hool threatened to file for bankruptcy.

On 19th March, Van Hool announced it was seeking protection from creditors to ensure business continuity. Van Hool states it “has petitioned the Commercial Court Mechelen to have a ‘judicial reorganisation’ procedure opened. By doing so, the company wants to enable the continuity of its activity and safeguard the ongoing constructive discussions and negotiations with banks, the Flemish government, employee representatives and other stakeholders concerning the Van Hool Recovery Plan”.

Following the deadline initially set at 31st March, Van Hool took an extra week to safeguard the possibility of a restart.

Recriminations to Van Hool family

At that time, which were the possible consequences after Van Hool deadline had expired? Simple, bankruptcy; a new course with a new ownership at the helm (following the bankruptcy) or the company’s relaunch still under the Van Hool family, thanks to the above-mentioned Recovery Plan put together by crisis manager Marc Zwaaneveld. Who in late March, however, outlined significants recriminations towards Van Hool’s family in an interview with De Standaard.

“Banks and the government had to bridge, partly with fresh capital – said Zwaaneveld at the Belgian media, explaining its plans -. Only after a few years, when the company would be healthy again, would an external party have to be found. The success of my plan did not depend on whether or not I would find an industrial party. In my scenario, that would have to be sought only later”.

But something apparently went wrong (although bankrupty at that time was not yet officially stated), and Zwaaneveld attributed it to Van Hool family: “I knew that the Van Hool family was not aligned before I came here. But I did not know the impact of the inheritance issue. The risk was that new equity in Van Hool would drain away to the descendants”, he said. And added: “The government and the banks really had the intention to reach a solution. The plan before them was very challenging but feasible. I bet heavily on that. The family put a stop to it. So the question is now irrelevant.”

Van Hool trambuses for Paris: future unknown, Zwaaneveld said

An interesting piece of news emerging from the interview was that Marc Zwaaneveld, asked about trambuses for Paris, showcased at Busworld and whose delivery had just began, answered: “I think those tram buses are technically beautiful, only they cost too much to make. So as with the other city buses, I think we don’t earn enough from them and so it’s better to stop production. It’s up to the acquirer to decide whether to adopt that strategy”.

VDL, Cargobull, Dumarey: potential buyers at the window

What about potential buyers? In addition to VDL and Dumarey, also German trailer and semitrailer manufacturer Schmitz Cargobull was at the window in alliance with VDL.

In particular, VDL Group was said from the beginning to be particularly interested in Van Hool’s coach business, with potential takeover of the US market, where Van Hool has a good foothold through its dealer ABC Companies.

April 8th 2024: Van Hool files for bankruptcy

On 8th April 2024, Van Hool officially declared bankruptcy. The declaration triggered a series of strategic discussions and potential acquisitions aimed at salvaging the company’s operations and assets.

The company was apparently set to be taken over by Dutch VDL and German Schmitz Cargobull, but together they would only have jobs for 650 to 950 Van Hool employees.

But on the day after the declaration, on 9th April, Flemish entrepreneur Guido Dumarey, with a long history of purchased and relaunched business, made a new bid for the take over Van Hool, claiming his offer was better concerning number of jobs that were to be saved in Belgium. Apparently, Dumaray was joining forces with US dealer of Van Hool, ABC Companies, as reported on VRT Nws.

VDL – Van Hool: the takeover bid has been accepted

Despite its own mixed results in 2023 (the bus&coach division’s sales dropped by 33 percent, from €454 million in 2022 to €304 million), VDL expressed interest in acquiring Van Hool’s assets and operations.

VDL – Schmitz Cargobull’s bid was at the end chosen by trustees in Van Hool’s case as the best fit to ensure continuity in the company. Administrators taking care of the post-bankruptcy takeover of the OEM “believe a much faster start-up can be achieved. They feared that with other acquirers too much time would be lost for the restart. This would leave customers and employees unavailable for the restart to succeed”, as reported De Standaard in the late evening of 10th April 2024.

According to VDL statements, the group will not integrate the acquired Van Hool operations into its bus and coach activities. Van Hool will remain as a VDL-owned brand. VDL Groep was set to take over all intellectual property, design rights, software, product names, tools and machinery from Van Hool.

VDL – Van Hool: what happens to the workers?

Further information about the future of Van Hool employees were released by VDL in early June, when VDL Group stated that its purchase of Van Hool will save around “1,600 jobs in the high-quality European bus industry with immediate effect” (1,350 in Macedonia and just 250 in Koningshooikt).

Concerning Van Hool’s site in Koningshooikt (Belgium), “around 250 Van Hool employees will be hired who will work in areas such as parts production, after-sales, purchasing, development and finance. Agreement has been reached with the trade unions on the terms of employment”, the Dutch group said. VDL is also taking over Van Hool’s production facility in northern Macedonia which employs around 1,350 people.

VDL has reached a 10-year exclusive distribution agreements with traditional distributor ABC Companies to supply Van Hool buses in the United States and Canada. By early June 2024, European authorities approved the takeover of Van Hool by VDL.

Last chapter, at the 2025 UMA Motorcoach EXPO held Feb. 20-23 in Oklahoma City, Van Hool / VDL North American distributor ABC Companies gave attendees the chance to hear directly from the new owners and ask about what lies ahead, as reported on Bus&Motorcoach News. By 2023, ABC had become VDL’s second-largest parts customer worldwide.