KKR and Infracapital invest £870 million in Zenobē to accelerate global fleet electrification and battery storage expansion

Zenobē has secured an investment of c.£600 million from KKR, a leading global investment firm. In addition, a further c.£270 million of equity has been invested by existing shareholder Infracapital. Upon completion of the transaction, which is subject to customary closing conditions and regulatory approvals, KKR and Infracapital will become joint majority shareholders in Zenobē. Jera […]

Zenobē has secured an investment of c.£600 million from KKR, a leading global investment firm. In addition, a further c.£270 million of equity has been invested by existing shareholder Infracapital. Upon completion of the transaction, which is subject to customary closing conditions and regulatory approvals, KKR and Infracapital will become joint majority shareholders in Zenobē. Jera and TEPCO Power Grid will remain as minority, strategic shareholders, the company states.

The investment “will fuel the expansion of the company’s fleet electrification and grid-scale battery storage business, accelerating the decarbonisation of fleet transportation and maximising the uptake of renewables”.

In November 2022 the company announced a £750 million investment into a trio of large battery storage projects in Scotland. With a total capacity of 1GW of storage, the battery projects will help to balance the grid at critical bottlenecks providing energy when it is needed. The projects are due for completion between 2024 and 2026. In 2022, Zenobē, working with Transgrid and Transit Systems, announced the opening of Australia’s largest all-electric bus depot in Leichhardt near Sydney.

The company has also experienced growth in its EV fleet business as it surpassed the milestone of 50 electric fleet electrification projects around the world. In November 2022 the first 50 all-electric National Express buses took to the roads in Coventry supported by Zenobē’s Electric Transport-as-a-Service (ETaaS) solution, with that figure set to grow to 130 e-buses by the end of the year.

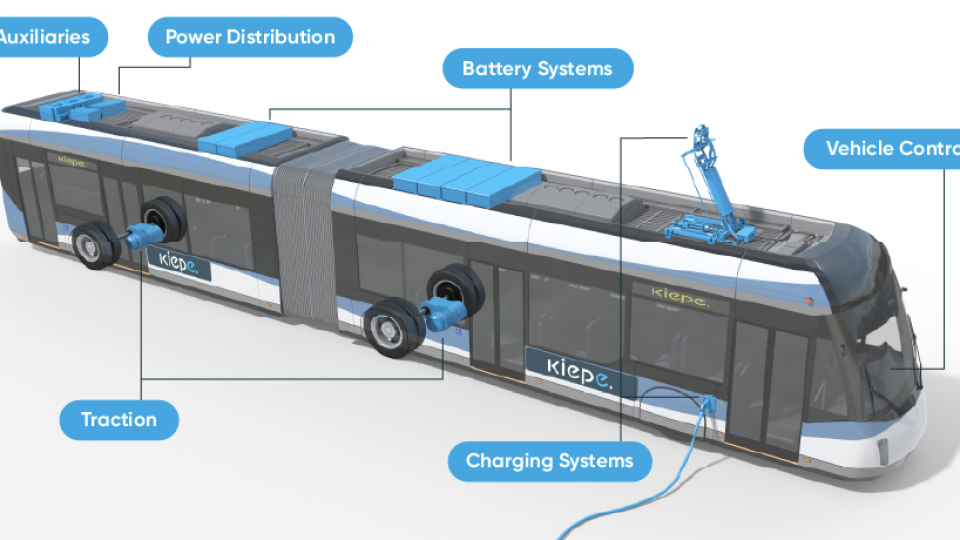

ETaaS includes the provision of on-board replacement of batteries, the charging and grid infrastructure system at a depot, with dedicated rapid chargers, and a software platform which helps monitor and optimise energy use, as well as parts and operational support.

4,000 vehicles is the 2026 target for Zenobe

Today, Zenobē supports more than 1,000 electric buses, trucks and commercial vehicles worldwide, and has worked with operators to deploy vehicles in over 75 depots ranging from Glasgow and Coventry in the UK to Sydney and Melbourne in Australia. By 2026, Zenobē aims to support 4,000 electric buses, trucks and commercial vehicles on the road.

Grid-scale battery storage will play a key role to ensure this power or renewables is not wasted. Zenobē currently has c.430MW of contracted grid-scale battery storage in the UK in operation or under construction, including its landmark 100MW battery storage asset at Capenhurst, Cheshire.

This latest equity investment, Zenobe says, “will enable the business to accelerate its offering with the design and construction of two additional battery storage sites across Scotland at Kilmarnock South and Eccles. It will also enable the extension in capacity of the company’s battery storage asset at Blackhillock. The site will support the integration of wind power resources into the grid and Zenobē’s target to commission c.1.2GW of storage in the UK by 2026. The investment will also back its target to develop an additional 2.5GW of battery energy storage assets in North America and Australia by 2030”.

Zenobe: battery role in energy transition

Nicholas Beatty, Co-founder and Director of Zenobē, said: “Batteries are the under-recognised crucial component of our future transport and energy systems, and they’re available now. We’re making huge strides in decarbonisation but it’s clear that too much renewable energy is being wasted and that transport decarbonisation must move faster. Batteries are critical to optimising the use of renewable electricity and making cheaper, greener and more secure power accessible. As fleet operators transition to electric, batteries offer a proven and available technology which, combined with software and data insights, can optimise the operators’ fleet while achieving zero emissions.

Alberto Signori, Partner, European Infrastructure at KKR, said: “This is a rare opportunity to support a clear leader in transport decarbonisation and battery storage, two sectors which are critical in driving the transition to a net zero world. We believe Zenobē will continue to benefit from strong secular tail winds including stricter emission regulation in urban and regional areas, and the greater use of low carbon generation in the energy mix driving a need for grid balancing solutions. We see significant growth opportunities within Zenobē’s existing customer base, as well as huge potential in new markets globally. We are excited to bring our operational expertise within KKR’s global platform to actively support the company in continuing to further build a market leading and climate critical business.”

Andy Matthews, Head of Greenfield at Infracapital, said: “Since our initial investment in 2020, Infracapital has supported Zenobē’s significant innovation and expansion as it has gone from strength to strength in both the battery storage and transportation sectors. We are delighted to announce our further investment into the business, and to embark on this exciting journey alongside KKR as joint shareholders in Zenobē”.