3,400 zero emission buses to be procured in Germany by 2025, PwC study shows

In 2021 Germany saw a doubling of zero emission buses onto its streets (they reached 1,269 compared to 683). Indeed, 586 new battery-electric and fuel cell buses were added in 2021. This means that the number of new registrations grew by almost 60 percent compared to 2020 and the 1,000 vehicles mark was exceeded for […]

In 2021 Germany saw a doubling of zero emission buses onto its streets (they reached 1,269 compared to 683). Indeed, 586 new battery-electric and fuel cell buses were added in 2021. This means that the number of new registrations grew by almost 60 percent compared to 2020 and the 1,000 vehicles mark was exceeded for the first time.

According to current plans, the transport companies want to purchase almost 3,400 purely electrically powered buses by 2025, including 513 with fuel cell drive. By 2030, there are already plans for more than 5,500 additional electrically powered buses. And this number is increasing almost daily, as more and more municipalities and transport companies are concretising their plans.

These are core findings of the fifth E-Bus Radar by the consulting firm PwC Germany. The analysis looks exclusively at buses with more than eight passenger seats (vehicle class M3) with electrified drives and external energy supply that are considered “clean” or “emission-free” within the framework of the European Union’s “Clean Vehicles Directive” (CVD).

It is becoming apparent that the battery-electric bus will form the backbone of the bus fleet in the coming years, especially in our cities. Depending on the application, other drive technologies and especially the fuel cell bus will complete the spectrum

Maximilian Rohs, Senior Manager Infrastructure & Mobility at PwC Germany

E-Bus Radar in Germany, by PwC

With more than 80 vehicles each, seven federal states are pioneers in the operation of electrified buses. More than every second bus with electrified drive is in operation in North Rhine-Westphalia (297), Hesse (186) or Hamburg (162). In Berlin, as in the previous year, 137 e-buses are in operation, putting the capital in fourth place, followed by Lower Saxony (117), Baden-Württemberg (94) and Bavaria (88). The other federal states operate a total of 188 buses with electrified drive.

Ten cities are currently planning particularly extensive purchases of e-buses. These include Berlin (+1,530), Hamburg (+1,066), Kiel (+224), Essen (+217) and Wiesbaden (+208).

In 2021, a total of 1,269 particularly environmentally friendly buses carried passengers in 116 cities. The vast majority of these are battery-electric buses (1,066). The other types of propulsion account for only a few percent: for example, 88 buses with fuel cell drive and 80 trolleybuses as well as 35 plug-in hybrid buses are currently operating in German public transport.

Hansjörg Arnold, Partner Infrastructure & Mobility at PwC Germany, says: “Many transport companies are already converting their bus fleets to environmentally friendly drives, and many more intend to do so in the coming years. In this way, an already environmentally friendly means of transport – the bus – is becoming a pioneer in climate protection.”

Companies need standards for the charging infrastructure. At the same time, the digitalisation of e-bus systems offers great opportunities for optimising operational processes. Transport companies need a future-proof electrification strategy – today rather than tomorrow

Hansjörg Arnold, Partner Infrastructure & Mobility at PwC Germany

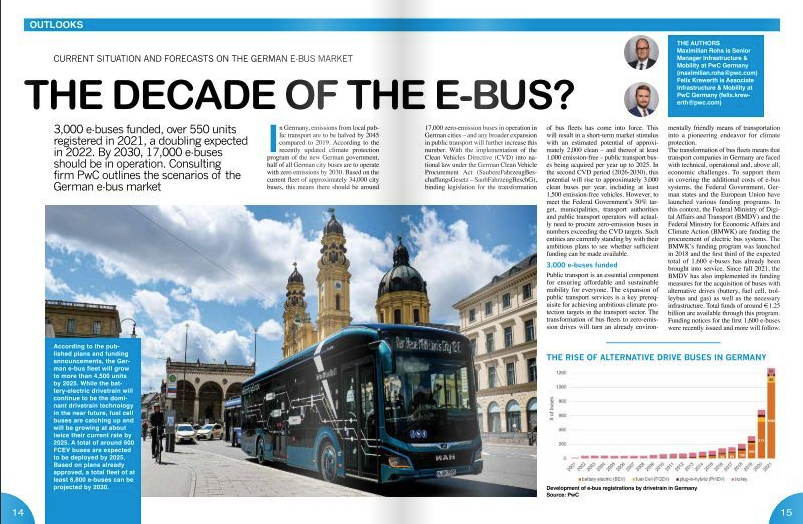

Zero emission bus registration in Germany: from 14 to 586 in five years

Since 2017, the number of new buses purchased each year has been growing exponentially: after 14 new buses in 2017, there were already 51 new additions in 2018; in 2020, 367 new vehicles were added, and in 2021 there were 586. Currently, five vehicle manufacturers account for around 85 per cent of the market. They produced a total of 1,071 of the e-buses in use. These come from the factories of Mercedes Benz (428), Solaris (287), VDL (239), van Hool (64) and Ebusco (53).

Most e-buses have batteries on board

Battery-electric buses are currently by far the most widespread e-bus variant (1,066). In 2021, transport companies put 553 new battery buses into service, compared to 313 vehicles in 2020. Both figures exceed the new acquisitions of the previous years 2019 (100) and 2018 (36) very significantly.

Maximilian Rohs, Senior Manager Infrastructure & Mobility at PwC Germany, says: “It is becoming apparent that the battery-electric bus will form the backbone of the bus fleet in the coming years, especially in our cities. Depending on the application, other drive technologies and especially the fuel cell bus will complete the spectrum.”

With 88 vehicles, electric buses with fuel cell drive are currently less widespread. The Cologne region is the leader here with 52 fuel cell buses at the moment. Wuppertal operates eleven and Höchst eight such vehicles.

Currently, electric buses account for only about 2.4 percent of the total public transport bus fleet of about 54,000 vehicles; in relation to the approximately 35,000 city buses in Germany, the figure is 3.6 percent. Financial support will also be necessary in the future. The vehicle alone costs considerably more than twice as much as a comparable diesel bus – not including the infrastructure.

“In order to successfully implement the transformation, municipalities and operators need comprehensive financial support, both for the purchase and for operation,” says Maximilian Rohs of PwC. “But this is an investment that pays off: in climate protection and quality of life!” The PwC experts expect strong impulses from the European Union’s Clean Vehicles Directive. It provides for mandatory minimum quotas for the procurement of emission-free buses: by 2025, the share of “clean” vehicles in newly procured buses must be at least 45 percent. At least half of them must be “emission-free”, such as battery and fuel cell buses. From 2026, the mandatory quota will rise to 65 percent.

“The question is not whether transport companies should convert their fleets, but how best to go about it,” says PwC partner Hansjörg Arnold. “Companies need standards for the charging infrastructure. At the same time, the digitalisation of e-bus systems offers great opportunities for optimising operational processes. Transport companies need a future-proof electrification strategy – today rather than tomorrow.”